Index Spread Betting

One of the key selling points of spread betting is that it opens the door to a variety of markets that have been unavailable to ‘at-home’ traders in the past. Some of the most popular markets to trade are called Indices. These are comprised from a number of companies in different countries, ranging from England and Germany to further a-field such as Japan and America. It is possible to enter into both rolling and futures contracts for these markets.

An index is the measure of the value of a financial market made up from the prices of its constituent parts, most commonly individual shares.

It is expressed as an overall price that has its original in base value that was set when the index was first compiled (often 100). Changes in the index price allow investors to perceive how a particular stock market has performed.

Stock indices measure and represent the value of a basket of shares. For the majority of the world’s major equity indices, there is a specific cash price and a futures price as well.

For instance, spread betting provider Ayondo will create a price based on the cash price on which clients may trade.

Stock indices are the most popular area of spread betting. Bets on indices appeal to:

- the pure speculator,

- the technical trader who watches stock market charts,

- and to some private investors who think they can see a big market move coming but do not want to disturb their underlying share portfolio.

The FTSE 100 is a share index of the 100 most highly capitalised companies listed on the London Stock exchange. Due to copyright issues this will normally be referred to by the spread betting companies as the UK 100. Lets say that the GDP figure was due to be released and you thought it would be better than expected, and in turn would have a positive impact on the index. The current quote was 6020-6022 and you bought at 6022. If the market did rise on the back of the news and you closed out at 6050 a 28 point profit would be secured.

Another popular index is the Dow Jones. This shows how the top 30 companies in America have traded during a standard session in the stock market. This will most likely be referred to as the Wall Street 30 or something similar for copyright reasons.

Investors can trade stock indices to profit from either rising or falling markets, as well as to hedge other investments they might have. For example, you might have £10,000 invested in a UK 100 tracker fund and you are concerned about a possible fall in equity prices in the near future. If the price for the UK 100 Rolling Daily was 5000-5001, you could sell at £2 per point at 5000 to fully hedge against the £10,000 investment in the tracker fund because £10,000/5,000 = £2.

If the UK 100 then fell 20%, the value of your tracker fund investment would now only be £8,000, so you would have a paper loss of £2,000. But since you had sold £2 per point of the UK100 at 5000.0 and the price would also have fallen 20% to stand at around 4000-4001, your trade would be in profit by (5000 – 4001) x £2 = £1,998. So you have been almost entirely compensated for the loss on the tracker fund.

Spread betting companies offer spreads on many stock index bets including:

- Daily closing levels for the FTSE100 index and Dow Jones Industrial Average and other international indices.

- Futures for the FTSE100 index and Dow Jones and other international indices, expiring around the middle of each month.

- Daily closing levels for futures in the FTSE100, Dow Jones and S&P index and major European indices.

- Monthly futures for many other indices, including the S&P500 Composite, the NASDAQ 100, the French CAC40, the German Dax, the Japanese Nikkei 225 and the Hang Seng index in Hong Kong.

- The points differential between certain indices at a particular futures expiry date. Examples are the differential between the Dow and the FTSE, and between the FTSE and the Dax.

These are the most popular stock indices -:

| UK and Europe | USA | Global |

| FTSE 100 | Wall Street | Japan |

| FTSE 250 | S&P 500 | Australia |

| Dax | Nasdaq 100 | India |

| Mdax | Russell 2000 | South Africa |

| CAC | Hong Kong | |

| SMI | China | |

| Euro Stoxx | ||

| Aex | ||

| Ireland 20 |

Stock Index Futures: You Are Trading Futures

We have covered these in some detail before, remember when I was talking about the FTSE100, the DJIA (Dow) and the Nikkei. Well, all these and more listed below, come under the umbrella of Stock Index Futures. Basically they are an easy way to trade in a whole group of shares, instead of just the one share.

It is important to remember that you are trading futures when spread trading. You are being quoted a spread based on the expiry date. You must be particularly aware of this when trading the Indices.

Take the FTSE 100 as an example. The FTSE 100 Cash Index is the one most people are familiar with and is the one quoted in the newspapers, on radio and TV. However, this Index itself cannot be traded on the Stock Exchange floor it is purely a reflection of the movement in price of the FTSE 100 companies. There is another Index called FTSE 100 Futures Index, which can be traded in the same way as a share, and as the spread trading company has to have the ability to lay off their risk in the market, it is the Futures Index that they use to trade.

The same goes for the Dow Cash versus the Dow Futures Index except that there can be a much bigger difference on the Dow between the two.

If you are looking at a real time chart or price, particularly of the Dow Cash Index changing, you will notice that the trading company Cash Index spread does not always follow every move exactly. The reason is because the spread they offer is a hybrid between the Cash Index and the Futures index. It follows both based on a programmed formula. You are actually not trading the pure Cash Index although it is very close.

Also, the Futures Index is tradable outside normal market hours therefore you can trade the FTSE or Dow (or other indices) at any time when the spread trading company is open for business. Some companies are open 24 hours a day so you can literally trade some markets around the clock. However, outside of normal market times, the prices quoted are linked purely to the Futures prices.

