While digital options find themselves among truly exotic trading vehicles, such as look-back options, chooser options and Bermuda options, they are the simplest options of all and individual traders can employ them, if only synthetically. A digital option is an option whose payout is characterized as having only two potential values - a fixed payout of, say $1, when the option is in-the-money or a $0 payout otherwise. The payoff remains the same, no matter how deep in-the-money the option is. Because the payout of a tight bull spread is closely similar to that of a digital option, so is its pricing. If a trading system has the capability of pricing a tight bull spread, it shouldn't be challenging to price a digital option. Using a forex example, digital options let you wager on whether the exchange rate will trade above or below the trigger level at expiration.

Digital options typically are placed into the class of financial instruments referred to as "exotic." However, digital options are simple, and can find a place in the average retail trader's trading toolbox.

Exotic options are the tools of multi-million dollar OTC traders with big bank and other financial institutions backing them. It is rare for an individual retail trader to use these instruments, and for good reason. They are complex, expensive and relatively illiquid. However, while digital options find themselves among truly exotic trading vehicles, such as look-back options, chooser options and Bermuda options, they are the simplest options of all and individual traders can employ them, if only synthetically.

Webster's dictionary defines the word exotic as "strikingly unusual or strange in effect, appearance or nature." To consider whether this word is fairly applied to digital options, think of the everyday occurrence of opening your mailbox and finding two discount offers from one of your favorite stores. We evaluate both offers:

Offer I: $5 off every purchase of $15 or more - this is the conceptual application of a digital option.

Offer II: 20% off any single item - this is the concept of a plain vanilla exchange-traded index option.

Which one you pick depends on how much you want to spend in the store. Let's say you only wanted to spend $20. You would exercise offer I and your purchase would cost you only $15. You also saved an additional $1 over Offer II that would have reduced your purchase price to only $16 ($20-(20%* $20))

A digital option is an option whose payout is characterized as having only two potential values - a fixed payout of, say $1, when the option is in-the-money (underlying price above strike for a call and below strike for a put) or a $0 payout otherwise. The payoff remains the same, no matter how deep in-the-money the option is.

The term digital is derived from the computing reference of a digital encoding/decoding system that can have exactly two possible states. For that reason, a digital option is also referred to as a Binary option, a binary number in mathematical or computer jargon is one where each digit can only have two possible values, either 0 or 1. Applying that terminology, an option that, at expiration, can have only one of two payoff possibilities, a 0 or a 1, is classified as a digital or binary option (these terms can be used alternately).

Using the example of our two discount offers, we will explain the pay-out value for a digital option.

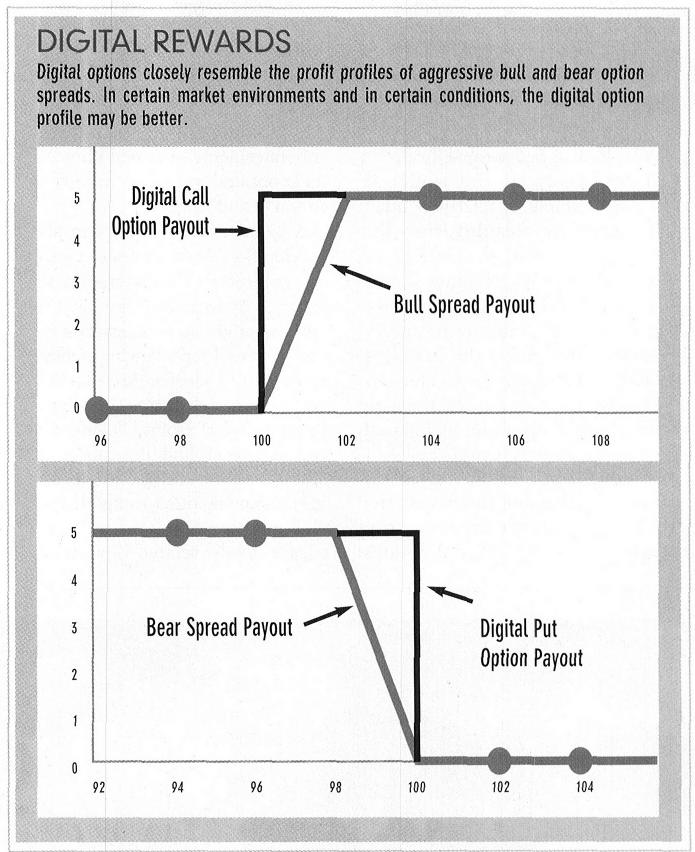

Binary call option: As any call option would, a binary call option pays out if the underlying or market price exceeds the strike price at expiration. The only difference here is that the payout is a preset amount, regardless of the difference between the market price and the strike price (see "Digital rewards," right) .

