Betting on Gold

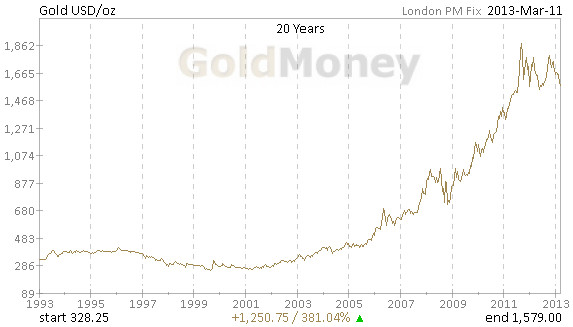

Investors have been left with few safe havens for their cash since the height of the credit-fuelled economic crisis, prompting many to seek out the one traditional store of wealth that has outlasted all previous crises: gold. The severity of this crisis and longevity of the recovery convinced many investors to look for a safe haven beginning a long upward trend for gold prices. More recently, however, gold prices have started to tumble.

Preamble

Gold is rare and cannot (easily) be faked so it retains its value even though banking systems and paper money are crashing. This is because gold has an intrinsic value which is not contingent on a third party’s performance or mere promise to pay. In fact, there’s a law in economics known as ‘Gresham’s Law’ which states that when there is legal tender currency (as the case with the Dollar), bad money will drive out good money out of circulation. Look at it another way. Should inflation continue rising then your food, fuel and gas are likely to continue moving up in price. So, if you had to visit your gas station and you had the choice to pay with either pure gold coins or US backed paper dollars…with the dollar giving ground while the price of gold remaining stable what would you spend? [obviously you would want to keep the gold!]

Spread Betting on Gold by Christopher Beauchamp of IG Index

Gold positives: scarce (it is thought that the global stock of mined gold is presently around 160,000 tonnes), widespread acceptance of gold as currency, central banks keep hoarding gold reserves (central bank buys increased 16% to a 48-year high of 532 tonnes in 2012), It is particularly advantageous to hold in times of disasters or great economic uncertainty.

Gold negatives: doesn’t provide any income and is not consumed, few industrial applications, lower demand for jewellery and gold bar investments in Europe and India in 2012, increasing mining costs (average cash costs for gold miners amounted to $738 an ounce in 2012). Since gold is considered a non-producing asset it requires an increase in demand to rise in value.

Below you can see an 800 year price-adjusted history for the price of gold. As you can see the price has mainly ranged (excluding short intervals of government intervention) for the best of 500 years demonstrating the value of gold as ‘insurance’.

800 year price history of Gold

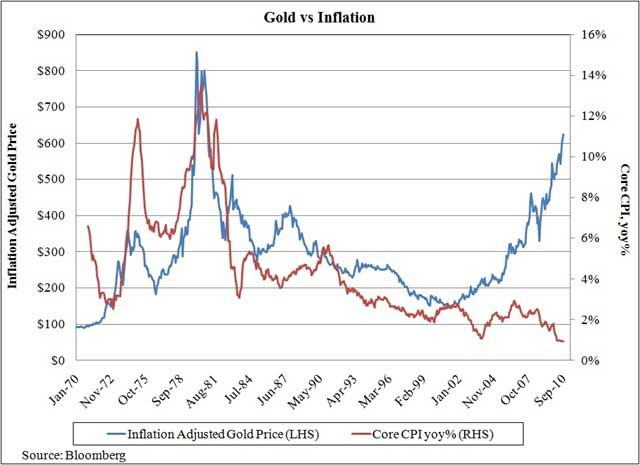

Gold is a good hedge against inflation – in fact up till about 2002, gold followed the inflation rate.

Demand for gold has surged since year 2000, with much of this demand originating from developing nations using their new-found wealthy to buy into bullion investments. The boom in the gold price is partly as a result of its desirability by a growing middle class in China and especially India (two-thirds of the global demand for gold originates from the the traditional demand for jewellery). China is today the planet’s leading gold producer followed by Australia (which supplied 250.10 tonnes of gold), the United States, Russia and Peru. China’s 2012 estimated output comes in at 413.10 tonnes of precious gold. Its also worth noting that local production in China has risen by about 15 percent a year in stark contrast to global production which in on the decline.

