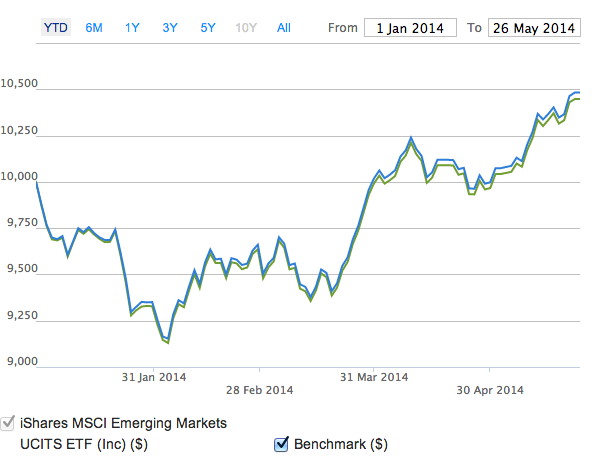

For those buying emerging markets funds and ETF’s in late January 2014 just as the Ukraine crisis started to turn ugly it has turned out to be a very rewarding investment. The Ishares MSCI Emerging markets ETF was down 8.5% year to date as of the first week of February and is now up nearly 5% year to date today, a 13.5% swing for those buying at the bottom. Clearly timing is everything!

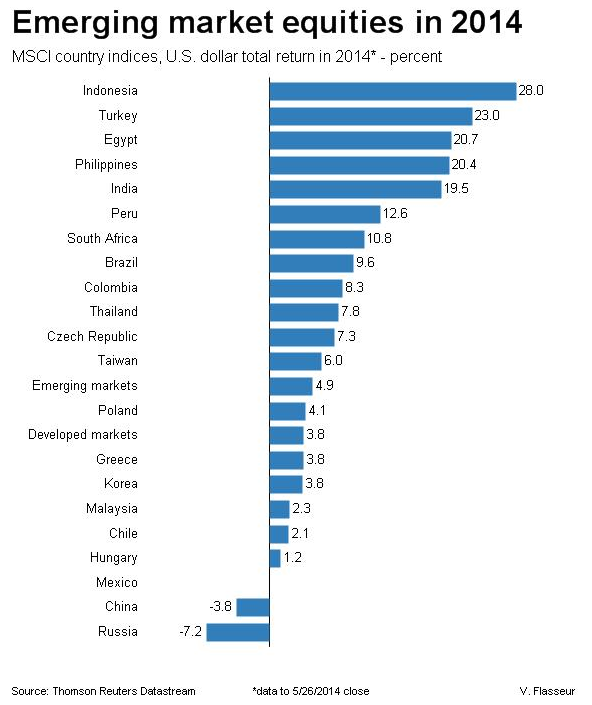

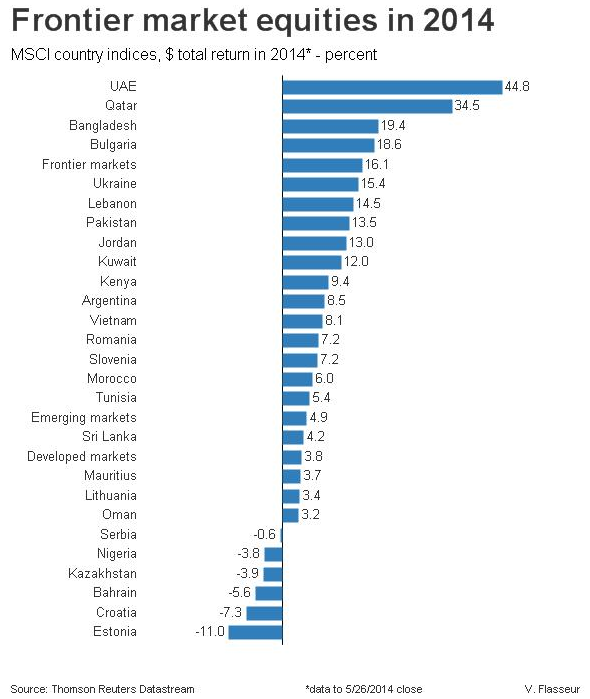

Looking at the emerging markets that have performed best in 2014, Indonesia (+28%), Turkey (23%), Egypt (21%), the Philippines (20.4%) and India (19.5%) are the stand out countries. In Frontier markets, UAE is up a staggering 44.8% and Qatar is up 34.5%.

