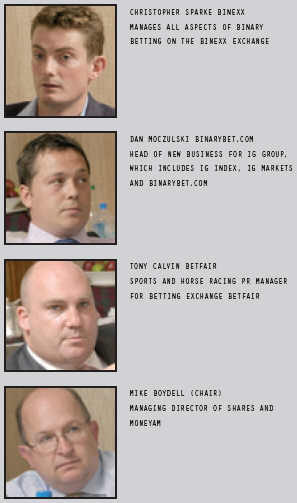

You can turn a dull, stagnating market into an exciting money-making opportunity with binary betting or a punt on a betting exchange. Shares' Mike Boydell chairs a panel of experts in the field on the advantages and characteristics of these innovative services.

|

Mike Boydell, Shares: Today we're talking about binary betting and betting exchanges. First, what is binary betting and how can traders profit from market moves?

Dan Moczulski, IG Index: It's a little removed from spread betting or traditional share trading. IG Index resolve any financial instrument into two outcomes - either it does happen or it doesn't happen. Let's take the FTSE - either it will finish up on the day or not.

We subscribe two numbers to that using this binary method: zero if something doesn't happen and 100 if it does happen. At any point of time before the actual outcome occurs, we will provide prices for people to deal on the possibility of either outcome.

Say we were making a price of 49-51 on the FTSE. If you expected the index to finish up on the day, you'd buy at 51. If it did finish up, the bet would finish at 100. You would have bought at 51 and therefore would have made 49 points. If you had traded £10p per point that's therefore £490 tax free.

Christopher Sparke: The principle of the 0-100 finish is exactly the same but a client has the opportunity to place an order on that market and potentially match with other clients on the exchange itself.

The way we settle the binary market on a 0-100 basis is different from how a fixed-odds market is settled on a betting exchange such as Betfair, but the risk is exactly the same - it's just how it's expressed to the user.

Boydell: How do betting exchanges differ from using a normal bookmaker?

Tony Calvin, Betfair: Betting exchanges are probably the ideal bookmaking model - they are bookmakers that don't have any risk whatsoever. They do this by providing a sophisticated betting platform by which punters bet between themselves and can set their own prices.

You have an added bonus. Once the tapes go up in a horse race, that signifies the end of the betting for most people. But betting on a horse that's running, for example, accounts for 10% to 15% of our racing business and is probably the most popular aspect of it. Second by second, there are always prices available.

We also do financials - betting for example on whether the FTSE or Dow will be up or down on the day and that is one area where we would look to grow.

Boydell: I understand that with betting exchanges you bet on the time result - what will it finish at an hour later?

Calvin, Betfair: Yes - the FTSE is a classic example. We bet by certain times of the day - will it be over or under a set price, and will it be up or down on the day.

|

"If there's no price or you're not happy with the price you simply request one. You can put your own price in. Once you get a lot of people requesting prices, that's when you get the two-way prices, because liquidity tends to breed liquidity."

Boydell: Do I have to wait until the end of the event to settle a binary bet or can I settle any time from the start of my bet?

Sparke: You can settle a bet whenever you like. It's similar to spread betting in that you can open or close a position whenever you like. If you wait for the outcome to happen and the outcome occurs, then the settlement of 100 happens. If the outcome doesn't occur, we know the settlement is zero. But you can come in and out of a position as many times as you like.

Boydell: Is there always a two-way price being made?

Moczulski, IG Index: We always guarantee two-way prices, 24 hours a day. It makes no difference to us whether clients are looking to sell or to buy, they'll have the same availability of pricing and in large size.

Boydell: Do betting exchanges have the same sort of model?

Calvin, Betfair: Some markets are very, very liquid - some golf and cricket markets, for example - so nearly all the time you're going to get a two-way price. Not only that but a great deal of the time you're going to get a far better deal on betting exchanges and Betfair in particular.

When we're talking about financials, there's obviously a liquidity problem as we don't have as many financial punters, so there isn't always a twoway price. However, the beauty of betting exchanges is that if there's no price or you're not happy with the price you simply request one. You can put your own price in. Once you get a lot of people requesting prices, that's when you get the two-way prices, because liquidity tends to breed liquidity.

Boydell: To clarify the two platforms for the readers: there's the Betfair model in which Betfair itself doesn't make a market but lets users make the market and there's the IG Index model, where the firm just makes the market.

|

Calvin, Betfair: In their nature they're very similar. The margins these guys work to are highly defensive but then if they are laying on the betting size they would argue that they provide guaranteed liquidity in that price.

Sparke: The market makers are there to provide liquidity - the clients don't have to take it and can leave orders wherever they like.

