They say that a dog is a man's best friend but for investors in these turbulent times I would say having an exposure to gold is a good equivalent.

The last few months have seen Gold and most commodities come off record highs, hardly a shock to my readers. When ever any market moves up or down so quickly we always get some sort of a correction. What is important to realise is that a correction does not mean that the long term trend is over. If you go back to the bull market in stocks before 2000 you may recall we had many bumps along the way, so it would be foolish to think that commodities would act any differently.

Just when everyone was convinced that Oil prices were on the way to $200 a barrel and the front pages of most business magazines were telling us to get out of the US dollar and into Oil - we now see exactly the reverse, the US Dollar bouncing and Oil moving to $100, still not a bargain but better than $150.

One of the best commodities to hold at present has to be Gold even with the stronger US Dollar which makes Gold more expensive for overseas buyers but Gold so far is holding up extremely well.

Seasonally, September to December Gold tends to do well. The recent summer sell off in Gold was nothing new and anyone buying Gold at below $800 should be well rewarded in the next few months.

You can back gold in various ways including Spread Bets, Fixed Odds and Warrants, at present I have trades on Gold using all three methods. For most, a covered warrant on Gold would be a fairly safe way to get exposure to Gold with a strictly limited risk. The SG $800 December calls 08 are currently trading at 30p.

What I am looking for is Gold and possibly Silver to decouple from other commodities and move higher even if Oil continues going down. Gold is accumulated as a store of wealth rather than actually used as in the case of copper. Whilst I am long Gold, I am short Copper as I see demand failing for industrial metals until at least early next year.

From my own research and talking to various banks who deal with wealthy clients; their has been a large shift away from any investment with high risk, in fact one Swiss based bank told me that most clients were holding large amounts of cash on account rather than speculating on the stock market or any other market. You could say that this is a good contrary indicator, as at some stage these clients will get fed up of earning small returns on cash and want to get back into the markets but this could be some time yet, certainly months. What we could see is more wealthy customers looking at Gold as a store of wealth and this could be what propels the next big move up in Gold which could easily take us to around the $1,000 level before Spring 2009.

|

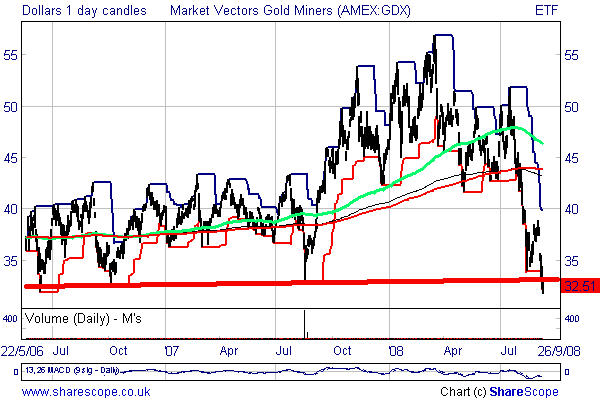

Investing in physical Gold and investing in Gold mining shares are two different animals. Just because actual Gold prices go up it doesn't mean that Gold Mining shares will go up, however, we are due a bounce in Mining shares. One way to trade Gold Mining shares is via the Market Vectors Gold Miners ETF (AMEX: GDX) This gives you exposure to a basket of major mining companies including:

Barrick Gold Corporation 12.60%, Goldcorp Inc. 10.67%, Newmont Mining 7.65%, Kinross Gold Corporation5.70%, Agnico-Eagle Mines, 5.38% Yamana Gold, Inc. 5.27%, Gold Fields Limited ADR 4.78%, Harmony Gold Mining Company Limited ADR 4.60%, Randgold Resources, Ltd. ADR 4.59% and Buenaventura Mining Company Inc. ADR 4.32%. The percentages represent the weighting of each share.

The content of this site is copyright 2016 Financial Spread Betting Ltd. Please contact us if you wish to reproduce any of it.