Plenty of fun and games with the share price of Nighthawk Energy

May 22, 2014 at 9:13 am in AIM by contrarianuk

Shareholders in US focused, non conventional oil and gas driller Nighthawk Energy (HAWK) had to have nerves of steel yesterday as at one point the shares collapsed nearly 30% (from 12p to 8.75p) following an article written by Tom Winnifrith. The piece highlighted that a law suit issued by ex-partner Running Foxes in the United States had not been announced via RNS. Shares in the AIM listed company have had a good run of late after production at its US assets has increased sharply over recent months.

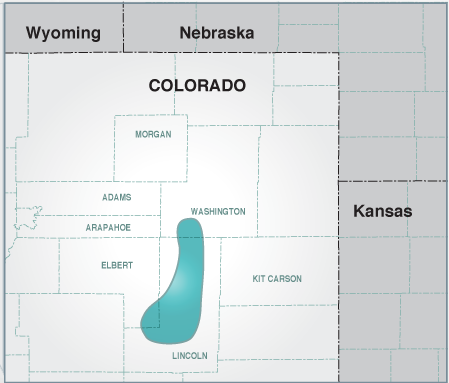

Nighthawk Energy operates in the Eastern Colorado plains with two primary projects, Smoky Hill and Jolly Ranch, comprise more than 300,000 gross acres within the southeast flank of the Denver – Julesburg Basin. In late 2012, Nighthawk drilled five new wells across its acreage and made a significant oil discovery with the Steamboat Hansen 8-10 well. In May the company announced that average gross oil production reached 2,153 barrels per day (bopd) from 13 April to 6 May and increased to 1,998 bopd during April from 1,885 bopd during March.

Winnifrith wrote that “The story And today’s star turn on the AIM Cesspit is Nighthawk Energy (HAWK) which was served with papers for a major law suit on April 29th. Surely under AIM rules it should have fessed up to shareholders even if it thought the case was without merit? Fear not, Nighthawk may not want to issue an RNS but the Sheriff of AIM is here to help.

Nighthawk is being sued in Colorado by its former business Partner Running Foxes on a number of counts. Does this potentially have material cashflow implications for Nighthawk? Who knows? Why has Nighthawk not followed AIM rules and told shareholders? Who knows? I offered Mr Richard Swindells of Nighthawk as well as the company’s fat cat PR spinners FTI a chance to answer these questions but there has been no answer.

http://www.shareprophets.advfn.com/views/5591/nighthawk-energy-why-isn-t-it-telling-shareholders-about-the-big-us-law-suit-it-faces#sthash.u9azuf4H.dpuf

Winnifrith himself has not been shy of controversy after battling a court case with Sefton Resources last year after upsetting their board of directors following articles he had published online.

The shares dived on the story, but began to recover mid afternoon before an RNS was released at 3.29pm by HAWK dismissing the allegations and claiming that the court case with Running Foxes was wholly without basis and immaterial to the business. The shares promptly bounced back to 5% down on the day and are up 2% today to 13p, now that’s what I call a bear raid!

The RNS read:

Nighthawk, the US focused oil development and production company (AIM: HAWK and OTCQX: NHEGY), has noted the article that has today appeared on certain web sites regarding a lawsuit brought by Running Foxes Petroleum, Inc against a subsidiary of the Company, in a Colorado state court in the United States.

“Nighthawk’s legal advice is that the case is completely without merit and the Company will be filing for dismissal. The facts and governing law do not give rise to any valid legal claim by Running Foxes Petroleum Inc, against Nighthawk, or otherwise raise a business issue that needs to be resolved between the companies. The allegations contained in the complaint are baseless, and the complaint is a frivolous, groundless and vexatious action. Nighthawk will vigorously defend against the complaint and seek all available legal remedies.”

The Board of Nighthawk also regard the claim as financially immaterial relative to Nighthawk’s current production, revenue and profitability.

I’m sure someone benefitted from the heavy sell off in HAWK during the day, with some big buy orders appearing at least an hour before the RNS. Some investors were probably smart and managed to top up at the low’s and make an instant 25%+ profit on the day, for others that were stopped out during the collapse it is a lesson to be very careful with auto stop losses on AIM stocks given their extreme volatility at times.

I’ve seen it many times before with small caps. Back in June 2010, Falklands driller, Rockhopper Exploration suffered a “flash crash” wiping out many small investors after false rumours on bulletin boards that their recent Sea Lion oil discovery had the wrong type of oil. After trading at around the £2.70 mark for much of the day it suddenly began to fall at around 12 noon, falling through the £1.00 barrier and moving into the 60’s at its low. The company was forced to issue a news release at 13.52 stating “notes the significant share price movement today. Rockhopper is not aware of any reason for this movement but makes the following update…”. The shares then promptly bounced back to where they were. In the interim there was carnage with stop losses being triggered willy nilly and plenty of fear of imminent disaster.

Previous Chief Executive of HAWK, David Bramhill, who led the company to the verge of bankruptcy a few years ago, threatened bulletin board posters with legal action in September 2010 after they allegedly made defamatory comments about him and the company. The court action never happened as the company had more to worry about at the time, like survival after disappointing production growth in Colorado. Bramhill announced officially he was retiring at the time and was replaced by Tim Heeley who was commercial director. Heeley subsequently left after Stephen Gutteridge was brought in as executive Chairman and in March Gutteridge informed the company of his intention to step down to pursue other opportunities.

It’s a good idea to take stories about small caps with a pinch of salt until news is officially announced but that’s assuming that the management team are wholly transparent and seemingly based on my own observations in recent years that’s very far from the case with AIM shares. Transparency of information is often awful and many seem to be in the know about news well before the RNS’s arrive, just look at the trading patterns and volumes before big official announcements, particularly with oil and gas companies drilling wildcat wells. The obvious advice is to watch your positions carefully and if spread betting or using CFD’s have plenty of margin in hand to avoid being caught out when these unexpected share price movement events happen. I’m sure shareholders in HAWK will have plenty of questions to the management team at the AGM on June 2nd and in particular why the legal action was not announced until Winnifrith wrote his piece – was it really non-material when the shares dived 30%. Surely its better to be proactive in releasing information even if the lawyers do see much of a problem? That’s AIM for you!

Contrarian Investor UK

IMPORTANT: The posts I make are in no way meant as investment suggestions or recommendations to any visitors to the site. They are simply my views, personal reflections and analysis on the markets. Anyone who wishes to spread bet or buy stocks should rely on their own due diligence and common sense before placing any spread trade.