Did you know? Gordon Brown, ex UK chancellor famously (or infamously) sold much of the UK’s gold reserves – a whole 400 tonnes of gold – in 1999 at a price of between $256 and $296 an ounce. It then spiked up, at one point reaching a high of $1,895 in 2011.

The USA can and probably will print more dollars to bail its economy out of the excesses of the property boom and subsequent credit crunch. To some extent, oil producers can pump more oil. It isn’t so easy to find more gold. In fact gold as an asset is unique in that it is not dependent on the performance of auditors, bank, corporations, financial institutions politicians or governments.

Thereby, we can say that Gold is a preserver of wealth. It will not get you any richer but it holds its value against inflation. When Elizabeth the First reigned, an ounce of gold would buy a man a suit of clothes, a fine pair of shoes and a hearty meal. Today, with Elizabeth the Second reigning supreme, an ounce of gold affords a man a suit of clothes, a pair of shoes and a Happy Meal. (I don’t have access to pricing of women’s clothing during the Elizabethan period–sorry!). Look at the price of gold in the 80s, then the 90s, now today. If you bought gold in the 80s you’d finally be breaking even.

For whole centuries currencies were directly linked to the gold price. Britain adopted the gold standard in 1717 when the administration then decided to link the currency to gold at a specified rate. Most major countries followed Britain’s move to the gold standard in the late 19th Century. Britain abandoned the standard during the First World War only to return to the gold standard in the 1920s

Gold is the ultimate form of financial insurance. This is the reason every major central bank in the world still maintains a considerable portion of their reserves in gold bullion and many nations such as the Chinese, are now looking into increasing their gold bullion reserves. In fact after the Great Depression that hit the world by storm in the early twentieth century, leaders of the world’s biggest economies realised that a currency system backed by physical gold was critical to eliminate much catastrophic volatility from the global system.

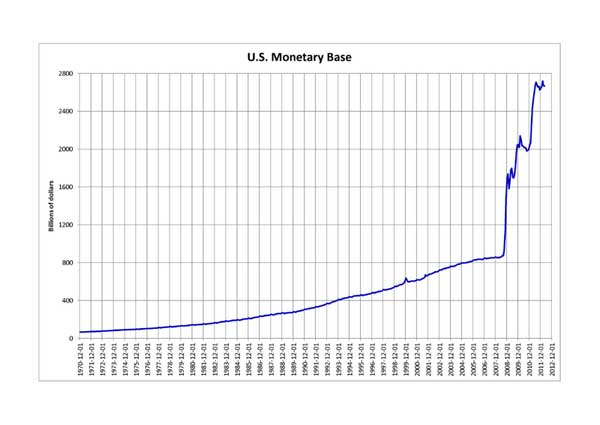

The supply of precious metals is limited which helps to protect personal wealth against the monetary excesses of governments and, more recently against market downturns. Gold and silver in particular are difficult to find and there is not much supply. The supply curve for these precious metals hasn’t changed much over the last 100 years. You can’t say that for fiat currencies, which we witnessed supply quintuple in the USA and triple in the Eurozone during the last 10 years.

This led to the establishment of the Bretton Woods agreement following World War II, which created the International Monetary Fund. However this agreement was scrapped after the Vietnam War when it became evident that the United States had printed a lot more money than what was stored in the country’s bank vaults. Subsequently, other currencies started being measured against the USA dollar and permitted to float. As such the fiat system had returned. Gold spiked up to US$850/oz in 1980 due to a sharp increase in oil prices hitting the USA dollar (incidentally just a decade earlier, gold was worth only US$35/oz). All this showed that the Dollar wasn’t as safe a currency as many thought and in the late seventies we witnessed the return of gold as an alternative ‘safe haven’ instrument.

Gold also acts as a hedge against financial/political turmoil. When financial/political turmoil levels are rising, so does the price of gold – consider gold as a protection to maintain your savings from collapsing currencies (gold can never go to zero). When financial/political turmoil levels are improving, the price of gold usually drops. So keep in mind that gold acts as mainly as a hedge against inflation and currency volatility meaning that the price of the gold metal will rise to offset any rise in inflation and currency prices. However, the price of gold also moves significantly and short-term traders can make a profit (or suffer a loss) from investing in gold.

Did you know? The letter G in IG Index is a reference to the shiny metal. An index based on gold happened to be the first market offered by IG Index when financial spread betting as a concept was first launched in 1974.

