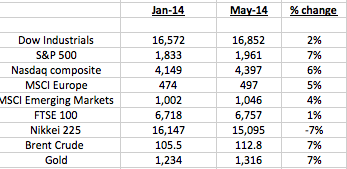

With the end of the second quarter of 2014 looming large, which markets have performed best so far?

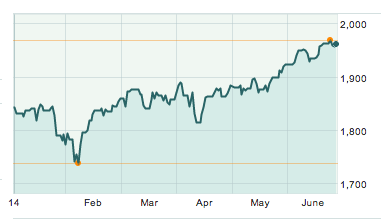

The S&P 500 is the standout performer year to date with a strong second quarter (April-June) after a wobble back in February brought on by the Ukraine crisis. The Nasdaq Composite wasn’t far behind the 7% growth of the S&P 500 with a 6% rise year to date. A pretty decent Q1 earnings season and accommodative Federal Reserve continue to support the US market strongly. The Dow Industrials has failed to keep pace with the broader market as airlines, pharmaceutical stocks and utilities ran wild in the broader index whilst poor performers like industrials, financials and household products feature heavily in the Dow.

The FTSE 100, Europe and particularly Japanese market have failed to keep up with the broader US market, with the Nikkei 225 down 7% year to date as 2013’s euphoria about Abenomics, the policies introduced by Prime minister Shinzō Abe in Japan after his election in 2012, have died down. Abenomics has consisted of targeting a 2% annual inflation rate, correction of the excessive yen appreciation, setting negative interest rates, radical quantitative easing, expansion of public investment, buying operations of construction bonds by Bank of Japan (BOJ), and revision of the Bank of Japan Act. Though inflationary policies are helping Japan’s exporters, severe structural problems exist in the economy e.g. ageing population, too much saving, gigantic government debt.

The FTSE 100, Europe and particularly Japanese market have failed to keep up with the broader US market, with the Nikkei 225 down 7% year to date as 2013’s euphoria about Abenomics, the policies introduced by Prime minister Shinzō Abe in Japan after his election in 2012, have died down. Abenomics has consisted of targeting a 2% annual inflation rate, correction of the excessive yen appreciation, setting negative interest rates, radical quantitative easing, expansion of public investment, buying operations of construction bonds by Bank of Japan (BOJ), and revision of the Bank of Japan Act. Though inflationary policies are helping Japan’s exporters, severe structural problems exist in the economy e.g. ageing population, too much saving, gigantic government debt.

An accommodative European Central bank with a recent interest rate cut has helped European/Eurozone markets, but concerns remain about the performance of some of the core eurozone markets particularly France. The pull back in the mining sector caused by the slow down in China continues to hinder the performance of the FTSE 100 with BHP Billiton, Rio Tinto and others struggling to make gains this year. Rio is down 7% in the last 6 months as iron prices in particular have shown real weakness as production from mines in Australia surges, but demand is faltering in the Chinese steel industry.

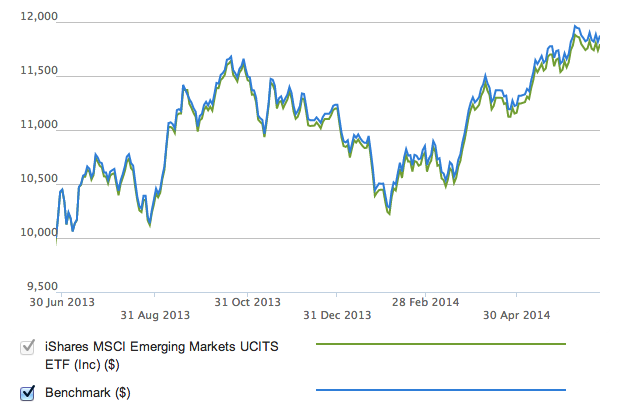

Emerging markets are back in positive territory after a strong rebound from mid-February onwards after a week start to 2014 and poor 2013 with Turkey, Russia and Brazil amongst others bouncing back.

Emerging markets 2014

Finally, investors in gold and oil have had a pretty solid start to 2014. The recent moves by Jihadist elements in Iraq to capture large swathes of the Northern part of the country as well as supply constraints elsewhere in the world have helped drive the price of oil higher this year, despite the impact of higher non-conventional oil and gas production in the United States. After a dreadful 2013, gold is more resilient this year despite the moves by the US Federal Reserve to end its asset purchase programme by the Autumn and little signs of inflationary pressures in the American economy. China and Russia have remained large buyers of the yellow metal this year.

So a good start to the year so far if you’re long the markets after the incredible gains of 2013 in many of the equity indices (especially US)….what next for the second half of 2014?

Contrarian Investor UK

IMPORTANT: The posts I make are in no way meant as investment suggestions or recommendations to any visitors to the site. They are simply my views, personal reflections and analysis on the markets. Anyone who wishes to spread bet or buy stocks should rely on their own due diligence and common sense before placing any spread trade.

by contrarianuk

End of second quarter of 2014 looms – what markets and assets have performed best?

Jun 29, 2014 at 2:38 pm in Market Commentary by contrarianuk

With the end of the second quarter of 2014 looming large, which markets have performed best so far?

The S&P 500 is the standout performer year to date with a strong second quarter (April-June) after a wobble back in February brought on by the Ukraine crisis. The Nasdaq Composite wasn’t far behind the 7% growth of the S&P 500 with a 6% rise year to date. A pretty decent Q1 earnings season and accommodative Federal Reserve continue to support the US market strongly. The Dow Industrials has failed to keep pace with the broader market as airlines, pharmaceutical stocks and utilities ran wild in the broader index whilst poor performers like industrials, financials and household products feature heavily in the Dow.

An accommodative European Central bank with a recent interest rate cut has helped European/Eurozone markets, but concerns remain about the performance of some of the core eurozone markets particularly France. The pull back in the mining sector caused by the slow down in China continues to hinder the performance of the FTSE 100 with BHP Billiton, Rio Tinto and others struggling to make gains this year. Rio is down 7% in the last 6 months as iron prices in particular have shown real weakness as production from mines in Australia surges, but demand is faltering in the Chinese steel industry.

Emerging markets are back in positive territory after a strong rebound from mid-February onwards after a week start to 2014 and poor 2013 with Turkey, Russia and Brazil amongst others bouncing back.

Emerging markets 2014

Finally, investors in gold and oil have had a pretty solid start to 2014. The recent moves by Jihadist elements in Iraq to capture large swathes of the Northern part of the country as well as supply constraints elsewhere in the world have helped drive the price of oil higher this year, despite the impact of higher non-conventional oil and gas production in the United States. After a dreadful 2013, gold is more resilient this year despite the moves by the US Federal Reserve to end its asset purchase programme by the Autumn and little signs of inflationary pressures in the American economy. China and Russia have remained large buyers of the yellow metal this year.

So a good start to the year so far if you’re long the markets after the incredible gains of 2013 in many of the equity indices (especially US)….what next for the second half of 2014?

Contrarian Investor UK

IMPORTANT: The posts I make are in no way meant as investment suggestions or recommendations to any visitors to the site. They are simply my views, personal reflections and analysis on the markets. Anyone who wishes to spread bet or buy stocks should rely on their own due diligence and common sense before placing any spread trade.