Baltic Dry Index slumps – more trouble for Miners

Feb 19, 2015 at 9:07 am in General Trading by Provenance

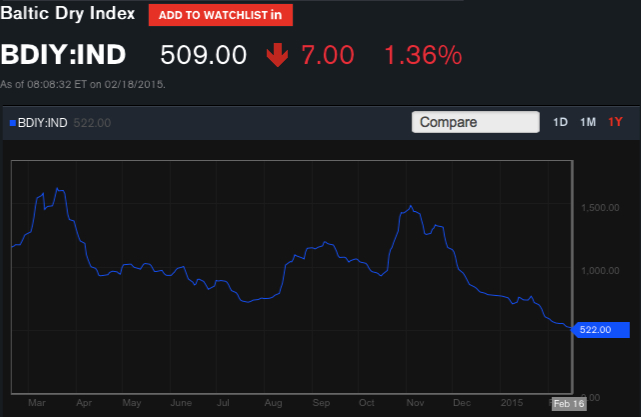

The Baltic Dry Index (BDI) has collapsed over the last two months. This index, derived from activity on twenty-three of the world’s busiest shipping lanes, has historically acted as an excellent proxy for global growth. Yesterday it hit a new record low of 503, strongly suggesting that economic activity has slumped, in China especially. At a time when the post-Crisis recovery is meant to be taking root and the US is “normalising” its monetary policy, this is an extremely worrying development for policy makers. Yet still stocks want to rally…

The disconnect between the Baltic Dry and global equity markets over recent years has become ever more pronounced. Once more on the verge of record highs, the major equity indices have shrugged off the Baltic Dry’s weakness. In fact, the disparity between what share prices tells us about the health of the world’s economy and what the Baltic Dry tells us has never been more extreme.

This situation cannot last forever and it is yet more evidence of the deeply distortive effect Quantitative Easing has had on our markets. Stock prices should reflect what is happening in an economy and what is expected to happen. However, thanks to the free availability of cheap credit, the rally of recent years has been powered by false finance. At some point there must be a reckoning, but then again the naysayers have been saying exactly this since 2009. While the optimists have grown rich on the surge in stocks, those that have clung to traditional (common-sense?!) economic principles have lost fortunes, not least in the mining sector.

Since the start of 2012, apart from a strong rally at the end of 2013, the Baltic Dry has been mired in a low range, between just below 700 and just above 1,000. This relative lack of activity on the world’s shipping lanes was a troubling indicator that the rhetoric of recovery didn’t have much substance. The Chinese boom looked particularly vulnerable, having been the driver of the Baltic Dry in the run up to 2008.

The recent price performances of iron ore and copper further reinforce the impression that the latest decline in the Baltic Dry could spell trouble ahead. For a period both the iron ore price and copper price were able to resist the Baltic Dry’s weakness. However, from the start of 2014 the price of iron ore began to drop like a stone, as too much supply caught up with weak demand. Although trading consistently towards the bottom of its range, the price of copper held out for longer, but since the start of this year has taken an ugly turn for the worse. In both cases, the drop in prices has had an increasingly disruptive effect. Not only has marginal production been decommissioned, but mining projects with apparently much stronger fundamentals have also struggled.

The troubled state of the mining sector has resulted in a lamentable performance of its stocks. And things could be about to get worse. With iron ore at $67.84/t and copper at $2.57/lb both prices are at multi-year lows. Miners of these metals could well struggle into the second half of this year. Unless there is a sharp pick up in economic growth and demand, and so long as the Federal Reserve remains committed to its withdrawal of Quantitative Easing, it is hard to see much hope for struggling companies. The disruption of the last twelve months could reach a crescendo. When this eventually happens, it will take a great deal of courage to buy into the mining sector, but there is one thing to remember.

Fortunes are made on such bold action.

IMPORTANT: The posts I make are in no way meant as investment suggestions or recommendations to any visitors to the site. They are simply my views, personal reflections and analysis on the markets. Anyone who wishes to spread bet or buy stocks should rely on their own due diligence and common sense before placing any spread trade