One important point you should realise that the current quoted price of the Future may not correlate to that of the actual Index. There are reasons for this as follows:

The Index future tends have a natural premium built into it called a fair value premium which is above that of the Index you are wishing to trade. This is because there is a natural financial advantage to trading in the future than physically buying the underlying stocks for cash, this is based on the interest advantage of the future. Interest rates are usually higher than any dividend payable on most shares and this is reflected in the price of the Future in question.

Future prices react to news and events much quicker than the underlying Index in question. Therefore the live price of the Index you see on some sites and services may not tie directly with that of the Index Future.

Now I know the above was a bit heavy, and like you, I sometimes have to re-read the first one especially (and I wrote it LOL). I have taken the liberty to tell you the above so you know. You need not worry about it much at all. As we always trade from the quotes that we receive from the spread betting provider, and the prices we use more than most, are those that are supplied by the financial spread betting company.

We only use online services to research trading patterns and trends in charts, or better still you may have already experimented with using a proprietary charting program. We don’t stress too much about the fact that the underlying price of the stock, indices or whatever it is we’re trading doesn’t match perfectly with the REAL stock quote etc. So don’t feel that you are being ripped off by the spread betting provider if the prices don’t match. In fact some spread betting providers now allow you to choose whether you wish the quote to be relative to that of the actual Index or the spread betting provider’s own book price.

At the current count there are 26 variants of Stock Indices that you can trade in. Now I know what you are thinking. I said that there was only 3-4 major league Indices out and that is true. However, many of the Indices break down the main index into parts, larger or smaller. For instance the FTSE can be traded in the following: FTSE100, Daily FTSE Index, Daily FTSE Futures, FTSE250 and so on. Essentially there is little difference between them, except the larger Footsie 250 is the top 250 companies and not 100. The Daily Futures can only be kept open for one day.

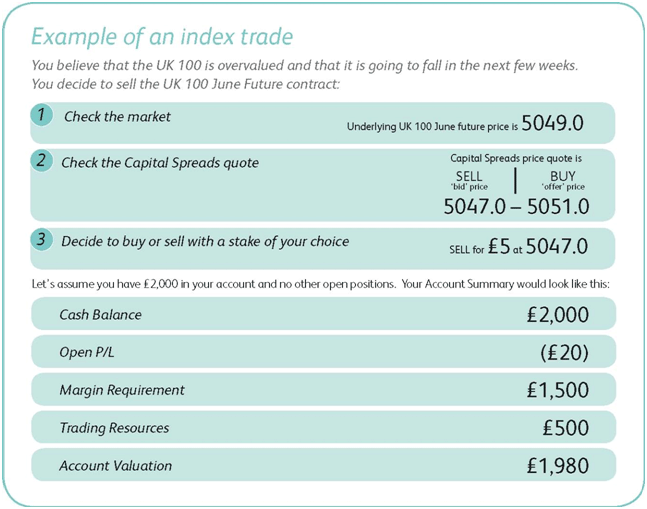

Example of an Index Spread Trade

Your automatic stop loss would be placed at 80% of the maximum computer generated stop loss (CGSL). The maximum CGSL for the June UK 100 contract is 300 so the stop would be placed 300×80%=240 points away at 5287.0.

The used margin would be 300 x £5=£1,500. As you have excess margin available you would, in this instance, be able to move your stop loss further away. If you did, this would reduce your Trading Resources.

The loss reflected on your account is a reflection of the spread of the quote multiplied by your stake: 4 x £5=£20 (the profit or loss recorded on your account is always a function of the price at which you could exit your trade at that moment in time).

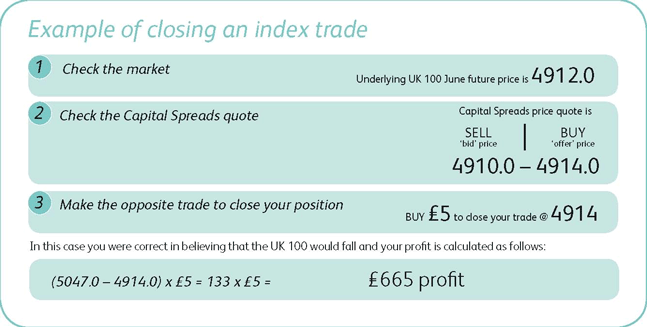

The next few weeks sees concerns over corporate profits causing the UK 100 to fall. You decide to close your trade: you think conditions will improve and hence close your short position.

In practice, different spread betting companies may have slightly different policies – for instance some might not assign trades with an automatic stop loss.

Example of Closing an Index Spread Trade

There are many factors that can have an affect on these markets, ranging from news on take-overs to the latest economic data. I think that because there is widespread coverage and news available it has become so popular with traders, as they can keep on top of the latest goings on. It’s also worth pointing out that a lot of people like to trade on Indices is due to their very volatile nature. Large swings can take place intraday and overnight. It is not unheard of for the FTSE to move by over 100 points and the Dow by as much as 200-300.

Join the discussion