Iofina proves an expensive investment as shares plummet

Dec 20, 2013 at 2:46 pm in AIM by contrarianuk

I noticed the drop in the Iofina share price this week as this was highlighted in Investors Chronicle a few weeks ago as a potential big growth story for 2014.

An tail of woe for investors in Iodine specialist Iofina Plc after announcing bad news last week and then following up with even more trouble with an RNS on the 17th December 2013. The shares are currently at 84p valuing the company at £106 million. In the last week they are down 33%, last month 49%. Back in May/June 2013 they were nearly 250p!

An tail of woe for investors in Iodine specialist Iofina Plc after announcing bad news last week and then following up with even more trouble with an RNS on the 17th December 2013. The shares are currently at 84p valuing the company at £106 million. In the last week they are down 33%, last month 49%. Back in May/June 2013 they were nearly 250p!

On the 13th the shares were hit hard by news from the Montana Department of Natural Resource Conservation (“DNRC”) Water Resources Office, that Iofina’s water rights determination did not meet certain criteria set out in state code 85-2-311. The application will require additional information, primarily with respect to offtake engineering and beneficial use of the water. The additional data required is being reviewed with the Company’s retained consultants to enable the Company to respond to the DNRC within the 15 days allowed to schedule a follow up meeting to review the application.

The company tried to soften the blow saying the Montana project was non-core and they still had time to appeal. Time will tell in January whether they can overturn the DNRC’s decision.

Iofina is involved in the exploration and production of iodine, iodine specialty chemical derivatives, produced water and natural gas. Iofina’s business strategy is to identify, develop, build, own and operate iodine extraction plants currently focused in North America based on Iofina’s WET® IOsorb™ technology. Iofina has iodine production operations in the United States, specifically in Texas, California, Montana, Oklahoma and Wyoming.

The company was incorporated on 15 March 2005 in the UK and registered in England and Wales. In January 2006 the Group acquired the entire issued share capital of Iofina Inc. and its wholly owned subsidiary Iofina Resources Inc., each of which is a Colorado corporation, with the objective of becoming a growing producer of iodine and natural gas. Iofina Chemical Inc., a Delaware corporation, was established in 1983 and acquired in 2009 as the specialty chemical division of Iofina Inc. The Group successful completed its IPO and was admitted for trading on 9 May 2008 on the London Stock Exchange AIM market.

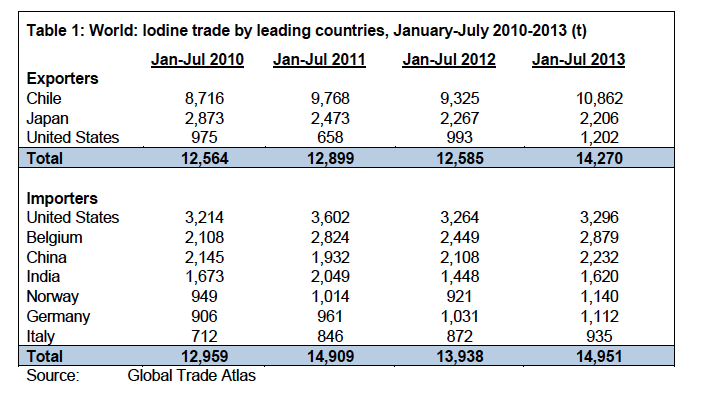

While a total of 62.5 metric tonnes (mt) of crystalized iodine was produced in H1 2013, the company expected c.700-1,000 mt per year which would already make Iofina one of the largest iodine producers in the North America, versus a global market of 27,000 tonnes. Unfortunately the news this week seem to have put pay to that though they remain tight lipped about actual production.

The shocker came on Tuesday when Iofina said that overall revenue in 2013 is likely to be comparable to 2012 levels i.e. $18-19 million.This was blamed on expected 2013 shipments at Iofina Chemical now being delayed into 2014. The RNS said “External iodine sales which were previously expected in 2013 are now expected to commence in 2014, resulting in an inventory build-up. To the extent that iodine produced by the Group is used in the production of iodine derivatives and not sold outside the Group, the value of such iodine production is a component of the derivatives revenue at Iofina Chemical and will not appear as raw iodine revenue from Iofina Resources. The Group’s overall margins benefit from using iodine produced at Iofina Resources, due to its advantageous production cost. Considering the lower revenue expectations, EBITDA excluding share option charges, will likely be similar to 2012 levels.”

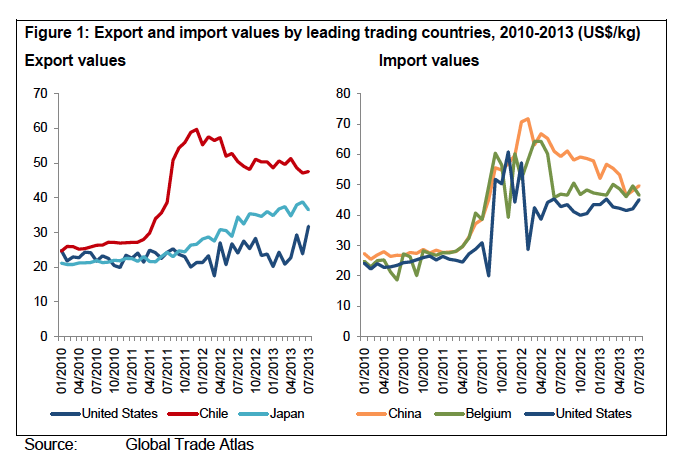

In 2013 a decline in iodine prices of greater than 20% has occurred. The company believes prices will recover in 2014. Though Japenese production of Iodine has been falling, new production from Chile in 2014 will keep a lid on prices.

In the first half of 2013, Iofina reported record revenues of $11,556,468 (30 June 2012: $7,667,162), and EBITDA of $558,495 and a net loss of $124,410 (30 June 2012: net loss of $969,935). The Group ended the period with $12,439,059 of net property, plant and equipment (30 June 2012: $8,375,996).

In the first half of 2013, Iofina reported record revenues of $11,556,468 (30 June 2012: $7,667,162), and EBITDA of $558,495 and a net loss of $124,410 (30 June 2012: net loss of $969,935). The Group ended the period with $12,439,059 of net property, plant and equipment (30 June 2012: $8,375,996).

The Group’s opening cash position for the period was $5,720,664 and the closing position was $16,189,567, an increase of $10,468,903 primarily due to the issuing of the convertible bond for $15,000,000. With the cash burn as it currently standards it looks like more financing will be needed in the 1st half of 2014.

Iofina is a tricky one. Certainly a low cost producer with very interesting patented technology, but building production capacity is sucking money out of the company. Iodine prices likely stuck at current levels for the foreseeable future with Chilean production increasing this will certainly hamper the companies efforts to improve margins and profit. Certainly the companies stated intent to open 6 new plants in 2014 looks under threat given this week’s announcement about revenue growth and inventory issues. Management seem very accident prone right now and with credibility wrecked they have much to do. I see that Non exec Chris Fay bought 150,000 shares on the 17th in two tranches which are now out of the money. The board seem to be keeping their hands in their pockets right now though….mmm wonder why?

At 84p…..doesn’t look expensive but certainly not without risks. But that’s AIM.

Contrarian Investor UK

IMPORTANT

The posts I make are in no way meant as investment suggestions or recommendations to any visitors to the site. They are simply my views, personal reflections and analysis on the markets. Anyone who wishes to spread bet or buy stocks should rely on their own due diligence and common sense before placing any spread trade.