Placing stops must be one of the most important and most controversial subjects in the whole of the spread betting and financial trading world.

More arguments and clients conflicts have arisen from stops than on any other subject that I know of, yet the other financial publications have on the whole brushed the matter under the carpet.

Using a stop-loss is probably one of the biggest and hardest things to do in spread betting. Of course, other magazines and publications make it sound simple, "Yes, place a stop 50 points below your entry level."

What a load of rubbish written by people who have never traded for real, because if they had they would not do that. Second piece of advice, "Son, you will never go broke taking a profit, and you should cut losses quickly." Now is that a contradiction or what!

Let's say you have found your share, index or whatever you want to trade, it doesn't matter if it is long or short. You decide to buy at £5 What's the very first thing that happens? You are in a losing trade because as soon as you buy or sell you have spread or commission factors to be considered.

The next point is an exit strategy if the trade goes wrong. In spread betting, we have two types of stops, a Controlled Risk Bet or (Guaranteed Stop) and a normal stop.

A controlled risk bet is charged for, normally a few points are added to your quote which is just like buying a small insurance policy. In return, the bookmaker guarantees your exit at that price regardless.

A stop is really a limit order which you have placed with your spread betting firm which will be executed if the market hits that price. The futures broker or financial bookmaker will endeavour to do their best to exit you at or as near as possible to that price. For example, if you buy the Dow at 10,500 so you are Long your Stop which is a sell order at 10,400.

If the market trades at 10,400 your stop order now becomes a live sell order and is executed at that price.

In a fast market, the dealer may not be able to fill your order at the price so your order could show at 10,380 or 10,350. Of course this causes many arguments especially out of hours, and while many may believe that bookmakers move prices just to stop your order out, I assure you that this is not the case. It's just not worth it.

If you are worried about this then always make sure to take a SCREEN price stop.

The first thing I did was to bring my £ per point down, at that time Spread Betting firms worked on a minimum of £5 per point however, IG Index were sympathetic and allowed me to trade £2 per point. Of course now you can trade a 1p per point with Financial Spreads and all major bookmakers now allow smaller minimum bet sizes. So I was able to make my bets last longer.

For example, if I place a spread bet at £ 5 with a 50 point stop I could now bet £2 with 125 point stop.

Once I did this my trading improved dramatically, it was far less stressful and I did not worry about being stopped out every 5 minutes.

I also added other rules and made the following observations:

In many cases, I did not understand how volatile a share or market was intra day. For example the daily range (OHLC, Open, High, Low, Close) is far bigger on a high flying technology stock than it is on a conservative property stock.

You can now use various tools to help you read how volatile a market is, such as the spread betting firm notional trading requirement (NTR). If you look at the spread betting bookmaker's handbook and I am currently looking at the recent folder issued by City Index, you can see a notional trading requirement figure for the contract month on the Dow Jones is 500.

|

If you now look at the Swedish OMLX it is only 50. So the Dow is far more volatile than the OMLX. Another indicator for shares is the Volatility reading on a charts indicator - the higher the number the more volatile it is.

If a trade went wrong and I was stopped out at £2 a point then its no big deal, I was wrong but if a trade started to go my way it meant that my trade was correct and in many cases it would go further, so I would add to my winning trades (Never average down) So if I bought £2 at £5 and now the price was £5.50 I could buy another £2. Of course, at some stage I had to close out or be stopped out. .

Most people place a stop and forget about it. What many successful traders do is trail the stop. The chart below shows a trailing stop.

The stop is taken from the previous high. This chart can be produced by various packages or you can even work it out by hand. The chart of Six Continents PLC shows how a stop loss line should be drawn.

| Remember a Stop was put to protect you. Many newcomers phone bookmakers to move stops away because they do not want to be stopped out. This is a bad strategy and in 99% of the cases you will end up losing more! |

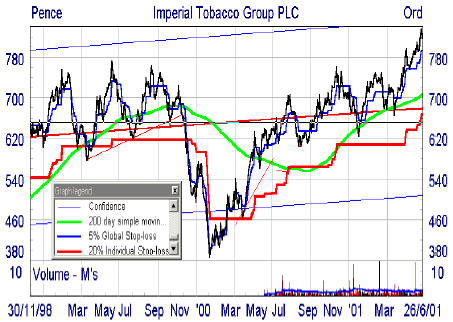

The example for Imperial Tobacco PLC (see below) shows where a trailing stop fails. The blue line which is very close to the share price is 5%. While you would never lose much on one trade you are stopped out multiple times, this is what we call death by a thousand stop cuts. Remember every time you have to enter and exit you have spread or commission on top. Using a 20% stop keeps you in the trade yet cuts you out during the major price fall at the end of 1999.

| However, do keep in mind that you can move stops as many times as you like and if your spread betting firm doesn't like it, then change the spread betting firm! |

When I first started trading with IG Index I had a limited risk account which meant that I had to place stops. At first I would keep stops fairly tight, my strategy was don't lose too much on one trade and I would be ok. For me it didn't work.