In that context, if you spent $20 and exercised offer I, you received $5 off, making your total out-of-pocket purchase worth $15. On the other hand, had you spent $100, your savings would still be only $5, making your entire purchase now worth $95. (In the latter case, you were better off exercising offer II and receiving 20% or $20 off instead.)

Binary Put options: Correspondingly, the binary put option pays out the stipulated amount to an option holder only if the market or underlying price is below the strike price.

If any segment of an option payout graph is vertical - that is, it doesn't contain a slope - your position has an element of a binary option, either on a standalone basis or embedded as a component of a compound option (an option on an option). The vertical aspect of the payout graph indeed reveals the existence of a binary option.

A speculator betting on rising and falling prices can use digital options as cheaper alternatives to regular vanilla options. A hedger uses this cost-effective instrument to effectively draw upon a rebate arrangement that will offer a fixed compensation (that is, payout) if the market turned the other direction.

A digital option can be simulated for pricing purposes and replicated for hedging purposes as an aggressive bull spread. A bull spread involves buying an option at a lower strike and selling a similar option at a higher strike; the difference in the strikes is the spread risk.

Because the payout of a tight bull spread is closely similar to that of a digital option, so is its pricing. If a trading system has the capability of pricing a tight bull spread, it shouldn't be challenging to price a digital option. Keep in mind though, the more aggressive the bull spread, the higher its premium, and therefore the costlier your hedge. On the other hand, the less tight the bull spread, the larger the exposure to spread risk.

'Digital rewards closely resembling bull and bear option spreads.' Click on the image to see it in more detail. |

Using a forex example, digital options let you wager on whether the exchange rate will trade above or below the trigger level (strike price) at expiration. If exchange rates move unfavorably to the position, the holder exercises his option and trims his losses by a predetermined payout amount, whereas if the market moves favorably, the trader continues to deal in current spot prices and doesn't exercise his option.

You may begin to wonder - why not just buy a regular option instead? The reasoning is that, in a volatile market, a digital option presents a cheaper alternative to the traditional vanilla option (and considering the cause/effect relationship, it therefore provides limited hedge capability).

Alternatively, if the trader is expecting a stable or relatively quiet market with low volatility, then the recommended strategy would be to write (sell) options, as doing so will generate profits in an otherwise unprofitable trading environment. Remember, the greater the flexibility and higher the payout for an unfavorable market price movement, the larger the upfront premium associated with purchasing that option.

Currency markets are event-driven and it is challenging to forecast the direction of market movement prior to important events. Digital options work well in these scenarios. Technical trading doesn't necessarily bode very well for profit-taking before the scheduled release of key economic and trade reports. But if you expect increased volatility in light of the announcements, your best choice is to trade options and reduce returivrelat' ed spikes and whipsaws.

A sophisticated trader can always develop flexible structures to maximize the risk/return characteristics of his portfolio by including options. Digital options might not necessarily be an excellent tool for following trends and are not truly adequate for maximizing profits either, but they help protect against a loss of profits. Trading pitfalls and jolts to profitability can be minimized if the digital options trader recognizes, among other things, the structural subtleties associated with specific trigger levels, related liquidity concerns, and stays alert to any warnings signaled by the greek ratios - delta, gamma, vega, etc.

Technological breakthroughs have made computing muscle affordable and available via sophisticated trading software and has simplified the pricing of these not-so-vanilla options. Marketing digital options as strikingly exotic might hinder demand and sometimes even daunt a pro trader from dealing in them. There is no golden rule that prescribes straightforward tactics for specific trading positions, but a skilled trader should evaluate these positions as a welcome break from the conventional tools and make a choice depending upon his sole appetite for risk.

The content of this site is copyright 2016 Financial Spread Betting Ltd. Please contact us if you wish to reproduce any of it.