Found myself a new toy, trading the FTSE 5 minute financial bets on Bet365, no worries of big price movements costing you a fortune, adds a bit of interest to a dull day! It is not the same as spread betting - but again if you have any type addictive personality don't even look at it! I saw a Bet365 advert and as I already have an account I thought I'd have a play around with it. Apparently financial betting is now on offer at Bet365!

|

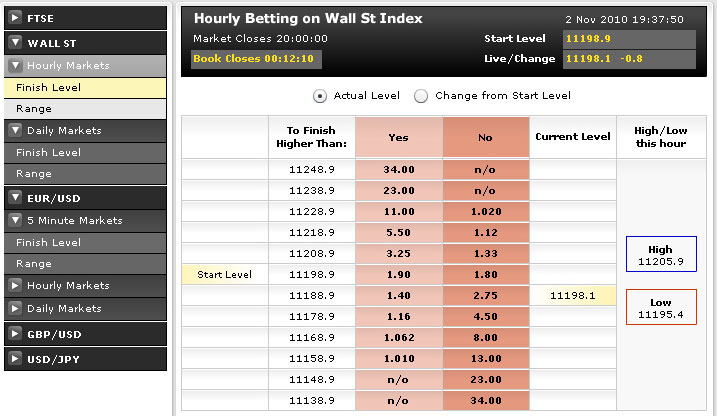

You can select from a wide range of markets and bets and can trade every business day from 08:00 until 21:00. Financial betting is available on main index markets like the FTSE and Dow Jones with betting on three forex pairs - namely EUR/USD, GBP/USD and USD/JPY - also available. For each of these markets you can bet on three time periods - 5 Minutes, Hourly or Daily. The odds are decimal so where it says 1.50 or 1.66 just simply means you get the second part as profit so for arguments sake 1.36 means you're getting 36% profit on your original stake and so on!

For each market Bet365 make available 7 financial bet types including the finish level of the market, whether it will hit a certain point before expiry, the highest or lowest level the market reaches, double touch, range and stay within range bets.

In addition, for each individual bet types there are as many as 12 different strike levels possible at any one time. Should the market move the levels are adjusted so you can always select from a wide range of prices.

How does it work? You choose to bet Yes or No for each strike level, as per the odds displayed. This implies that you can take a bullish or bearish view of a market, or switch between the two as you may prefer. Charting displaying how the market is moving are also displayed on each financial betting page. You also have the choice to close your bet before expiry for which you will take profits or incur a loss if you prefer not to wait until the full expiry period of the bet. Winnings are credited to your account.

Addictive, 17 bets 14 wins you could trade for just 10p if you wanted and you can close out anytime in the 5 minute window there's a window running that shows you your potential returns as the 5 minutes tick down, you can also hedge and wait for the price to hit a certain parameter that see's you in profit and then close, I'm trading it off 5 minute candles and using the 1 minute chart for entries an hrs work trading both euro and FTSE 100 has returned me a profit of 55%!

I'm finding the Bet365's, 5 minute binaries particularly good for some quick in and out trades although I tend to use these in bursts. I think my years of spread betting helps on this as I can get a good edge over where I believe the market will head by simply watching the odds action coupled with a bit of charting skills. It can be a nice way to hit the markets when no spreadbets are on offer, but the odd 30 minutes here and there should be enough for me at this stage. So far I don't have any problems to report although I'm still in a learning phase in the game of custom bets. However, I do think that I can really use them to my advantage. However, use with care - I'm not sure how IG Index's custom bets equate to spreadbets where we are supposed to see some 90% of losers but it's obviously not going to be greatly in our favour. The advantage with Betonmarkets over IG Index if that you can use smaller stakes so might be a first port of call if you just wanted to play around with it, although I'm preferring the IG Index platform, a little snippet of a 15 minute burst of trade I did yesterday on Bet365!

How can they hedge off their positions on such a short period of time?

I doubt very much that they hedge their trades, mind you saying that you could have a computer programme that does it, if I can compute it quickly enough in my brain then it's obvious they could do it...

For myself I'd say that I hedge 10% of my trades, 70% I simply take profit early - why wait for an extra few points when you can bank it before you lose control, the other 20% I let run, my one loss today I closed early and lost 31% of my stake as I could see it was turning so even on the loss I didn't lose my whole stake.

What criteria do I use to enter bets?

I just look at all the evidence and come to a conclusion on what way I think the market will go, then fine tune it down to get an entry, I don't have an entry strategy per se' like MACD has gone green enter, if I get an entry and resistance is directly above I will wait if the previous candle is bearish I'll wait, if I can see a double top forming I'll wait, it really is a game of patience. The FTSE trade is my 2nd trade of the day I went long euro at 7.15am ,so some days I will trade loads others very little, that's where my new 365 toy comes in handy!

To-date I have used the binary and one-touch bets, basically I simply use the fast bets for either candle trades or resistance and support trades (or better still both). The one-touch bets come in handy when the markets are going in a direction that my technical analysis is predicting and one of my support or resistance lines is coming up. In such cases I will take out a one touch trade. So, say I thought that the FTSE 100 would now retrace and hit 55 I'd get a 60% payout on that. Obviously that varies greatly on what parameters you use. I particularly make use of binaries when entering a trending phase, the good thing with this over spreadbets is that you can use the minimum 10 quid stakes and that is all you can lose with the binary. The fixed odds trades simply require less maintenance; when I take an index trade out via them I'm prepared to let it run to expiry (the trading day ends at 16.30pm for UK trades). This gives me more flexibility to get involved in trades for longer whilst knowing my risk. To take on these trades via spreadbets I'd need a stop that i'm not particuraly comfortable with, so now I can mix and match between the fixed trades and spread trades depending on what the risk is for each trade, but should the markets move significantly in my favour I will close the trade. You can even utilise a stop loss system so as not to risk more than, say, 40% of your stake should the market start going against you. With this stop loss mechanism in place you could simply close the bet when you are 40% down. I still love the spreadbetting but it just becomes a bit extreme at times as I actively manage each trade, it just gives me a nice alternative to take trades that I might usually dismiss!