Key news for Hurricane energy due from Lancaster horizontal well

Jun 18, 2014 at 12:40 pm in AIM by contrarianuk

Hurricane Energy (HUR) the North Sea, AIM listed, oil explorer focusing its effort on so called “fractured basement reservoirs” in granite formations in blocks 60 miles West of Shetland is due to report important news on its latest well in coming weeks.

The company had its IPO back in February Hurricane and raised £18 million at 43p a share with another £31.4 million through the conversion of loan notes and a warrant.

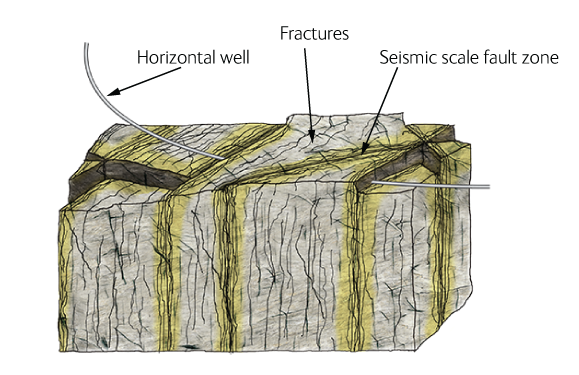

Unlike sandstone reservoirs that hold oil in the rock and have provided much of the world’s oil over decades, fractured basement rock is very hard and brittle, composed of rocks such as granite. Billions of cracks have been created when the basement structures moved through tectonic action, resulting in seismic scale faults and highly connected fracture networks. For Hurricane it is these faults and fractures that are most interesting because that is where, under the right conditions, significant volumes of oil accumulate. The oil is not in the rock, it is in the cracks between the rock.

In early June Hurricane announced that it had completed the drilling phase of the ongoing operation to drill and test a horizontal appraisal well on its Lancaster discovery, West of Shetland. The well has been drilled to plan after spudding on 26 April 2014 and a one kilometre horizontal section through the basement reservoir is now being prepared for testing. Dr Robert Trice, Chief Executive Officer, said:

“I am pleased to report that Hurricane has successfully completed its drilling phase of the reservoir section. The planned operation has gone well and we have succeeded in drilling the one kilometre horizontal section in the fractured basement structure. I am extremely encouraged by the data so far acquired as it indicates that the target fault zones are present and that the encountered section is fractured and oil bearing. Operations have now switched focus to the preparation for the well testing phase of this operation.”

With the annual results for 2013 which were released in April, the company said of Lancaster, “The one kilometer horizontal section is targeted within a reservoir volume of proven oil on the Lancaster field with the well path having been designed to cross at least nine faults identified from 3D seismic data. Hurricane’s previous operation on Lancaster, inclined well 205/21a-4z, penetrated two seismic scale faults and tested at a flow rate of 2,500 barrels of oil per day. The current operation is intended to establish whether sustained higher oil flow rates can be achieved through horizontal drilling. Once drilled, the well will be tested to evaluate commercial flow rate potential. The overall operation is planned to take 75 days and results will be announced after third party analysis in summer 2014. Assuming the drilling operation is successful and the reservoir behaves as we expect the well will be suspended to join the existing 205/21a-4z well ready for tie-back to a host production facility as part of the proposed Phase 1 development plan for Lancaster.”

RPS Energy Consultants have given the Lancaster discovery a 2C recoverable Contingent Resources of 207 million barrels and in total the company has around 450 million barrels of 2C Contingent Resources and 440 MMboe P50 Prospective Resources.

The company’s AGM is being held next week on 23 June 2014 at 11.00am and investors are hoping to get some insights on the Lancaster result around this time. Flow rates in excess of 4000 barrels per day are expected and may be as high as 8000 barrels.

Hurricane’s shares have slipped significantly from the 43p IPO price, though have recovered from the low 20p range reached in mid April. The key is now Lancaster to generate a move upwards on positive news. As John Hogan (Chairman) said back in April, “The share price performance in the period since flotation has been disappointing and we believe that we can address this over time by delivering a successful appraisal well result at Lancaster to further underpin the substantial value of Hurricane’s assets. In the meantime, management has been working hard to ensure the market recognises the scale of the opportunity that Hurricane represents. An extensive and ongoing programme of meetings with brokers, analysts and industry commentators coupled with presentations at special investor events is underway to tell the Hurricane story. I am confident that management is being proactive in engaging with the investment community in an undoubtedly difficult market.”

Contrarian Investor UK

IMPORTANT: The posts I make are in no way meant as investment suggestions or recommendations to any visitors to the site. They are simply my views, personal reflections and analysis on the markets. Anyone who wishes to spread bet or buy stocks should rely on their own due diligence and common sense before placing any spread trade.