Chariot Oil and Gas surprises investors with placing

Jul 22, 2014 at 10:11 am in AIM by contrarianuk

A bit of head scratching this morning as Chariot Oil and Gas announce a surprise placing last night to raise $15 million. The shares are down 8.5% to 16p on the news.

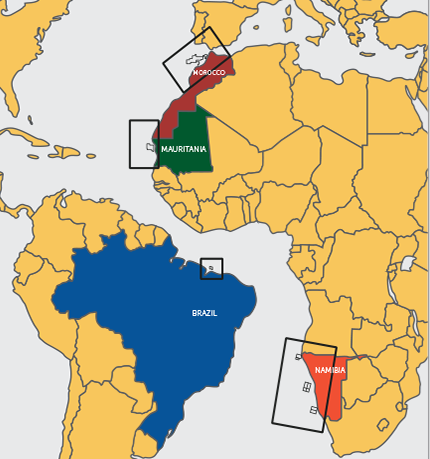

The company has four licences covering eight blocks offshore Namibia, one licence offshore Mauritania, three licences offshore Morocco and one licence offshore Brazil.

The announcement read as follows:

Chariot Oil & Gas Limited (AIM: CHAR), the Atlantic margins focused oil and gas exploration company, announces that it intends to conduct a placing (the “Placing) to raise proceeds of up to US$15 million (approximately £8.8 million). The Placing is being conducted through an accelerated bookbuilding process, which will be launched immediately following this announcement and will be made available to new and existing eligible institutional investors.

The proceeds of the Placing, will be used to:

o facilitate the acceleration and completion of its 3D seismic work in Brazil (approximately US$7.5 million)

o fund a new venture opportunity in a country where the Company currently operates to increase option value and sustain the growth potential of the portfolio (approximately US$7.5 million)

This fundraising will also result in greater flexibility in partnering negotiations and provide further optionality in executing the forward work programmes as detailed below.

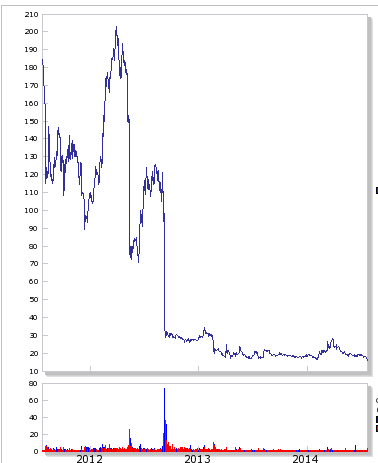

The question for shareholders is why now given the company was meant to be fully funded for 2014 and 2015 with around $25 million projected to be left on the balance sheet at the end of this year. What is this new venture to sustain the growth potential of the portfolio? The placing price is likely to be well discounted which means for painful dilution for private investors. The shares have had a pretty horrible time after some poor drilling results offshore Namibia at their Kabeljou well and Tapir South in 2012 meant that the high hopes on their Namibian acreage have so far some to nothing.

Larry Bottomley, the Chief Executive seems to have regrouped after the disappointment of 2012 but the shares are now down at all time lows after trading over £3 in 2012 valuing the company at £32 million at the current 16p. In common with many other smaller E&P oil companies getting funding for wild cat drilling is proving difficult and good farm out agreements in unexplored acreage is a tough proposition.

More dilution for private investors is the last piece of news that they wanted to hear. It will be interesting to see what price the placing gets away at with the institutions given they’ve been burnt in the past and are likely to want to get their pound of flesh.

Contrarian Investor UK

IMPORTANT: The posts I make are in no way meant as investment suggestions or recommendations to any visitors to the site. They are simply my views, personal reflections and analysis on the markets. Anyone who wishes to spread bet or buy stocks should rely on their own due diligence and common sense before placing any spread trade.