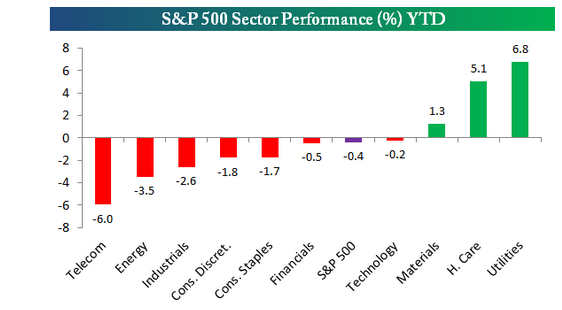

With the U.S. market S&P 500 finishing the 2013 at 1,848 and currently sitting at 1,855, broadly flat so far in 2014 it has been healthcare and utilities, overcoming weakness in telecoms, energy and industrials.

It will be Janet Yellen’s first FOMC (Federal Open Market Committee) meeting as US Federal Reserve chair on Wednesday and the news from the meeting is likely to be highly influential over coming months in terms of where the S&P 500 ends 2014 given the switch in leadership of the Fed from Bernanke to Yellen. The Fed is likely to taper its asset purchases by another $10 billion to $55 billion a month. Investor interest will be on forward guidance for how long interest rates stay at zero with the Federal Reserve balancing asset purchases, employment data and inflation indications.

Contrarian Investor UK

IMPORTANT: The posts I make are in no way meant as investment suggestions or recommendations to any visitors to the site. They are simply my views, personal reflections and analysis on the markets. Anyone who wishes to spread bet or buy stocks should rely on their own due diligence and common sense before placing any spread trade.

by contrarianuk

Relative performance of S&P 500 sectors year to date 2014

Mar 17, 2014 at 3:51 pm in Market Commentary by contrarianuk

With the U.S. market S&P 500 finishing the 2013 at 1,848 and currently sitting at 1,855, broadly flat so far in 2014 it has been healthcare and utilities, overcoming weakness in telecoms, energy and industrials.

It will be Janet Yellen’s first FOMC (Federal Open Market Committee) meeting as US Federal Reserve chair on Wednesday and the news from the meeting is likely to be highly influential over coming months in terms of where the S&P 500 ends 2014 given the switch in leadership of the Fed from Bernanke to Yellen. The Fed is likely to taper its asset purchases by another $10 billion to $55 billion a month. Investor interest will be on forward guidance for how long interest rates stay at zero with the Federal Reserve balancing asset purchases, employment data and inflation indications.

Contrarian Investor UK

IMPORTANT: The posts I make are in no way meant as investment suggestions or recommendations to any visitors to the site. They are simply my views, personal reflections and analysis on the markets. Anyone who wishes to spread bet or buy stocks should rely on their own due diligence and common sense before placing any spread trade.