Range Resources looks to have turned the corner after vote of confidence from Hong Kong investor

May 29, 2014 at 4:39 pm in AIM by contrarianuk

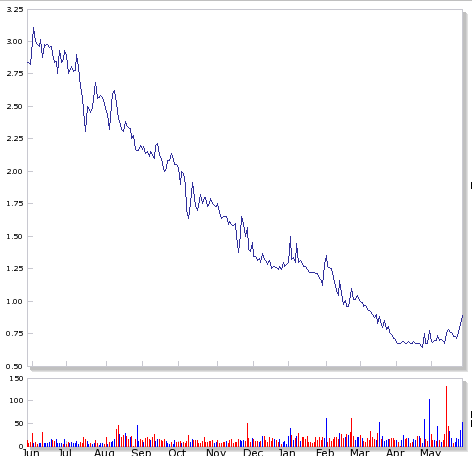

Its been quite a month for investors in Range Resources with the shares up 33% over 4 weeks after an 8.5% rise today following a series of announcements, though unlucky long term holders are still well down on their investment with the shares down over 60% in the last year. The company is now valued at £34.5 million. In March I summed up some of the recent stresses and strains for the company in an article entitled, “Billions of shares created in Range Resources mean uncertain prospects despite Trinidad opportunities” http://www.financial-spread-betting.com/community/aim/billions-of-shares-created-in-range-resources-mean-uncertain-prospects.html

Its been quite a month for investors in Range Resources with the shares up 33% over 4 weeks after an 8.5% rise today following a series of announcements, though unlucky long term holders are still well down on their investment with the shares down over 60% in the last year. The company is now valued at £34.5 million. In March I summed up some of the recent stresses and strains for the company in an article entitled, “Billions of shares created in Range Resources mean uncertain prospects despite Trinidad opportunities” http://www.financial-spread-betting.com/community/aim/billions-of-shares-created-in-range-resources-mean-uncertain-prospects.html

An unexpected outside investor seems to have turned sentiment 180 degrees! The recent bounce is testament to the renewed interest in this oil and gas company with its varied assets, drilling failures in areas like Somalia and troubled history under previous management.

In mid-May the company announced it had secured a $12 million (£7.16 million) investment to refinance debt and provide additional working capital from a Hong Kong-based private institutional investor Abraham Ltd. The investment was in exchange for around 712 million ordinary fully paid shares at 1p each representing 15% of the company’s enlarged share capital, with the subscription worth around £7.1 million at current exchange rates. The investment represented a premium of 49% to the mid-market share price at market close the day before the announcement. Range will also issue 237 million unlisted warrants to Abraham, with half having the exercise price of 1p and the other half 2p. Today the company announced it had received the full proceeds of the investment.

On Wednesday this week the company has announced the appointment of Nick Beattie as chief financial officer to work alongside new CEO Rory Scott-Russell who took over from the less than successful Peter Landau who left in February 2014 leaving a bit of a mess at the company. Beattie is the former managing director in the BNP Paribas Upstream Oil and Gas team, where he was responsible for the bank’s relationship with UK-focused exploration and production companies.

Earlier this week Range announced that it was issuing an additional 67.6 million shares meaning that the company has a staggering 3.943 billion ordinary shares and 80.51 million options. As at 30 April 2014, Range’s debt totalled $10.5 million before the Abraham investment.

All eyes on progress in further drilling on the company’s prospects particularly in Trinidad with the new management team seemingly able to grapple with the complicated previous debt instruments which led to huge share dilution. Beattie and Scott-Russell have a busy agenda to keep Abraham Ltd happy with their investment.

Contrarian Investor UK

IMPORTANT: The posts I make are in no way meant as investment suggestions or recommendations to any visitors to the site. They are simply my views, personal reflections and analysis on the markets. Anyone who wishes to spread bet or buy stocks should rely on their own due diligence and common sense before placing any spread trade.