Calvin, Betfair: And I suppose, if you get the initial prices up, people come in and make the margin smaller. If you are a market maker in betting exchange terms, we call that seeding, though we don't actually do that any more.

Boydell: Which financial markets can I trade through your companies?

Moczulski, IG Index: In terms of financial markets, we quote stock indices, from the FTSE, Dow, S&P and Nasdaq to the more exotic ones such as the Korean KOSPI. We offer a huge range of currencies, shares and commodities. Importantly, there are extensive ways of trading these on an end-of-day or end-of-hour basis or even a five-minute basis. You could set a 10-point range that if the market finishes within that particular range the bet will come good. You can trade on a one-touch basis, so that if the market ever reaches a particular level at any time of the day you will make a profit on the back of it. You can profit from 'tunnel' bets in that you make money if the FTSE stays in between two particular levels. There are a variety of ways of trading, not only which markets but on the way you trade that particular market.

I think it's important to add that with the binary style it's not just the actual underlying financial market that we're looking at, it's the types of market available. We also offer a client a different form of leverage and gearing. The variety of types of market means that given any market situation - low volatile, high volatile, extremely high volatile, no volatility at all - there's always a market available.

Boydell: On Betfair, I understand you've got things being added to the financial model?

Calvin, Betfair: Yes, we bet on the FTSE, Dow Jones, daily currency markets, interest rates. We've just recently introduced a house-price market whereby you can bet on what price the Halifax index is going to be at any particular point. You can bet on that every month now.

We're always looking to improve the financial area, it's very much 'watch this space' for Betfair.

Boydell: How are your prices set and how does this flow through to charges.

Calvin, Betfair: On Betfair, we provide a platform for punters to set their own prices. If you'd fancied Tiger Woods to win the Open, you would have put a price in to back him, and if you wanted to oppose Woods - that is to lay him, to back him not to win - you would offer a price for other punters to take from you.

To do that you must have in your account enough to cover your maximum possible loss - there is no credit on Betfair. A bet is never accepted unless we can immediately hedge it off somewhere else. We match punters with opposing views at prices acceptable for them to back and lay. It's a very high-tech business and a big undertaking to actually provide that kind of betting platform.

Betfair takes commission between 2% and 5%. The more you bet, the less you pay in commission.

Moczulski, IG Index: Binary betting is a new product and for people to get into it they have to have liquidity on the whole range of markets that we offer. Clients need to know they can get out at any time at the prevailing price. Therefore we thought the best model for IG Index was to be a market maker. Any one of our markets is good on £100 a point at any one time. The other positive of a market-making model is that there is absolutely no commission.

Boydell: Binary or decimal? We know at IG Index you quote, say, 49-51 while the bookmakers make 2 to 1 and 3 to 1. Which is the easier one for a client to understand?

"The major selling point of binaries for private investors is that they provide volatility on unvolatile markets."

Moczulski, IG Index: They are identical in terms of potential profit or loss - it's just a different way of relating to clients our market on a particular outcome. I would say private investors are more familiar with the binary method but people who are more used to sports betting would generally go for the decimal.

IG Index is the only one that provides both so you can toggle between the two and decide which you prefer. The display can be in either.

|

Sparke: We feel binary prices are very transparent and that it is easier for the client, especially in financial markets, to understand a binary price rather than a fixed-odds price in a fraction format or decimal format.

With the binary price, how much you are winning and losing during the event is very clear, which isn't always as clear with a fixed-odds bet.

Calvin, Betfair: Betfair prices are purely decimal. We feel that's the easiest way. The profit and loss is easily displayed as you're trading events, so you're always aware of how much you'll lose in one eventuality and how much you'll win on another. No one else in the world uses fractional odds so we feel decimal is obviously the way to go . If you're having £100 on a 1.27 chance you know your return if that wins is £127 - it is very easy to do and very transparent.

Boydell: Take a punter who has just bought shares in the normal way over the years or has traded more familiar derivatives. Why would he want to get involved with binary betting?

Moczulski, IG Index: The major selling point of binaries for private investors is that they provide volatility on unvolatile markets. For example, a one-point move on a FTSE spread bet is only worth that, one point. A one-point move on the FTSE for a binary bet could easily be 50 points, so it's creating volatility where there isn't necessarily any there.

For anyone who is trading for capital gain, it does provide that now on the most sedate of markets 24 hours a day.

Sparke: With private investors looking to make an income over a 10 to 15-year period from dividend payments, binary betting is probably not the product they should consider. But if an investor is buying shares for short-term or mid-term capital gains, a low-volatility underlying market can become a very volatile binary market.

