Xcite Energy and Gulf Keystone Petroleum on the rack this morning

Mar 31, 2014 at 9:54 am in AIM by contrarianuk

Xcite Energy dropped as low as 59p and Gulf Keystone Petroleum fell to 90p this morning as fear swirls around the bulletin boards.

The pricing of the forthcoming bond issue and talk of the shares being worth 30p by the likes of Simon Cawkwell (Evil Knievil) were hitting GKP hard. The move from AIM to London’s main market doesn’t seem to have helped dampen Gulf Keystone’s extreme volatility. Xcite Energy fell as much as 10%, and is now down 6% to 62-63p following last week’s disastrous announcement relating to stalled farm out talks with margin calls on leverage positions on both GKP and XEL certainly playing their part.

XEL is now valued at less than £180 million despite 257 booked 2P reserves in the North Sea and it is now cheaper than the original well test in 2010 which proved the heavy oil could be flowed from the field.Despite a $250 million extended well test in 2011 which proved up the Bentley asset and which led to an upgrade in 2P reserves from 155 million to 256 million barrels, panic stalks this share. Each barrel of 2P oil is now valued at an incredible $1.15 a barrel on fears that the oil will never be extracted and also probably some realising tax losses before the year end (6th April 2014). When punters are fearful anything can happen…the problem is many private investors haven’t got the spare cash to average down and be greedy and with suspicion about the board of directors rife, many haven’t got the stomach for further bomb shells!

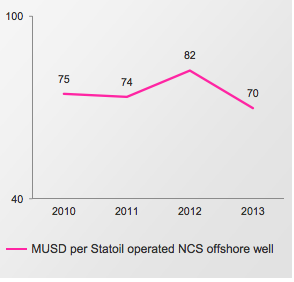

At 60p, a low ball takeover for XEL must be on the cards. This is getting ridiculous. A company offering a 50% premium to the current share price can get a 909 million barrel field for say £250-300 million, why bother drilling wild cats or even developing fields like Kraken, Catcher and Mariner? For Statoil the average cost of a well was around $70 million in 2013. Buying Bentley and putting in $700 million would net you 45,000 barrels a day from 2016.

Contrarian Investor UK

IMPORTANT: The posts I make are in no way meant as investment suggestions or recommendations to any visitors to the site. They are simply my views, personal reflections and analysis on the markets. Anyone who wishes to spread bet or buy stocks should rely on their own due diligence and common sense before placing any spread trade.