Rockhopper Exploration surprises shareholders with purchase of Mediterranean Oil & Gas

May 23, 2014 at 10:33 am in AIM by contrarianuk

A bit of a surprise for Rockhopper Exploration and Mediterranean Oil & Gas (MOG) shareholders this morning with the announcement that they had reached agreement on the terms of a recommended £29.3 million acquisition of MOG by Rockhopper. “While the acquisition cost and capital exposure are modest in relation to our balance sheet, the upside potential is significant and we believe that the new acreage will create an attractive entry platform to one of the most exciting regions in the industry at this time,” according to Rockhopper chairman Pierre Jungels.

A bit of a surprise for Rockhopper Exploration and Mediterranean Oil & Gas (MOG) shareholders this morning with the announcement that they had reached agreement on the terms of a recommended £29.3 million acquisition of MOG by Rockhopper. “While the acquisition cost and capital exposure are modest in relation to our balance sheet, the upside potential is significant and we believe that the new acreage will create an attractive entry platform to one of the most exciting regions in the industry at this time,” according to Rockhopper chairman Pierre Jungels.

MOG is listed on AIM with operations in Italy, Malta and France. It produces natural gas onshore and offshore in Italy with reserves and contingent resources of 33 mmboe and total unrisked prospective resources of over 1,200 mmboe. Net production from the Guendalina field, MOG’s principal production asset, was 35,650 scm per day as of 13 May 2014.

MOG shares are up 17% to 6.75p whilst Rockhopper shares are down marginally to 94p.

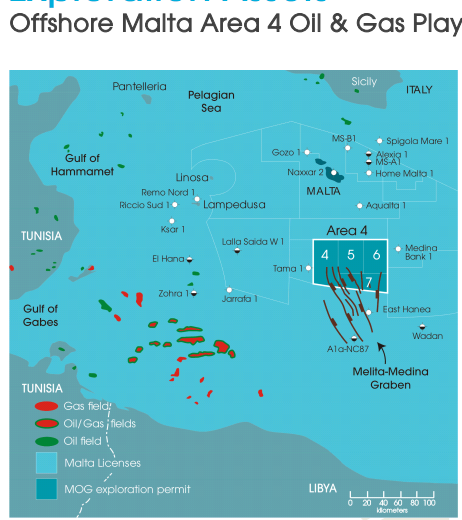

Rockhopper will pay 6.5p per share comprising 4.875 pence in cash and 0.0172 shares of Rockhopper per MOG share. In addition, MOG Shareholders will receive a contingent entitlement up to a maximum amount of 3.550p in cash for each MOG Share based on the results of a forthcoming well result. The new shares issued to MOG shareholders represent approximately 2.65 per cent of the issued share capital of Rockhopper as enlarged by the Acquisition. · The contingent offer amounting to between £11.9 million and £16 million will be determined by the success of an exploration well targeting the Hagar Qim prospect in Offshore Malta Area 4, Block 7 and will only be paid if the 2C Contingent Resources of Liquid Hydrocarbons estimated to be potentially recoverable from the HQ Prospect equal or exceed 80 mmbbl in total, which is a level that the Rockhopper Directors consider to be commercially viable and is equivalent to Rockhopper paying approximately $1 per barrel of 2C Contingent Resources of Liquid Hydrocarbons.

MOG has a 25% stake in its offshore Malta acreage, and the Hagar Qim prospect is being drilled shortly by the Noble Paul Romano rig though it is a high risk wild cat prospect. The company is targeting 27MMboe most likely unrisked resources net.

Genel Energy are covering all the drilling costs of the first well which is due to spud next week and up to $30 million of a second well following a farm out deal in 2012 where MOG sold 75% of offshore Malta Area 4 acreage to Genel.

In April MOG had some excellent news when it confirmed that a court case with Leni Oil and Gas over the Genel deal had been won with Leni confirming that it has decided not to petition the Court of Appeal against the judgment the Commercial Court handed down on 27 March 2014 dismissing LGO’s case, which the court said had “failed at every stage”.

MOG’s total net revenue for Q1 2014 was €1.05 million, representing an average realised price of €0.249 per scm and total net production for Q1 2014 was 4.23 MMscm (equivalent to 0.15 Bcf, or 26,875 boe). This represents average net production of 46,975 scm per day or 299 boe per day during the period (Q1 2013: 700 boe per day).

MOG shareholders seem to be disappointed with the low offer for the company but it is clear that the management team was struggling to get the financial resources to advance its prospects and Rockhopper has a strong cash balance after the Premier Oil farm out of £147 million.

Why has Sam Moody, Rockhopper’s Chief Executive pounced on MOG? The management have some experience of drilling in the Med/North Africa and at the moment there is little operational activity in the Falklands until 2015. It clearly diversifies its interest beyond the Falklands. Is it a good or bad sign for its assets in the Falklands? You could argue it either way….either things aren’t going well Premier Oil and there is a risk of them getting cold feet over the Sea Lion development in the North Falklands basin or on the other hand Premier have a new farm out partner e.g. Noble Energy and Rockhopper will have even more cash at hand by perhaps participating its further selling down its ownership?

Shareholders in Rockhopper are expecting news on a rig deal for the falklands not a MOG takeover, is Sam Moody planning further surprise announcements to take its focus off the Falklands?

Contrarian Investor UK

IMPORTANT: The posts I make are in no way meant as investment suggestions or recommendations to any visitors to the site. They are simply my views, personal reflections and analysis on the markets. Anyone who wishes to spread bet or buy stocks should rely on their own due diligence and common sense before placing any spread trade.