The MSCI emerging equity index fell off a cliff in late May 2013 when Ben Bernanke announced the start of tapering of the US Federal Reserve asset purchase programme. The index clawed back some of these losses in 2013 but still had a very poor year versus the S&P 500, Japan and European indices. Chinese stocks were down 7.1% on the year, Brazil 15.9%, India 3.5%, Turkey 18.3% and Russia 4.3%. Early in 2014 the emerging markets were hit again by the political issues surrounding the Ukraine, Egypt and Turkey amongst others. The strong bounce back in recent weeks was slightly tempered by yet another military coup earlier this month in Thailand.

In contrast to the significant volatility in the emerging markets this year, the US indices have been relatively subdued after their amazing performance in 2013, with the S&P 500 showing a reasonable gain . Both the Dow Jones industrials and Nasdaq are up 0.2% for the year, while the S&P 500 is up 2.8%. Everyone is wondering where things will go next after a relatively unexciting few weeks in the American market given a pretty good quarter one earnings season. But with valuations looking stretched and earnings growth driven by sales growth in short supply (as opposed to cost cutting and share buy backs), many are wondering what will happen when the Federal Reserve finally pulls the plug on its asset purchase programme. Certainly no signs of a slam dunk when it comes to earnings growth in the developed economies in the second quarter of 2014 and the strong bounce in the emerging markets may not be set to last. A testing year to see where things go for the hedge funds in particular who have struggled to perform ahead of their benchmarks. The average hedge fund reported a gain of 1.1% in the first quarter, with alternative managers making their worst start to the year since 2009.

Contrarian Investor UK

IMPORTANT: The posts I make are in no way meant as investment suggestions or recommendations to any visitors to the site. They are simply my views, personal reflections and analysis on the markets. Anyone who wishes to spread bet or buy stocks should rely on their own due diligence and common sense before placing any spread trade.

by contrarianuk

For braver investors emerging markets have proven sound bet in 2014

May 27, 2014 at 9:37 am in Market Commentary by contrarianuk

For those buying emerging markets funds and ETF’s in late January 2014 just as the Ukraine crisis started to turn ugly it has turned out to be a very rewarding investment. The Ishares MSCI Emerging markets ETF was down 8.5% year to date as of the first week of February and is now up nearly 5% year to date today, a 13.5% swing for those buying at the bottom. Clearly timing is everything!

Looking at the emerging markets that have performed best in 2014, Indonesia (+28%), Turkey (23%), Egypt (21%), the Philippines (20.4%) and India (19.5%) are the stand out countries. In Frontier markets, UAE is up a staggering 44.8% and Qatar is up 34.5%.

The MSCI emerging equity index fell off a cliff in late May 2013 when Ben Bernanke announced the start of tapering of the US Federal Reserve asset purchase programme. The index clawed back some of these losses in 2013 but still had a very poor year versus the S&P 500, Japan and European indices. Chinese stocks were down 7.1% on the year, Brazil 15.9%, India 3.5%, Turkey 18.3% and Russia 4.3%. Early in 2014 the emerging markets were hit again by the political issues surrounding the Ukraine, Egypt and Turkey amongst others. The strong bounce back in recent weeks was slightly tempered by yet another military coup earlier this month in Thailand.

In contrast to the significant volatility in the emerging markets this year, the US indices have been relatively subdued after their amazing performance in 2013, with the S&P 500 showing a reasonable gain . Both the Dow Jones industrials and Nasdaq are up 0.2% for the year, while the S&P 500 is up 2.8%. Everyone is wondering where things will go next after a relatively unexciting few weeks in the American market given a pretty good quarter one earnings season. But with valuations looking stretched and earnings growth driven by sales growth in short supply (as opposed to cost cutting and share buy backs), many are wondering what will happen when the Federal Reserve finally pulls the plug on its asset purchase programme. Certainly no signs of a slam dunk when it comes to earnings growth in the developed economies in the second quarter of 2014 and the strong bounce in the emerging markets may not be set to last. A testing year to see where things go for the hedge funds in particular who have struggled to perform ahead of their benchmarks. The average hedge fund reported a gain of 1.1% in the first quarter, with alternative managers making their worst start to the year since 2009.

Contrarian Investor UK

IMPORTANT: The posts I make are in no way meant as investment suggestions or recommendations to any visitors to the site. They are simply my views, personal reflections and analysis on the markets. Anyone who wishes to spread bet or buy stocks should rely on their own due diligence and common sense before placing any spread trade.