In my book, gold is also one of the few investments that does not involve a future promise to repay, as stocks and bonds and CD’s do. This can be a very important property during difficult times. Of course, gold doesn’t always appreciate in price. In 1980, it was selling at more than $800 an ounce. Twenty years later, it had dropped to $275. It is theoretically possible to get rich by betting on fiat currencies and against gold. But the scoring average of all those who try is pretty poor.

In general, precious metals performance does not correlate with S&P performance, nor does it correlate with US bond performance, nor does it correlate with foreign stock performance. Thus precious metals can provide an additional element of financial diversity to any investment portfolio since it doesn’t move in line with many other common investments like shares, bonds or property. In fact, gold is one of the few commodities which price is dicated by macro-economic events as opposed to other commodities where price is simply driven by supply and demand. Unlike some other commodities like silver or copper, gold’s price isn’t driven by its industrial uses and for a very long time the shiny metal has been considered a safe haven in times of political and economic crisis. Gold as such is something commonly sought in the worst of times, and as a hedge against spiraling inflation.

So what drives the price of Gold? The US dollar is the most obvious factor to check as a driver for the price of gold (in dollars) and money supply being the next logical factor. Money supply relates to the speed at which money is being printed by governments, especially in the USA which has been upsetting investors as America seems loathe facing the problem of wild expenditure. Keep in mind that the price of gold is mainly affected by sentiment as opposed to demand. This is akin to any stock market investment, where sentiment or rumour can have a marked effect on the share price with the difference that gold has an intrinsic value.

Historically, the price of gold tends to peak in the spring following the Indian wedding season, drift or dip slightly over the summer, before approaching new highs for the year in the autumn ahead of Diwali and Chinese New Year. It is interesting to note that this particular pattern has happened in around 50 per cent of years since 1968.

My own personal philosophy involves selling out of investment categories that are entering downtrends and buying into investment categories that are in uptrends to keep average returns positive. Others will stick with one investment category through all of the ups and downs in hopes that the long term average will be positive. If you subscribe to the latter philosophy, and if you are going to confine your investment activity to a single investment category, then clearly precious metals is not the best long term choice. However, if you subscribe to the former philosophy, or if your investment activity is going to cover many different investment categories, then precious metals definitely have their moments!

While it is true that the gold price is to some extent correlated to the dollar, all assets in reality follow their own charts and so move independently to everything else, in the purest sense. There is, however a strong connection between the USA dollar and the Euro/Dollar currency pair. This is because the dollar index is linked to a basket of currencies of which the Euro is the main weighted.

Recent Retracement in the Gold Price

What has happened to the gold price?

When governments started printing money with their quantitative easing programmes in 2008, many speculators took positions expecting hyperinflation to grip developed global economies. The gold price reached a high just short of $1,900 per ounce in 2011 and then continued hovering between $1,600 and $1,800 for much of 2012 before retracing sharply from October 2012. However, gold prices haven’t increased in tandem with the money supply even if central banks continued printing money at unprecedented rates. In the first half of 2012 the price of gold dropped to below $1,200.

What has happened to shares in gold mining companies?

Many gold shares have dropped sharply as the price of gold plunged and to a much greater severity than the gold price drop particularly as most miners were also hit by strikes and rising energy bills. Gold mining funds which invest and buy into gold mining companies like Junior Gold, and BlackRock Gold & General have suffered serious losses.

Last year gold has underperformed other commodity prices which further boosts attractiveness of the yellow metal in an environment with many uncertainties. Gold should be rising because apart from anything else there is a big demand from retail buyers worldwide. However for sometime Gold was going down as investors withdraw capital from hedge funds. This is because hedge funds were having to liquidate their commodity assets to provide that cash. Add the fact that people have been putting more and more money into risk assets like shares and a rising USA dollar which usually means a fall in gold price.

Then if governments around the world are giving assurance of bank deposits why do you need gold?

Cash may still be king at the moment and the Gold price is retracing from its historic intraday high of $1920 a troy ounce. However, even central banks are starting to switch again to net buyers from net sellers due to the uncertainty over currency valuations as a result of the various quantitative easing programmes around the world.

