May 2005 Commentary Vince Stanzione

In my previous columns you will recall that I had become somewhat bearish on major markets especially the US. Since then the Dow has dropped some 800 points. It's amazing how many traders still want to know "when should I buy," instead of trading markets to go up or down.

For most traders it still seems wrong to make money from markets going down and in fact most spread betting customers still tend to want to bet to go up.

Traditionally we are now moving in to slower months hence the old saying "Sell in May and go away."

If you think that this is just a saying then take a look at the facts. This works on buying in November and selling in the next April. For this study a tracker stock on the S&P500 (SPY) was used. You would then switch to cash and re-invest again in November and so on. The results from 1950 to 2004 was $10,000 grew into $461,774, if you had done the reverse and Bought in May and sold in October your US$10,000 would have lost money- $8,375.

So statistically it makes sense to reduce your exposure to the stockmarket over the coming months.

|

The US Dollar has held steady for the last few months, however, I am looking for a large down move over the coming months. Against the Euro I am looking for the dollar to fall back to 1.40. So you would be long the Euro/Dollar.

As you can see from the chart since hitting the high of 1.36 level around December 04, the dollar has recovered against the Euro, but even with the higher US interest rates the Dollar has not been able to do better.

April 2005 Commentary Vince Stanzione

In case you have not spotted it already the UK smaller companies market has a new mania and it's the mining and exploration sector. The names have changed since the DOT COM boom but the behaviour of investors and traders have not.

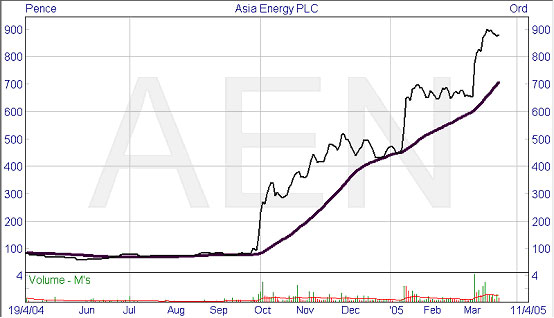

If you look at some of the recent charts of smaller mining stocks you can draw similarities to the old dot com shares. Many new mining companies are using the London AIM market as a way to raise money with investors happy to pile into anything that has mining, gold, oil, resources or exploration in the name.

Now many will say that mining is far safer than some internet story and I agree if you are talking about major players, but most of the shares that are being bid up are not actually producing anything.

In many cases they own no Gold, Copper, Zinc, Oil or whatever. In most cases they have a small rented office and maybe a licence to mine. The actual results if any will be years down the line.

There's a big difference between owning a physical commodity and owning mining or oil exploration share, with most shares you are buying a story.

Now before I sound anti mining shares I am not, I own by fair share of them including African Diamonds, Firestone Diamonds, Asia Energy, Falkland Oil & Gas, Centurion Energy, Vane Minerals to name a few.

And my own mining portfolio is up well over 400% but I do realise that these are high risk shares and are not for ploughing your life savings into this companies.

For every mining share that will become a winner you can bet that we have at least 12 that are going to crash and burn, and that's my concern. Most traders have not realised this. Charts that go up in a straight line often come down to earth.

|

Over 800% in a few months. No one is saying that this share cannot continue but keep your feet on the ground.

The key is to be sensible and not over invest in any one share, however sure you are. And make sure you have a stop loss or an exit. Don't get married to your trades, if bad news comes out then be ready to cut and run. In many cases bad company news comes in 3 or 4s so don't hang around for a second chance to get out.

Another point you have to be aware of is spreads and liquidity. Many smaller companies may be hard to buy and sell, or you may find you are able to buy but then when you come to sell you find liquidity is very thin, especially if the market has become negative on the company. This is another reason to spread your trades over various companies.

Many of the mining shares can be traded via IG Index and other spread betting firms so you have the option to bet shares to go down. You should never go short a share just because its looks high, who says it does not go higher? What you are looking for is the price to start moving down after a very big move up before you start placing down bets.

Mining shares are hot and I see no let up in investor's appetite for these junior stocks, however I warn you that whilst some of these companies will go on to great things the majority will never report a profit or find anything, and a lot of people will get burnt.

So play the mining mania carefully.

Until next month wishing you lots of success with your trading.

Vince Stanzione is a major name in the UK spread betting industry, having generated a reputation for making millions of GBP pounds tax free with a simple style he now sells as both a mail order course and a 1 day seminar, usually thru his FinTrader.net operation.

Opinion seems to be divided on whether or not Vince's style is anything original - his mail order course (costing several hundred pounds GBP) seems to be nothing more than a ring-bound folder containing a basic 'beginner's guide to trading (explaining such concepts as 'moving averages', stop losses, how to open a spread betting account and so on). On the other hand, although the same information may be available in a few manuals from Amazon for 40 or 50 bucks, Mr Stanzione has assembled it into one easy course, which will probably save a beginner much time and effort at the start of their trading career. Stanzione's reputation in the various online trading forums is both attacked and defended with equal vigour.

YOU SHOULDN'T SPEND MORE THAN GBP500 TO ATTEND A WORKSHOP OR SEMINAR NOT EVEN IF THEY PROMISE YOU GOLD FOR ATTENDING

The "Ads by Google" are just ads and help support the free information aspect of this site. You'll have to do your own research to decide whether those companies are reliable or not.The content of this site is copyright 2016 Financial Spread Betting Ltd. Please contact us if you wish to reproduce any of it.