If you're going to bet on whether the FTSE is going to be up or down on a day and it's flat with five minutes to go, you know one thing with a binary product. It has to settle at nought or 100, so there's a nought to 100-point move on a one-point move of the market.

Added to that, with a binary format, unlike spread betting, your risk is always known in advance - you cannot bet with more than you have. If you've got £10 in your account and the market on a binary bet is offered at 20 and you want to buy at 20, you can't do that. At the same time, if you buy the market at 10 and you've got

£10 in your account, that's the limit to how much you can lose.

Boydell: I've heard that binary bets have variable spreads. Correct?

|

"There are so many ways you can bet on an exchange that the types of punter we have are very varied"

Sparke: They can do. It really depends on the liquidity. If there is a high amount of liquidity on a market - usually a market close to settling - liquidity increases and the spreads tighten. On other occasions, there are markets that have little interest, whether it's to do with a lack of volatility or whether interest is elsewhere, and spreads can be slightly wider. Essentially, though, we are always looking to maximise liquidity as the greater the liquidity, the tighter the price will be.

Calvin, Betfair: What would be an acceptable spread - one you're happy with?

Sparke: It's up to the market maker but on a binary market we would rarely have a spread wider than four or five.

Calvin, Betfair: Presumably that would allow you to lay any bet in size?

Sparke: Yes. The market maker displays the size as well on the exchange so the size is always clear.

Moczulski, IG Index: Spread is important to binaries but it's nowhere near as important as it would be with a conventional spread bet or a conventional share trade. Remember, the spread of the binary bet has very little to do with the underlying market itself.

If you're spread betting or trading shares conventionally, the reason why spread is important is the amount you have to beat to make a profit. That is not the case with a binary bet - the market itself only has to move one point. The spread that you paid on the binary bet is irrelevant.

For example, using absolutely ridiculous numbers, our spread could be 30 at 50 on a binary bet for the FTSE to finish up on the day when it was unchanged. If the FTSE only moves one point but ends up in positive territory, it still makes up at 100.

Boydell: How do most of your clients trade? Are they day traders, short-term traders, long-term traders?

Calvin, Betfair: There are so many ways you can bet on an exchange that the types of punter we have are very varied. We have the gamblers, people who strike one bet, sit down in front of the telly and let it ride. If it comes up, fine. They won't react to events happening in front of them, they'll just sit there and suffer or celebrate.

Then you have the traders who will take a position pre-event and trade that position - that is continue to back and lay throughout the event, trying to maximize their best return and hopefully trade themselves into a position where they can't lose and, best-case scenario, win on both eventualities.

If you call the market right early on in a golfing tournament or a football match, you can get yourself into what we call an all-green book, that's a no-lose scenario where you win on both eventualities.

We also get the hedgers - people who will call the market right and just cut out so they minimise any losses they may incur - or the arbitrageurs. I'm sure they're very established in any other walk of betting. A punter might take 8/1 in the betting shop and if there's a big gamble on that horse be able to lay it back at 5/1.

Certain people will only bet in-running. These are people who are very good at, say, judging a horse's style of running or maybe know how a jockey rides. Some jockeys are very deceptive - the horse looks to be going badly but the jockey is just building up a momentum.

Moczulski, IG Index: Most of our clients are short-term. We do some end-of-year contracts but holding a position for more than a couple of days is quite rare.

The obvious reason for this is volatility. The volatility of binary bets is produced by its short-term nature. People enjoy the volatile aspects of them. For example, if the FTSE today goes down 100 points and

tomorrow goes up by 50 points, it doesn't really bear any relevance to what is going to happen in two months' time. Many financial traders on IG Index are trading within five minutes and very few people are trading any longer than a day.

Sparke: The binary product is conducive to short-term trading. The fact that it creates a volatility that isn't there in the underlying market is precisely because of the time delay. Our clients always prefer the shorter-term markets. We do offer slightly longer-term bets - you can bet on whether the FTSE is going to be up or down in a week and there is some interest there but it is not big.

Calvin, Betfair: That's very true of Betfair as well. The closer you get to an event the more money and interest there is in that market. If you're talking about who's going to win the World Cup 2006, there is a market there but there's not nearly as much interest. If you place a bet now, you have to put your money up front so you're tying up those funds for maybe the best part of a year.

While punters do tend to be more short-term, though, sometimes you'll find that the prices are so good in the long-term market that they are willing to tie up their money.

Boydell: Are there any tax benefits with binary betting?

