U.S. stocks ended at all time highs pre-Christmas after a strong durable-goods orders report with the Dow at 16,358 and the S&P 500 at 1,833. The S&P is showing a gain of 28.5% year to date, pretty impressive! The Nasdaq Composite at 4,155 is now at its highest level since September 2000, the infamous Dot-Com boom and bust, up 34.4% year to date. The FTSE 100 sits at 6,694, up 13.5% year to date.

U.S. stocks ended at all time highs pre-Christmas after a strong durable-goods orders report with the Dow at 16,358 and the S&P 500 at 1,833. The S&P is showing a gain of 28.5% year to date, pretty impressive! The Nasdaq Composite at 4,155 is now at its highest level since September 2000, the infamous Dot-Com boom and bust, up 34.4% year to date. The FTSE 100 sits at 6,694, up 13.5% year to date.

Yet the market bull run shows no obvious signs of slowing down right now. All the worries about Euro Zone debt, Federal Bank money printing, low growth have all disappeared.

For my own portfolio, it has a been a tepid 2013 given my contrarian bets on oil and gas stocks, particularly AIM which have suffered badly. Shares like Bowleven, Gulf Keystone, Xcite Energy, Premier Oil, Ithaca Energy, Ophir Energy sit pretty much at 52 week lows despite a remarkably robust oil price. Some “bargain hunting” back in September has failed to deliver. The sell off by institutional investors in oil stocks is in common with the severe sell off in resource stocks this year. But Brent crude for February 2014 delivery now sells at around $112 a barrel, close to 52 week highs! So I hope for better news in 2014 since for many mid-caps they are highly cash generative right now. Increasing global growth, with a potential added sprinkling of geo-political risk, means sub $100 a barrel oil seems very unlikely next year. Increasing US production using fraccing is largely land locked within the United States and with large producers like Saudi Arabia and Russia needing oil to stay close to $100 to keep their economies afloat a big sell off doesn’t seem to be on the cards.

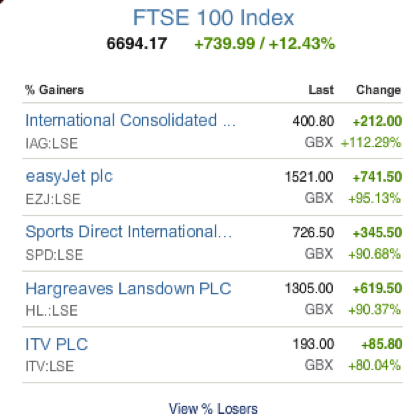

It has been interesting to look at the biggest risers in the FTSE 100 and FTSE 350 indices over the past year.

Topping the list of risers in the FTSE 100 are airlines – IAG and EasyJet. With oil prices so high , a surprising statistic but with economic activity rebounding, and hence air travel, the institutions have been piling in. I remember the days of doom and gloom surrounding sports retailer Sports Direct International with Mike Ashley at the helm. The shares were languishing well below a £1 five years ago at the peak of the last recession and with a price war raging with JJB Sports, which is now no more. Today they sit at £7.26. Online financial services provider Hargreaves Lansdown and ITV have benefited from a booming stock markets and an improving UK economy leading to higher advertiser spend.

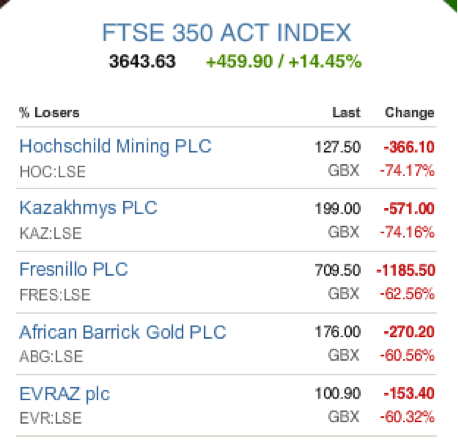

The big losers in the FTSE 100 are all resource stocks with copper and iron ore prices under pressure in 2013 and hence earnings. Bloated investment projects with huge capital investments which were set in train when demand from Asia was soaring have come back to haunt shareholders as China’s appretite for raw materials have slackened.