The truth is that central banks are forced to keep interest rates low to help boost growth. Inflation will persist at higher levels and most leading currencies like Sterling will remain weak. Even if there are rumours of cutting quantitative easing, the reality is that both the Feb and BOE might have to continue boosting the economy with new stimulus for years which will be supportive for the gold price.

The truth is gold is also a form of insurance, that is not to say it may not pay very well to have it as a 10%+ in a portfolio if things get very nasty…

USA Monetary Policy

In the last few years there has been a truly astronomic increase in currency supply in the USA and monetary policy is still way too loose despite interest rates having been kept at close to 0% for the last 5 years in the aftermath of the crisis. The Federal Reserve has injected over $3 trillion of dollars into the market (and it keeps adding at a rate of $40b every month). Adding to this the USA is still heavily burdened with huge debt and this isn’t good for the Dollar.

But the gold price isn’t expected to go up in a straight line. It usually makes its big move as we start to come out of a recession as inflation picks up with rates increasing and currency falling. Remember though that high prices for gold tend to boost supply and kill demand as what happened with oil last fairly recently. At the moment for instance investor demand for gold is very strong but high gold prices will discourage people from buying jewellery (which still accounts for 2/3 of the global demand).

‘Gold is becoming increasingly difficult to come by and the quality of gold ore is degrading, and the costs of extracting and shipping it are rising’

Is November traditionally a good month for the price of gold?

It is true that there is usually a seasonal pick-up in demand around this time of year, but significant price increases have to rely on something less predictable than the annual approach of Christmas.

In fact talk of a consistent seasonal pattern in the price of any financial asset should be viewed with suspicion. The existence of such a pattern (at least where the price swings are substantial) would imply that the market is so inefficient that some participants would be able to profit at the expense of others simply by following the calendar. That seems particularly unlikely in the case of gold. There are three reasons why this reasoning is nothing more than a myth, including the fact that the seasonal drivers of the demand

Sales of gold (especially jewellery) pick up in the autumn and winter due to the timing of harvests, the Indian wedding season and a string of festivals associated with gift-giving (Diwali, Thanksgiving and Christmas). Every year the media run the same stories about the impact this may have on the price of gold. Second, the physical characteristics that make gold a popular store of value also make it easier to hold stocks to arbitrage away any seasonal price patterns. Above all, gold is durable (unlike foodstuffs), fungible (unlike housing), and has a high value to volume ratio (unlike oil).”

Finally, the increasing participation of investment funds and other financial institutions in the gold market mean that there is now more liquidity than in the past to smooth out any potential price swings.

Production Issues

Despite the reasonably bullish outlook for gold longer-term and the current appetite for equities, short-term investors should be

aware of the issues facing the gold mining and production industry. In a recent speech to the London Market Bullion Association, Barrick Gold Corporation president and CEO Jamie Sokalsky claimed there were a number of challenges facing listed mining companies, claiming that investors were ‘no longer rewarding production growth to the same extent as in the past’.

Adrian Lowcock of Hargreaves Lansdown says the relationship between the gold price and the share price of gold miners has changed since the financial crisis, adding ‘where gold shares used to track the gold price more closely since the beginning of 2008 this has not been the case’.

Barrick’s Sokolsky also described the challenges facing the gold mining industry to ensure supply meets demand, saying that the outlook was under threat. ‘We are not going to see huge growth [in production], even if the gold price goes up considerably. That should then be supportive for the gold price and ultimately result in a healthier industry,” he says.

With demand for the precious metal likely to remain elevated, the issue of supply is also likely to be an issue and price supportive. ‘Gold is becoming increasingly difficult to come by and the costs of bringing it to market are increasing: the quality of gold ore is degrading, and the costs of extracting and shipping it are rising,’ says Jon Wingent, investment client director, Close Brothers Asset Management. ‘This is also supportive of gold and if it becomes economically unviable to mine, the value of existing supplies will rise.’

It’s also interesting to note that prices of other precious metals also remain under pressure, with both silver and platinum both trading at lower levels. Although, as alternative stores of wealth, this is to be expected, it could also offer a further opportunity for investors.

Silver is a particularly interesting investment story, given its wide use in a number of new technologies; however, as supply has adequately increased in recent years to match demand, it’s unlikely to see the strong growth experienced by gold.

Of course, while the global economy remains in a state of flux, it’s difficult to make accurate predictions. While many commentators remain bullish about the long-term prospects for precious metals, the near term outlook remain uncertain.

