Quindell tries to reassure investors in the face of share price slide

Sep 29, 2014 at 9:03 am in AIM by contrarianuk

After a near 10% fall on Friday and 15% drop last week, Quindell’s board was forced to issue an RNS this morning stating that,

“The Board of Quindell Plc (AIM: QPP.L), a market leading global provider of professional services and digital solutions, notes the recent share price performance and confirms that it knows of no reason for such falls. As originally planned, the Company will update the market on or before 15 October 2014 on its trading for the quarter ending 30 September 2014 and the continued positive progress being made by the Group in respect of all key performance indicators including cash performance.”

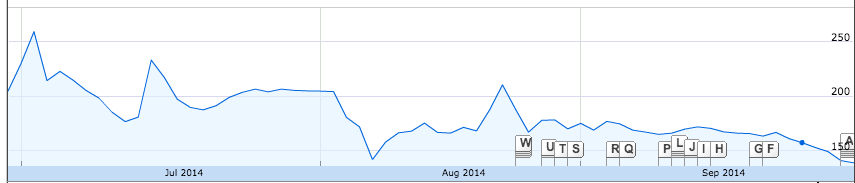

The shorters have been having a field day in Quindell, with the shares dropping to 136p at the end of last week compared with a 52 week high of £6.60 (adjusted for a share consolidation). The recent interim results in late August failed to reverse sentiment despite some apparently reassuring metrics including an increase in profit before tax from £39.2 million in H1 2013 to £153.7 million in H1 2014 with earnings per share jumping from 11.8 to 30.1 pence per share.

The basic worry is cash collection predominantly as a result of processing industrial deafness claims and the time it can take between taking on a case and final settlement. If cash doesn’t come in as hoped some are saying that another fund raising is certain. Sentiment wasn’t helped by the fall out from the restructuring of the terms of its joint investment with RAC in Connected Car Solutions in early September which although helping cash flow was seen as one of the highest profile deals for Quindell and its unravelling was seen by supporters of short sellers Gotham City as vindication that the company’s fortunes were built on sand. It seems that the Quindell board is losing a battle on the PR front with many sceptical of the company’s numbers and management team.

I for one am sitting on the fence on this one and with the share price collapse there’s little reason to back the board against the shorters at the moment. Who is right on Quindell – Gotham or the board, who knows and I wouldn’t want to take sides! But uncertainty can kill an AIM stock. Quindell’s shares are up 2% this morning but seem way too hot to handle as a contrarian bet in the face of all the negativity in the press and online forums. For those braving the battered share price at these levels in the hope of good news on October 15th they must have a strong stomach for some serious volatility.

Contrarian Investor UK

IMPORTANT: The posts I make are in no way meant as investment suggestions or recommendations to any visitors to the site. They are simply my views, personal reflections and analysis on the markets. Anyone who wishes to spread bet or buy stocks should rely on their own due diligence and common sense before placing any spread trade.