Online food retailer, Ocado stands out in the FTSE 350 risers with a 450% increase in the last year, a rise precipitated by its deal with Morrisons to provide delivery services for its products. This heavily shorted share, saw plenty of hedge funds nursing very heavy losses buying back their positions. From the verge of bankruptcy, Thomas Cook now sits at 165p. For those buying in the darkest days, a handsome return! The FTSE 350 losers like the FTSE 100 fallers are the resource shares once again, with gold miner African Barrack Gold in the list with a 60% fall reflecting the 30% drop in the gold price this year as well as huge upward pressures on costs at its key mines.

Will resource stocks rebound in 2014…the $64,000 question!

IMPORTANT

The posts I make are in no way meant as investment suggestions or recommendations to any visitors to the site. They are simply my views, personal reflections and analysis on the markets. Anyone who wishes to spread bet or buy stocks should rely on their own due diligence and common sense before placing any spread trade.

by contrarianuk

Resource shares prove the dogs of 2013

Dec 26, 2013 at 8:42 am in Market Commentary by contrarianuk

Yet the market bull run shows no obvious signs of slowing down right now. All the worries about Euro Zone debt, Federal Bank money printing, low growth have all disappeared.

For my own portfolio, it has a been a tepid 2013 given my contrarian bets on oil and gas stocks, particularly AIM which have suffered badly. Shares like Bowleven, Gulf Keystone, Xcite Energy, Premier Oil, Ithaca Energy, Ophir Energy sit pretty much at 52 week lows despite a remarkably robust oil price. Some “bargain hunting” back in September has failed to deliver. The sell off by institutional investors in oil stocks is in common with the severe sell off in resource stocks this year. But Brent crude for February 2014 delivery now sells at around $112 a barrel, close to 52 week highs! So I hope for better news in 2014 since for many mid-caps they are highly cash generative right now. Increasing global growth, with a potential added sprinkling of geo-political risk, means sub $100 a barrel oil seems very unlikely next year. Increasing US production using fraccing is largely land locked within the United States and with large producers like Saudi Arabia and Russia needing oil to stay close to $100 to keep their economies afloat a big sell off doesn’t seem to be on the cards.

It has been interesting to look at the biggest risers in the FTSE 100 and FTSE 350 indices over the past year.

Topping the list of risers in the FTSE 100 are airlines – IAG and EasyJet. With oil prices so high , a surprising statistic but with economic activity rebounding, and hence air travel, the institutions have been piling in. I remember the days of doom and gloom surrounding sports retailer Sports Direct International with Mike Ashley at the helm. The shares were languishing well below a £1 five years ago at the peak of the last recession and with a price war raging with JJB Sports, which is now no more. Today they sit at £7.26. Online financial services provider Hargreaves Lansdown and ITV have benefited from a booming stock markets and an improving UK economy leading to higher advertiser spend.

The big losers in the FTSE 100 are all resource stocks with copper and iron ore prices under pressure in 2013 and hence earnings. Bloated investment projects with huge capital investments which were set in train when demand from Asia was soaring have come back to haunt shareholders as China’s appretite for raw materials have slackened.

Online food retailer, Ocado stands out in the FTSE 350 risers with a 450% increase in the last year, a rise precipitated by its deal with Morrisons to provide delivery services for its products. This heavily shorted share, saw plenty of hedge funds nursing very heavy losses buying back their positions. From the verge of bankruptcy, Thomas Cook now sits at 165p. For those buying in the darkest days, a handsome return! The FTSE 350 losers like the FTSE 100 fallers are the resource shares once again, with gold miner African Barrack Gold in the list with a 60% fall reflecting the 30% drop in the gold price this year as well as huge upward pressures on costs at its key mines.

Will resource stocks rebound in 2014…the $64,000 question!

IMPORTANT

The posts I make are in no way meant as investment suggestions or recommendations to any visitors to the site. They are simply my views, personal reflections and analysis on the markets. Anyone who wishes to spread bet or buy stocks should rely on their own due diligence and common sense before placing any spread trade.