Trading the Gold Price

The way investors have traded gold has changed dramatically in recent years, with investors able to access the precious metal in a number of ways. Everything from new financial products to vending machines has made investor access to the metal easier. In today’s markets investors can access the yellow metal directly by buying ETFs [exchange-traded funds].

This has generated a lot of interest from a wide range of investors as they are now more easily able to trade gold. As such the nature of how gold behaves is changing and speculators have entered the market. While this will not necessarily change the over nature of the asset as a hedge against inflation and defensive asset class it is more likely to lead to greater volatility and swings in the asset price.

Another way to get gold exposure is to buy into shares of mining companies. Mining shares have traditionally followed the price of the metal, so when gold prices are rising, so to the stock prices of these companies (and vice versa). But over the last couple of years this has not always been the case with mining shares having lagged behind the gold price. One reason for this could be due to the risk that gold mines might be seized from companies by hostile governments in less business-friendly parts of the globe.

However, gold continues to be an asset to shelter against risk, so when confidence returns to markets as we have seen this year investors move out of more defensive assets. As such the gold price has come under pressure when equity markets are rising.

It’s a phenomenon that has been observed for a number of years, although the recent meteoric rise will have taken many by surprise. The severity of the latest, exceptional economic crisis and the resilience of emerging markets probably explain the rise, however.

Gold will continue to serve as a capital preserver during times of market stress as it tends to perform well when other assets are languishing or when investors are anxious, the World Gold Council reports. Its role in this regard will transcend the economic fortune of any one country or region. The current period of relative market stability compared with the turmoil seen more recently has, therefore, made gold a less attractive investment proposition.

The record high prices enjoyed by gold could have led to much of the profit-taking by investors more recently, as long-holders of the metal seek to cash in. This coupled with the point that very plainly if everyone’s long, there’s no one left to buy. ‘I can’t remember a time when popular media and culture has been so saturated with the obsession of owning gold. It feels like you can’t turn on the television or flip through a magazine without seeing advertisements for buying gold.’ This frenzy matched the time the gold price hit an-all time high of $1921 in 6th Sept 2011 and from which level it has subsequently retreated.

Gold prices are likely to remain volatile for now, as investors continue to take profits, following the significant run-up in recent years. Improving US fundamentals, deeper understanding of the fiscal cliff and receding eurozone risks have relieved short-term uncertainty, and the safe haven demand for gold has diminished.

However, most commentators believe prices still remain on an upward trend, with the global economy remaining uncertain and a number of potential challenges on the horizon.

With concerns that the 10-year commodities super-cycle has already peaked, gold has seen some heavy selling amongst both institutional and retail investors. Despite promises of continued quantitative easing from the US Federal Reserve and threats of similarly aggressive measures from the Bank of Japan, gold prices have fallen significantly from recent peaks.

Spread Bet Gold Example

Traders like gold because it is traded round-the-clock. Most providers will quote prices at 0.1 basis points per USA dollar, which simply means that for each dollar movement in the underlying gold price, you stand to make or lose 10 times your stake. As such if you place a £15 stake and the gold price moves up $5 you would make £750 (15 x 5 x 10).

Let’s take an example:

- Gold has been rising sharply and you believe that a retracement is due.

- You check the quotes for the June contract and are quoted 1590.10 – 1590.90 (1 spread bet point is 0.10).

- You sell £5 a point short at 1590.10.

- The market starts moving higher in the next few days but a month later the price of gold has fallen heavily to about $1520.

- The spread betting firm then quotes you 1519.5 – 1520.3 and you decide to buy back your short trade on the offer price of 1520.3

- Total profit on the trade is 1590.10 – 1520.3 = 69.8 or 698 points x £5 = £3490.

Trading Gold by David Jones of IG Index

Gold Trading Strategies

As always the broad choice is between trading of your views and trading off the charts. Trading off your views requires a good understanding of the economics of gold and fast reactions to breaking news. However Gold does lend itself fairly well to Technical Analysis so, while I don’t do more than the occasional Gold trade and therefore do not hold myself up as an expert, I do recommend checking out the following articles for ideas. And feel free to skip the first few if they are too basic:

- The Basics of Using Charts

- How To Trade From The Charts

- Support and Resistance

- Trading using Moving Averages

- Trading using RSI

- Finding Trends In Markets

Tips for Spread Betting on Gold

- Did you know that the letter ‘G’ in IG Index refers to gold? Indeed Gold was the first speculative product offered by IG Index when financial spread betting first emerged in 1974.