In many cases I had the correct trade but my timing would be a little out, so I would buy BT, it would dip down (as Vince Stanzione already stated you are down because of costs the minute you trade), I would be stopped out and then BT would and I would be out of the trade, yet if I had not had a stop I would have been fine.

In an article in the Times, May 18th 2000 on Spread Betting, Simon Mansell, the managing director of City Index cautions against the use of a stop loss in a highly volatile market for exactly the same reasons.

If we look at any share or index you will find various points where the market finds support and resistance.

A great example of this is the chart shown for the FTSE 100. For months the FTSE 100 6000 level continued to hold. Anyone long on this market that had a stop around 100 points below 6000 would have been fine.

|

Most people spend hours, days and months deciding where to enter a trade, yet entering a trade is the easy bit. The hard bit is exiting whether it be with a profit or a loss.

If you've never traded you will be thinking exiting with a profit isn't hard, Yeah, ask any real trader and he or she will tell you what a mind game this business is. I (Vince Stanzione) remember reading a quote by Oscar Wilde who said, 'The coward dies a thousand deaths, a brave man dies but once'. He was wrong and if Oscar has ever traded the futures market he would have never said that.

Believe me holding a profitable position can be in most cases as hard as holding a losing one. Why? It's human psychology and our emotions of GREED and FEAR.

The Greed element says to run your profits, the Fear element says we need to take our profits. What happens if the market turns?

I remember two pieces of advice I had when starting my trading career, 'Son, you must let your profits run, you will never make money if you cut winning trades quickly." OK, I can understand.

Moving averages have also been widely discussed. Many traders like to use moving averages as a buying signal, however, they can also be used as a Stop Loss signal. If we look at the chart of Man Group PLC we can see a great upward trend and following a strategy involving a trailing stop would have paid off. Of course when Man Group does turn, you are holding a large position.

|

By using a trailing stop you would have locked in profit on the upside. The break of the 50 days moving average confirms that the trend has changed or has at least came to a halt for now. From my experience, after a strong bull run it is normal to see some retracement or a consolidation before the next direction is decided.

For most of us we are better off staying out while the bulls and bears fight over the next direction. Once the winner looks clear we are happy to get back in.

A big problem that many traders have is what to do if they are stopped out, whether it be a profit or not. Take a look at the Man Group chart and you will see that you would have been stopped out and the share now continues to move back up you re-enter and start again. In the Man Group case you would have lost around 20 points, but that did not matter as the share continues to rise.

Summary and Conclusion to using Stops - Vince StanzioneWhile the text book may say to keep losing trades small, you have to realize that markets are far more volatile than they were 10 years ago. At the same time it is a financial suicide to run a losing trade down to a massive loss. You can recover from a 10% to a 20% loss but recovering from a 50% loss is very hard.

Whatever strategy you do use make sure to stick to it. Don't keep moving stops because you do not want to take a loss, in most cases you will end up with a bigger loss that you will find hard to recover.

Don't trade the Nasdaq or a very volatile high technology stock when you are first starting out. Know what you are trading, look at the volatility or at the NTR for that market. Is the stock liquid, what is the spread, and what is the normal market size? All these factors will make a difference in your stop-loss levels. At the time of writing low volatility FTSE 100 stocks include: Land Securities, Boots, Scottish and Southern and Canary Wharf. Notice no telecoms or techs here.

Attention: This article should not be taken that I approve or recommend Vince Stanzione expensive seminars. The article has been published here because I do believe that Vince Stanzione is a genuine trader with several years hands-on experience of spread betting. Spread trading seminars and courses are a good introduction, but what you learn is only what you can learn from books and the Internet, all for either free, or a fraction of the course price. This site in itself is already a good solid resource

YOU SHOULDN'T SPEND MORE THAN £500 TO ATTEND A WORKSHOP OR SEMINAR NOT EVEN IF THEY PROMISE YOU GOLD FOR ATTENDING

Please do not copy/paste this content without permission. If you want to use any of it on your website contact us via email traderATfinancial-spread-betting.com (remove the AT and substitute by @).

The content of this site is copyright 2016 Financial Spread Betting Ltd. Please contact us if you wish to reproduce any of it.