A: Leveraged exchange traded funds work in a similar way as the conventional Exchange Traded Funds, but they buy more futures, for the same cash collateral investment. This provides gearing - but there is a catch. If you buy on margin, as the price of the underlying investment changes, the amount of leverage you get changes.

(For instance: If you buy £2k of stock with £1k collateral - a 1% change in stock price will return you a 2% change in your equity. However, if the stock goes to £4k, then a 1% change in stock price will now only return you a 1.33% change in your equity). Such funds are 'constant leverage' which implies that each day, the fund managers rebalance the fund, to get back to 2x leverage. So, every day, they must buy or sell contracts to reset the leverage. If oil moves up, then a leveraged oil fund, must buy additional futures at the end of the day. If oil moves down, then it must sell at the end of the day. To summarise the fund must buy high and sell low. This isn't really a great long-term strategy. So although the fund should in theory always yield double the daily commodity price change, this is absolutely not the same as double the long-term commodity price change.

There are more reasons why you should be careful here -:

ETFS Leveraged Crude Oil (LOIL) is designed to change each day by two times (+2x) the daily percentage change in the DJ-AIG Crude Oil Sub-IndexSM (before fees and adjustments). The 2x leverage is on a daily basis: arithmetical. Over more than one day, the difference is geometric. So: 100 -> 75 day one gives ETFS Leveraged Crude Oil (LOIL) down from 100 to 50. If day two is 75 -> 50, LOIL goes from 50 to 16.67. So while oil has lost 50% over two days, LOIL is down 83.33%. It helps to know the math!

Compare the following theoretical example:

Day: Monday -> Tuesday -> Wed -> Thurs -> Fri

Oil: $100 -> $80 (-20%) -> $100 (+25%) -> $120 (+20%)-> $100 (-17%)

Oil ETF: $100 -> $80 (-20%) -> $100 (+25%) -> $120 (+20%) -> $100 (-17%)

Loil ETF: $100 -> $60 (-40%) -> $90 (+50%) -> $126 (+40%) -> $84 (-33%)

So, even though oil hasn't changed in price - the volatility has forced the fund manager of the leveraged fund to buy high, sell low and has destroyed the value of the fund - the fund in this example has lost 16% of its value, and will now track at a 16% discount going forward. In this case, I've exaggerated the volatility - so real funds don't suffer this badly, but this is for illustrating the point that over a period of a year or more, these 'slippage' losses can be very substantial. So all things being equal (i.e. ignoring fees, interest, etc.) a leveraged ETF will not get back to par when the oil price does when measured over more than a single day. A similar problem is found with the 'short' funds. This is especially true during periods of high volatility as we have seen recently.

|

A leveraged ETF will not return to its own starting price when the underlying index returns to its start position.

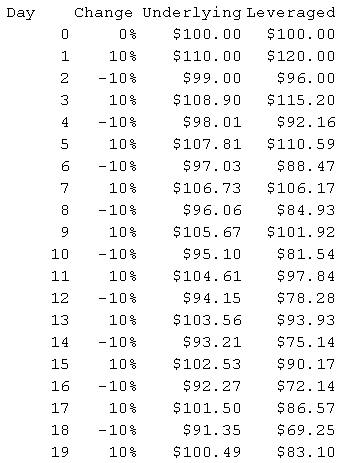

For an (extreme) example of how this works, put 100 dollars into a hyperthetical exchange traded fund and another 100 into the equivalent leveraged exchange traded fund. Over a period of days, alternatively increase and decrease the former by 10% and therefore the latter by 20%. After day 9 the underlying investment is worth a little under 106 dollars whilst the leverage investment is worth 102 (and not 112)! On day 19, it is 100 versus 83 (and not 100). Thereby, leveraged ETFs are best used in strongly trending markets to benefit from the compounding effect.

Here are some of the other risks associated with leveraged and Inverse ETFs

It is interesting to note that the value of the x2 ETF should only reach zero if the price of the commodity drops 50% (or more) in one day. However the most you can lose is always limited to the amount you put in initially (this applies even for a short ETF).

Take the following example:

Oil: $100 -> $90 -> $80 -> $70 -> $60 ->$50 ->$40

LOil ETF: $100 -> $80 -> $62.2 -> $46.65 -> $33.32 -> $22.21 -> $13.32

So, oil has dropped 60%, but the 2x leveraged fund has 'only' (!) dropped 87%. Of course, the possibility for recovery isn't good (oil must rise 150% to return to its starting point, but the Loil exchange traded fund must rise 650% to get back to its starting point). This is the 'slippage' I discussed earlier.

In the event that the oil price dropped 50% in one particular day, the fund would end up worthless. The fund manager would then likely close the fund and cancel the shares. The would then be free to create a new fund, with new shares starting from a new baseline.

There are numerous examples of leveraged exchange traded funds not providing leveraged returns. They are just not suited for Buying and Holding, simple as that. The reason is that these products are designed for short term trading and do not and cannot deliver over longer time scales. In a smoothly rising market a leveraged ETF might do what you expect but in volatile conditions the whip-sawing does the damage.

For these reasons inverse and leveraged products are best held for short periods of time and they work best in strongly trending markets (to benefit from the compounding effect). Since the geared ETFS will track the underlying instrument on a daily basis, holding a position when the market is moving against you means that the fund will have to work harder just to breakeven due to the daily compounding.

A: ETFS Nickel (NICK) is an open-ended Exchange Traded Commodity (ETC) designed to track the DJ-UBS Nickel Sub-IndexSM on a total return basis.

http://www.etfsecurities.com/csl/classic/etfs_nickel.asp

The Price of ETFS Leveraged Nickel (LNIK) will change daily by 200% the daily percentage change in the DJ-UBS Nickel Sub-Index SM (before fees and adjustments) and accrues a daily capitalised interest return..

http://www.etfsecurities.com/csl/lev/etfs_nickel_le.asp.

You or I would think that if the price of nickel changes by 10%, NICK will do the same, and LNIK will change by 20%. In theory you could invest £2500 in LNIK for the same exposure as £5000 in NICK. However, whilst that maybe true on a daily basis, when you read through the LNIK factsheet and arrive at the specific risk section you come across 'Returns measured over periods longer than one day may differ from twice the index’s return over that period' and 'If the index falls by 50% or more in one day, an investment in a Leveraged ETC will lose all of its value.' At this point my (admittedly uneducated) brain gives up as (a bit like covered warrants) there seem to be too many unknowns. Of course NAI :-)

The content of this site is copyright 2016 Financial Spread Betting Ltd. Please contact us if you wish to reproduce any of it.