Bux Markets is a trading platform originally launched in Germany in 2009. It is currently headquartered in London, where its operations are regulated by the Financial Conduct Authority (FCA).

From their site:

'TradeHub® uses the very latest HTML5 technology and has been purposely designed for people who are both new to trading as well as professional traders. TradeHub® allows clients to trade like institutional investors. By providing them with tools and resources previously only available to institutions, clients are able to take charge and manage their investments. From top institutional grade research to real time market news, clients are equipped with everything they need to meet their trading goals in one beautifully designed, elegant and easy-to-use platform. Created with no one but the client in mind, TradeHub® is intuitive enough for anyone to use. The entire trading experience has been streamlined and a platform created that is fully customisable to suit client trading needs as well as being rich with exciting features and tools.'

75.9% of retail investor accounts lose money when trading CFDs and spread bets with this provider. You should consider whether you can afford to take the high risk of losing your money.

TradeHub is a highly intuitive and easy to use trading and investment platform that comes in two versions: browser based and mobile app.

|

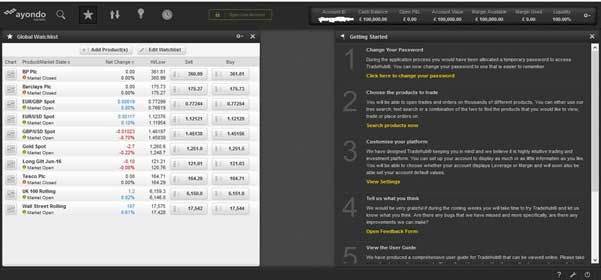

This is how the platform looks like after you log in for the first time. It is split into three main areas: the top menu bar, the bottom menu bar and the trading area. The left side of the Top Menu contains five easy to identify icons:

Product Search icon: here you can find all the financial instruments that can be traded with Bux Markets grouped in six categories (indices, FX, commodities, stocks, interest rates bonds and ETFs). In order to find the desired product, you can use category search, text search or a combination of the two.

Watchlists icon: allows you to toggle between lists of preferred products.

Open Positions and Orders icon: opens a new window which displays any open trades and orders. It also shows details about the entry price and the current market price, margin used, what the current profit or loss is and stop loss and take profit levels.

Tools and Resources icon: here you can access Reuters News feed and an economic calendar with data about forthcoming holidays, expiries, dividends and company earnings.

Account History icon: here you can see a list of all the transactions and orders in the account or you can either choose to see only those between a predefined time period (this or last week, month, year) or those between 2 selected dates.

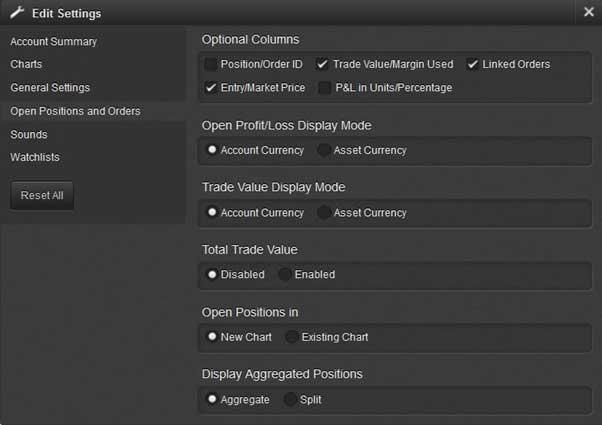

The right side of the Top Menu contains the funds management interface, with details about the account ID, cash balance, account value, open P&L, available and used margin. From here, using the small 'cog' icon, you can also access the Settings menu, which proves that TradeHub is a highly customisable platform. Firstly, you can select which tabs to be displayed in the funds management interface. Then, under Charts settings, you can choose the quote mode (bid, ask or mid), type of gridlines, theme, default scale and whether one-click trading is enabled or not. In the General settings you can choose from the 5 platform languages available, select whether leverage or margin is displayed, what date format and background style you prefer and choose one from the four input methods available for stop loss and take profits. There are also various options for Open Positions and Orders (such as selecting the display mode for open P&L and trade value) and Watchlists (add optional columns, sort direction ascending/descending).

|

The bottom menu bar contains 3 buttons; you can access the Getting Started section (here you can access the Search Products and Settings windows, provide feedback and open the platform user guide) Preferences (or Settings, the screen above) and the logout button.

The trading area, the largest part of the TradeHub platform, is where you will be carrying out the majority of your trading and research activity.

|

The first step in personalizing the trading area is to get a Watchlist with the instruments you normally trade or have an interest in. You can either customize the existing Global Watchlist (click on Add Products button to add instruments and Edit Watchlist to remove) or create a new one.

If you want to find out more information about a particular product (EUR/USD in the screenshot above) just click on it and a Product Information window will pop up. As you can see, this is quite comprehensive, containing everything from trading hours and base margin rate to minimum and maximum trade size. Clicking on the Chart icon in the top left corner will launch a chart with the instrument.

The charting package of TradeHub is fully customizable and very intuitive. The size of the chart can be adjusted to occupy the entire trading area. You can select from 6 different chart types (candlesticks, OHLC, line, spline, area and range bar) and 13 different time frames (from 1 minute to 1 year). The most popular indicators (such as moving averages, Bollinger Bands, RSI, Pivot points) are available and you can also add onto charts trendlines, channel lines, Fibonacci projections and retracements, arrows and rectangles. The active charts can be printed or exported as PNG, PDF or SVG files.

|

When you're ready to place a trade or an order, you can open a deal ticket either from the Watchlist or directly from the chart. If you decide to open a trade at the current market prices, you can now select the trade size, and set stop loss and take profit levels. As it can be seen in the screenshot above, TradeHub comes with two very interesting features. Firstly, the different colours used for Buy (blue) and Sell (red) deal tickets. Secondly, the variable margin slider which can be used to select the desired margin/leverage for each trade. For instance, if you want to buy one lot of EUR/USD you can choose to post the minimum 1% margin (£774) or the entire amount (£77,401). One benefit of this feature is that you will be able to reduce the amount of overnight funding you pay.

To sum up: TradeHub from Bux Markets is a highly customisable and easy to use trading and investment platform that also comes with some unique features such as variable margins and ability to input notional amounts in the deal ticket.

The content of this site is copyright 2016 Financial Spread Betting Ltd. Please contact us if you wish to reproduce any of it.