Moczulski, IG Index: Every trade that you do is completely and utterly tax-free.

Sparke: Yes, but for people betting abroad it is their responsibility to check their own tax status.

Boydell: Is there commission to pay and if so, how is it calculated?

Calvin, Betfair: At Betfair, we match bets through punters and we take a 2% to 5% commission from the winning punter. Obviously you don't pay any commission on losing bets so if you win we take 2% to 5% off.

The more activity you have on the site, the less commission you pay. So our most active users would only pay 2%. The commission isn't a problem for them for the simple reason that, according to an independent survey, Betfair offers on average 20% better odds in the market place than anywhere else.

Boydell: Does your commission structure also depend on the type of event?

Calvin, Betfair: We have what we call a market base rate. If a market is underperforming, if, for example - we feel it should be doing more trade than it is - we have the facility to lower the rate.

Boydell: Your commission rate is 2% to 5%...

Calvin, Betfair: Yes, but there's a lot of scope for improvement. We might go to users and say: 'If it was a flat rate 1% would you use it more?'

Moczulski, IG Index: It doesn't make any difference because we have absolutely no commissions whatsoever at IG Index - zero. Your profit is yours to keep.

Boydell: On a betting exchange, rather than buying and selling shares you bet on whether stocks or indices will close higher or lower at a particular time. How does this work and how can I close out before the event finishes?

Calvin, Betfair: If you take the FTSE market, it will it be up or down by the end of the day. If you've taken a price in the morning, say £500 even money (or two in decimal terms), you would win £500 if that bet came to fruition or lose £500 if you were wrong.

If the market then moves so much in your favour that towards close of day that basically it is a 1.02 chance - 1.01 to back and 1.02 to lay - you could lay £1,000 back at 1.02. So you'd be risking £20 to win £1,000. As you've already won £500 because your bet is right, if you did close out for that thousand at 1.02 you would be winning £480 of your bet and £500 the other way. So no matter what happens in those last minutes of trading you are guaranteed a £480 win on one eventuality and a £500 on another.

In that respect, if you call the market correctly in Betfair you can always close out and take your profit there and a lot of people do. They like to have the peace of mind - take their money, sit back and see the last 10 minutes of trading.

Boydell: How do I place the trade? Is there a limit to a buyer who wants to trade over the phone or online.

Moczulski, IG Index: We don't accept trades over the phone - it's such a fast moving market that the five seconds it takes to relay a price to a client over the phone means it's potentially not valid any more. If the system ever were to go down, there are facilities in place to cover that, with more than 50 dealers available immediately. For people on the move, we have a dealing platform available for mobile phones.

Sparke: Ditto to that. Even if we offered the services we do over the phone, which we won't, you would still probably see no one call up.

Calvin, Betfair: Betfair is an online-based betting product. However, we have got an extensive telephone centre so you can bet over the phone. We have two call centres and about 75 telephone operators. It's a very clean and efficient thing to do online but, say you're at the racecourse, you can ring up for a price and bet as you would online.

Boydell: Is it possible to set stop losses?

|

Boydell: What is your minimum bet size?

Boydell: So your stop loss really is £100 basically.

Sparke: It depends the price you bet at. Let's not forget the leverage of the product means if you buy £1 at three you know you can't lose more than £3 but you can make £97. Conversely, if you buy £1 at 90 you know you can win £10 but you can lose £90. Those figures are all set in stone in advance, you know them before the bet is placed.

Calvin, Betfair: Stop loss is not a term that is particularly relevant to binary exchanges. Obviously you take a position and you can close on that position in a fast-flowing market any time you want, so in that respect you can cut and run. There's no real stop loss as such but obviously the ultimate stop loss is going in there, reversing your position, taking your profit or whatever. And punters will do that because the market is so tight and favourable that they don't have to pay a lot to get out of a bet - it's not like you pay a big spread price.

"If two exceptionally wealthy people want to match on the exchange, then it is unlimited how much you can win. You're not a bookmaker on an exchange, it's client-to-client matching so there is the potential to win thousands and thousands of pounds"

Boydell: What is the most I am likely to make or lose?

Calvin, Betfair: Basically, if you have £1,000 in your account, you can lose that £1,000. However, if you keep on calling markets right, that can build very quickly.

There's no shortage of people willing to risk £100 to win £1. If you take these guys on and you're right twice out of 100, you can turn that thousand into many

Please do not copy/paste this content without permission. If you want to use any of it on your website contact us via email at ![]() traderATfinancial-spread-betting.com (remove the AT and substitute by @).

traderATfinancial-spread-betting.com (remove the AT and substitute by @).