Muted response to Bowleven’s Etinde farm out news

Jun 24, 2014 at 9:01 am in AIM by contrarianuk

Some surprise news today from Cameroon focused oil explorer, Bowleven, with the announcement of a farm out deal for their Etinde permit with LUKOIL and NewAge.

Some surprise news today from Cameroon focused oil explorer, Bowleven, with the announcement of a farm out deal for their Etinde permit with LUKOIL and NewAge.

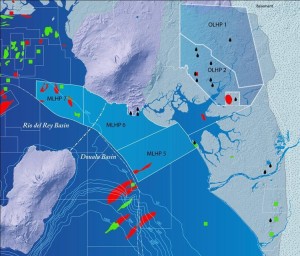

Bowleven will reduce its interest in the Etinde permit, offshore Cameroon, from 75% to 25% and LUKOIL will acquire a 37.5% interest and NewAge will acquire an additional 12.5% interest to increase its group holding from 25% to 37.5%. The permit covers blocks MLHP-5, MLHP-6 and MLHP-7.

Bowleven will receive approximately $250 million (subject to final working capital adjustment) comprising $170 million cash payment at completion, $40 million staged deferred cash payment due at Etinde development project FID and on completion of appraisal drilling and $40 million (net) carry for two appraisal wells. The Group’s current P50 net contingent resources for Etinde, prior to this transaction and any state participation, are 263 mm boe. This implies a valuation $1.4/boe for the deal. Estimated costs for first oil on the permit are $650-700 million.

With 50% of Etinde being farmed out for $250 million, the remaining 25% stake in Etinde owned by Bowleven is worth $125 million. This together with the cash payments mean that Etinde is worth $375 million to the company. The current market cap is £128 million or $219 million, which implies some upside particularly if the appraisal wells on the prospect deliver as expected. “The transaction facilitates the accelerated appraisal of the extensive Intra Isongo reservoir interval encountered with the IM-5 well, with funding from the $40 million drilling/testing carry considered sufficient for Bowleven’s share of the two appraisal wells.” The purpose of the two appraisal wells, which are likely to be drilled in 2015, is therefore to test the upside volumes at the IM field so that the Etinde development could potentially become part of a wider LNG regional scheme and effectively remove the downstream gas processing restrictions.

The deal means that the previous strategic alliance entered into with Petrofac in late 2012 worth around $500 million is being terminated. $60 million was due from Petrofac at final investment decision (FID) which was due this quarter.

Support and approval of the Etinde Exploitation Authorisation Application (EEAA) over block MLHP-7 was given by the Cameroon State following a Special Operating Committee Meeting (OCM) held in late May 2014 and the formal decree awarding the Exploitation Authorisation (EA) is expected to follow in due course. The EA will give development and exploitation rights over block MLHP-7 for an initial period of 20 years.

The deal gives Bowleven the firepower to drill the Bonomo prospect in Cameroon as well as exploration assets in Kenya and Zambia which is a relief given the recent funding concerns and the previous pressure to farm out on Bonomo.

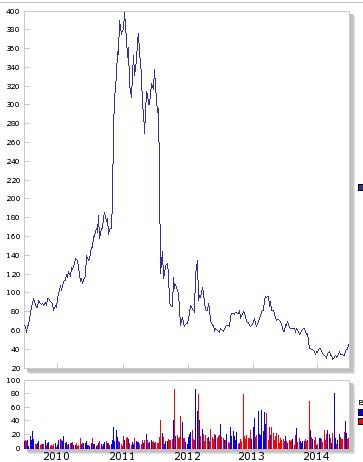

The shares are up 13% this morning to 45.25p, a little underwhelming given that the last placing of shares back in November 2013 was at 45p without the approval of the Etinde development in June and this latest news on the farm out. Perhaps reflecting disappointment at the relatively low value per barrel and cancellation of the arrangement with Petrofac. A far cry from the 135p reached when Dragon oil muted a bid in 2012. For those buying in at the low’s of around 30p good news, but underwhelming for those who were in this share from the glory days of 2011 and 2012, when the shares were trading around £4 and even a year ago they were say just shy of 70p. Still a healthy return for the bottom fishers!

Contrarian Investor UK

IMPORTANT: The posts I make are in no way meant as investment suggestions or recommendations to any visitors to the site. They are simply my views, personal reflections and analysis on the markets. Anyone who wishes to spread bet or buy stocks should rely on their own due diligence and common sense before placing any spread trade.