- Betting on gold has always been popular due to the metal’s inverse correlation with the dollar and equity markets. Gold is also one of the best known ways of playing weakness in the dollar as gold is regarded as a hedge against inflation. This is because a weak dollar is often linked to nervousness in the marketplace, especially about inflation.

- Spread betting allows you to gain exposure to gold in sterling i.e. your bet is denominated in sterling. Which means that you are gaining exposure to any movement in the price of gold, but without any currency exposure. This is important since gold is in itself priced in US$ dollars so even if you’re right on the dollar falling in value, buying gold won’t solve your problem since your profits will still be lower as they’ll be paid to you in a currency that is depreciating. Spread betting solves this because with a spread bet, your holding will be in pounds sterling, from the open to closure of the bet. You deposit pounds in your spread bet account and receive any gains as sterling. As such, your £1-a-point spreadbet on the gold price pays out based on the movement in the dollar price, but your winnings (losses) will remain in sterling. Any currency fluctuations are irrelevant so trading gold in this way eliminates the exchange currency risk.

- But more than that. Spread betting allows you the possibility to speculate on the future price of the metal without having to accept ownership. Remember gold in itself pays no interest, or dividends unlike bonds and equities and no rent unlike property. In fact it actually costs money to hold gold because there are storage and insurance costs to be paid.

- One of the advantages of spread betting is that you can go short but remember that this also requires to be contrarian and look beyond the media headlines. In other words when the tabloids finally start highlighting the fact that US dollars are losing lots more purchasing power and ‘Joe Sixpack’ starts looking at investing in Gold it may be time to consider shorting it…

- The other advantage of spread betting on gold instead of buying into an exchange traded fund, for instance, is leverage. In fact most spread betting providers allow a gearing of up to 40 times your stake (20 times if going for a gold futures contract) although this also increases the risk (hence the importance of guaranteed stop losses on trades).

- Gold like any other currency is a 24-hour market so you can deal round the clock. Most spread betting firms offer a daily rolling bet on gold as well as a longer-term bet based on the two-month futures contract. Beware that the gold market is highly volatile.

- The daily rolling bet allows you to take a short-term view of Gold and will mirror the gold spot price – plus a dealing spread of course. Spread betters can roll the position over into the next day although this will incur a small additional cost (aka financing charge).

- Normal closing time for the Spot Gold and Spot Silver markets is 22.00 (London Time). It is important to note that with some providers daily bets expire without spread.

- When a Spot metal bet is rolled over, the open bet expires at the official spot settlement price and a new bet is automatically opened for the next trading day at the settlement price plus or minus the provider’s rollover spread (say at 0.02% of the price).

- A spread bet on a gold futures contract is priced directly from the futures market, with the provider simply wrapping the spread around the quote. As with other commodities and index contracts this will differ from the spot price as it reflects the cost of carry over the remaining time to expiry. It is also important to appreciate that a spread bet on gold futures always expires the month before the futures contract itself settles. Usual margin requirement on a futures gold spread bet ranges from ten to around twenty times the per dollar stake which is about twice the margin required for a daily rolling contract.

- The minimum bet size is usually £1 per dollar per ounce and some spread betting providers allow bets in USA dollars as well.

- A key point to check is the tick size as providers such as InterTrader and City Index will use a tenth of a dollar/troy ounce, while at IG Index this is ten times larger. For instance, at InterTrader, gold trades are calculated at 0.1 (i.e. 10 cents move) per US dollar. In simple terms, this means that for every dollar you move, you would either make or lose 10 times your stake. So if you buy £8 worth of points and gold moves up $3 you would make £240 (£8 x 3 x 10).

- At IG Index prices are quoted ten times larger. Suppose the current gold price is about $850 (gold is always quoted in US dollars per ounce). IG Index is quoting $880 by the end of September. You decide that it will rise further than this and put up a £100 stake on each point. Your total position is therefore 880 x £100 = £88,000. If at the end of September the gold price is $900 and your position is now worth 900 x £100 = £90,000 equivalent to a £2000 gain. Another way to compute this would be [20 points (i.e 900-880) at £100 each] = £2000 gain. What happened to the dollar is irrelevant. Gold gained 2.27% and you have made a profit of 2.27%.

