You can spread bet on options as well, but it must be emphasized that the risk factor in this instrument for betting is very great. The 'gearing' attached to options is considerable, and this is increased substantially by superimposing a financial spread bet onto what is already a highly geared price. You really do need to understand how options work, quite apart from the influence that movement by the underlying cash price of the share or index, even though that movement may be in your favour. As the 'life span' of an option approaches its end, the price will weaken correspondingly.

When you consider placing a financial spread bet on an option, you will be given various strike prices to choose from, and these will be close to, or further away from the current cash price of the underlying instrument. These will be described as being 'in the money', or 'out of the money', depending upon the proximity of the cash price to the strike price.

|

|

|

|

|

In September with the FTSE at 6550, The spread betting firm quotes the Dec 6700 Call as 150 - 160. (This option expires on the 3rd Friday in December and will settle at the difference between the level of the index on that date and 6700, or at zero if the index is below 6700). You buy £5 per tick at 160.

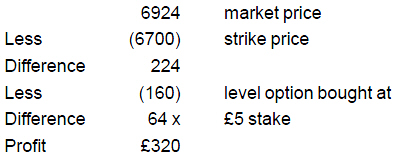

and the index rises to 6924 on expiry date -:

and the index is below 6700 on expiry date. Your option has a settlement value of zero. You therefore lose £5 x 160 (price paid) = £800 loss. (Note: it doesn't matter how far the index is below 6700, your loss is the same).

In September with the FTSE at 6550 the spread betting provider quotes a price for the Dec 6700 Call of 150 - 160. (This option expires on the 3rd Friday in December and will settle at the difference of the index on that date and 6700, or zero if the market is below 6700). You sell £5 per tick at 150.

and the index is below 6700 on the expiry date. Your option has a settlement value of zero. You therefore make £5 x 150 (price received) = £750 profit. (Note: it doesn't matter how far the index is below 6700, your profit is the same).

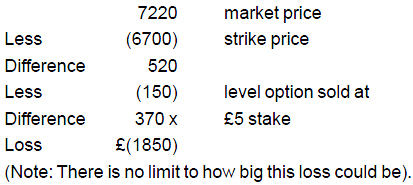

and the index rises to 7220 on the expiry date -:

In September with the FTSE standing at 6550 City Index quotes a price for the Dec 5925 Put of 45-52. (This option expires on the 3rd Friday in December and will settle at the difference between 5925 and the level of the index on that date, or zero if the index is above 5925). You buy £25 per tick at 52.

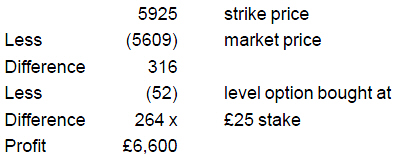

and the index falls to 5609 on the expiry date -:

and the index is above 5925 on the expiry date. Your option has a settlement value of zero. You therefore lose £25 x 52 (price paid) = £1300 loss. (Note: it doesn't matter how far the index is above 5925, your loss is the same ).

In September with the FTSE standing at 6550, City Index quotes a price for the Dec 5925 Put of 45 - 52. (This option expires on the 3rd Friday in December and will settle at the difference between 5925 and the level of the index on that date, or zero if the index is above 5925) You sell £25 per tick at 45.

and the index is above 5925 on the expiry date. Your option has a settled value of zero. You therefore make £25 x 45 (price sold) = £1,125 profit. (Note: it doesn't matter how far the index is above 5925, your profit is the same) .

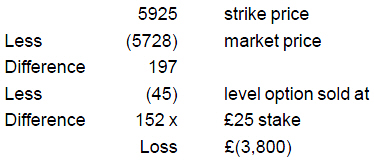

and the index falls to 5728 on the expiry date -:

>> Examples: Trading Shares via Options

|

For currency trading InterTrader is hard to beat... EUR/USD from just 1 pip, GBP/USD from just 2 pips... Trade over 60 major and exotic currency pairs with very few requotes. plus the trading platform is INSTANT and reliable with free professional charts. Apply for an Account. |

Please do not copy/paste this content without permission. If you want to use any of it on your website contact us via email at ![]() traderATfinancial-spread-betting.com (remove the AT and substitute by @).

traderATfinancial-spread-betting.com (remove the AT and substitute by @).