- Given the way that gold is traded it is important to understand your contract exposure; with gold trading at 850 an ounce a bet of £1 per point would represent an effective exposure of £8500 which would typically require an initial margin requirement of around 300. However, in practice you would need more cover as your stop needs to be sufficiently away to allow for the wide daily swings.

- The spread for the Rolling Gold Daily is normally 5. This means that a £2 per point bet on Gold would be equivalent of 40 ounces of Gold as you are betting on the $0.10 move. The Gold April Future is currently showing a spread of 8 points.

- Contango and Backwardation

- The LME has an important peculiarity. The main quoted price for all LME metals is the so called 3-month price, a price for metal to be delivered on a particular date in roughly ninety days time. The 3-month price quoted on, say, 3 July, and the 3-month price quoted on, say, 17 July, a couple of weeks later, are thus prices for different settlement and delivery dates. (This is in contrast to the situation in other commodity futures markets; ‘March Cocoa’, for example, has the same settlement date whether you trade in December or in February).

- This peculiarity has an important practical consequence when you bet on LME metals with a spread betting provider. Say, for example, you ‘buy’ 3-month copper. A week later the price rises and you decide to take your profit. You cannot close your position simply by ‘selling’ 3-month copper, because the 3-month date is now a different day. Instead you have to ‘sell’ copper for the same date for which you ‘bought’ it. The price for this date is not normally the same as the current 3-month price. It may be lower, if the market is in ‘contango’ (where the price for future delivery is higher than the spot price), or higher, if the market is in ‘backwardation’. When metal is in short supply, backwardations can sometimes be very large. So you should be aware that it is possible to lose money on an LME bet even if the 3-month price has moved in your favour, or make money even if the 3-month price has moved against you.

- If this sounds confusing consider contango like the fair value, in that fair value is basically the cost of carry. But, while fair value is more the arithmetic calculation of where the price should be, contango for instance is where it actually is. Let’s take an example. The April Gold Future is trading at 922 but the Gold Spot price is at 922.8 so this is an example of backwardation. Normally a future is higher than the underlying spot price, ie Contango. However, the combination of lower US interest rates (so lower funding) and the April Gold contract being close to expiry (27th March so less funding days) has resulted in the backwardation price.

- Although the average gold spread better has a much longer term than the average client and gold punters tend to take out bigger positions, spread betting is not really designed as a long term investment medium. Bets can be rolled forward from one expiry date to the next but this comes at a cost so spread betting on gold is best confined to situations where you believe that the short-term price is out of line with events. If taking a longer term view the best way to take a position would be to place a spread bet on the two-month Comex futures contract.

- The Comex Gold contracts are traded in the pit from 1.20pm to 6.30pm (UK time) and afterwards they continue trading electronically from 7pm to 1pm the following day with the spread betting hours being about the same (meaning that you can trade Gold almost round-the-clock from Monday to Friday).

- Gold is not the only metal available either – you can speculate on gold’s poorer sister silver or copper or aluminium, uranium, platinum or palladium. However be wary that copper is hugely volatile (more risky) and it is also difficult to predict the price of aluminium (although aluminium is a very liquid market). It takes substantial energy to produce aluminium so prices tend to be stressed by the cost of energy.

- Gold, silver, platinum and palladium are all considered precious metals and there is always demand for these metals by private investors. Some investors prefer gold, others prefer silver, while others look at their relative ratios to choose those that look cheaper in relative terms.

- Gold is likely to move very differently from the other precious metals due to the lack of industrial uses and its more appealing monetary element. Gold works better as a hedge while silver, platinum and palladium should be more correlated with the economic cycle. As such the power of silver, platinum and palladium as hedges against a market economic downturn in a portfolio is likely to be limited.

- Gold is very correlated with silver but there is less correlation with platinum. There is virtually no correlation between gold and palladium. Gold also exhibits a negative correlation with the wider equity markets.

- You can gain exposure to gold by using several mediums; the most appropriate will normally depend on the timeframe. Investors with longer time investment horizons are likely to prefer gold funds, mining stocks, ETFs and physical gold while more active traders will likely focus on instruments like futures, options, spreadbets and CFDs due to their shorter time speculative horizons and desire to use leverage to amplify movements.

- Buy the gold metal directly in bullion bars or gold coins. Gold coins are valued mainly for their intrinsic value but also as collectibles linked to their rarity in terms of the number issued. Manufacturing coins also costs money so these typically trade at a premium over spot; generally speaking the higher the quantity, the lower the premium (and vice-versa). South African Krugerrands typically trade at a 5% premium while the premium for gold bars could be anything between 2 to 3% although prices do of course vary from one merchant to another.

- Other ways to gain exposure to Gold include mining funds like BlackRock Gold & General; exchange traded funds such as iShares COMEX Gold Trust, ETFS Gold Bullion Securities (GBSS) or ETFS Physical Gold (PHGP) (this one is actually backed by physical gold in a vault) which track the actual price of gold or silver but trade like a stock on an exchange. One thing to keep in mind with ETFS is that they have built-in management fees so they represent gradually depleting assets – the fees are small in practice but they do add over time. If you had a bearish view you could also use an exchange traded instrument such as ETFS Short Gold (SBUL) to take a short gold position.

- Buy stocks and shares in gold mining companies and gold mining funds although here you need to appreciate that gold share prices are even more volatile than the price of gold. In an inflationary period it is generally better to hold gold shares versus the physical gold as the gearing provided by gold shares makes the shares winners over the physical. A few gold mining stocks listed on AIM include Avocet Mining, Ariana Resources, Chaarat Resources, GGG Resources, Medusa Mining, Highland Gold, Nyota Minerals and Shanta Gold. Gold stocks give you a little more leverage than owning the metal itself but this comes with more risk as they have the tendency to promise much more than they deliver. Mines may be subject to shutdowns for various reasons (strikes, landslides, political risks…etc) and the amount of gold reserves are in the most cases simply an estimate. As such the value of a mining stock may fall, even if the price of gold rises, should production levels fall short of expectations. Owning stock in a company as such also exposes you to their business practices, failure or success in finding new gold deposits…etc. and it is also important to note that different gold mines operate at different levels of cost. Many of the smaller exploration mining shares are driven by market perceptions of value, as opposed to known intrinsic value.

- In particular, beware of gold mining firms that have hedge positions (meaning they have sold gold in the futures markets, as they will NOT profit if the gold price goes up. Alternatively, if you wish to avoid company specific risk but still want exposure to gold, one ETF to consider would be the Junior Gold Miners ETF (GDXJ), which invests into 60 small-and medium-capitalization companies in the gold or silver mining industry, which tracks the share prices of companies based in the USA, Canada, Australia and the United Kingdom.

- Another alternative is to trade in gold futures which are traded on exchange like the New York Mercantile Comex Exchange London, or at the metals department of the Chicago Board of Trade. Unlike shares, futures have a pre-defined expiry date and a standard gold futures contract represents 100 ounces although you can also trade mini-contracts at some internet brokers. But futures are volatile products even more so than shares and their very high leverage means that they are suitable only for advanced traders. With gold trading at $1600 per ounce, a standard futures contract (100 ounces) would represent $160,000 worth of exposure.

- It may be wiser to buy the higher cost gold producers over the lower cost producers (no, not a mistake) because there is potentially more money to be made. This is best demonstrated by an example. If it costs a) $200 per ounce to mine and the gold price goes from $900-$1200 then that moves the margin from $700 per ounce to $1000 per ounce, an increase of 42%. If it costs miner b) $600 per ounce and there is a similar move in the gold price, margin moves from $300 to $600, a 100% increase. Scope therefore for a doubling of price. MML is a low cost producer. Vatakula (sp?) is a high cost producer.

- Please note that both exchange traded funds and spread betting are primarily a speculatory tool. Exchange traded funds and spread betting are both good ways to speculate on the gold’s spot price or to speculate or invest for the short term. However, it is important to understand that when buying a Gold ETF you do not directly own gold and you do not have an automatic right to take possession of your gold. This means that in the event of a 1929 style stock market crash or a global financial meltdown, banks and financial markets may be closed for a period of time and financial markets including exchange traded funds would become illiquid (as recently happened to some Exchange Traded Commodities (ETCs). It is also important to understand that ETF come with counter-party risks as well as liabilities and responsibilities of the market participants such as the auditors and custodians.

Join the discussion