It’s the dot com madness again….this time just look at Twitter!

Dec 28, 2013 at 8:36 am in Market Commentary by contrarianuk

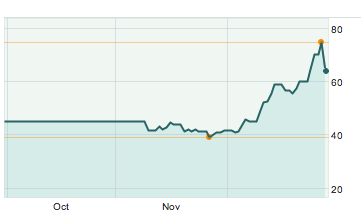

Twitter (TWTR) shares finally did an about turn yesterday, dropping 13% to close at $63.75 in normal trading and to $63 in after hours, after the shares were downgraded to sell by Macquarie Equity Research analyst Ben Schachter. On Thursday they were up about 100% since late November, having closed at $73.31. This compares with the $26 IPO price and the opening price at its listing on the NYSE of $45 on November 7th 2013.

Despite yesterday’s fall the shares still ended the week with a 6.2% gain and the company has a market capitalisation of $35 billion, down from over $41 billion on Thursday. Just to compare, another media company, the Walt Disney company has a market cap of $131 billion, but with revenues of $45 billion and gross income of $9.5 billion!

In 2012, Twitter had revenues of $316 million. It is expected to lose 22 cents a share this fiscal year and 5 cents next year.

So a big negative P/E right now…..we are back to the madness of the 1999-2000 dot com all over again.

A history lesson! The Nasdaq hit 5,100 in March 2000 and between January 1998 and March 10th 2000, the Nasdaq increased by over 200%. The company that exemplified the boom and bust was Boo.com, a U.K. listed company founded by Swedes Ernst Malmsten, Kajsa Leander and Patrik Hedelin in 1999, selling fashion items over the internet. The company spent $135 million of venture capital in just 18 months, and it was placed into receivership on 18 May 2000 and liquidated. in 1988 as Bookham Technology. It became the first company in the world to make optical components that can be integrated into a silicon chip. It floated in July 2000 at £10 and in August 2000 its shares hit an eye-watering £53! it was promoted to the FTSE 100 of the U.K.’s leading companies in 2000. By the end of 2000, its shares had fallen 99% to less than 50p a share and in 2004 it moved its listing to the U.S. on Nasdaq. In January 2000, AOL Time Warner was created when AOL purchased Time Warner for $164 billion. The shareholders of AOL owned 55% of the new company while Time Warner shareholders owned only 45%. In 2002, the company was forced to report a loss of $99 billion due to the goodwill write-off related to AOL, at the time, the largest loss ever reported by a company. In 2003, the company dropped the “AOL” from its name, and removed Steve Case as executive chairman. In May 2009 Time Warner announced that it would spin off AOL as a separate independent company, with the change occurring on December 9, 2009.

The social media space is red hot! Facebook at $55 has bounced incredibly since the low of $18 in late 2012 and is on a p/e of 128 (69 for full years estimated earnings) with a market cap of $145 billion. LinkedIn at $216, has a market cap of $45 billion and a p/e of 676 (136 on year estimated earnings).

Schachter at Macquarie said of Twitter,

“We expect this to be among the shortest downgrade note you’ve ever read, as nothing fundamentally has changed since our Neutral initiation on Dec. 11, except that shares have risen 40%. When we launched on TWTR 15 days ago, we laid out pros and cons and stated that TWTR was worth $46/share. Since that time, on the back of virtually no new news, the stock has risen in value 40% (vs. 2% for the S&P 500). Since the IPO open on 11/7, TWTR shares are up 62% (vs. a 4% gain for the S&P 500). We continue to believe that Twitter as a company has a bright future and many opportunities ahead. However, as a stock, we believe nothing has changed over the last 15 days to justify the rise in valuation. Therefore, we are reducing our rating to Underperform, from Neutral, and maintaining our estimates and $46 target price.”

Also on Friday, S&P Capital Scott Kessler raised his price target to $43 from $30, but reiterated a sell rating on Twitter, arguing that the stock was overvalued.. The stock has more than doubled since the company went public in early November with an initial public offering price of $26. Earlier in the week, Blake Harper, an analyst with Wunderlich Securities, wrote that Twitter’s stock had “graduated to cult status.”, “While the company is growing revenues faster than its fastest-growing peers and we do recognize the potential for the company to capture larger portions of the mobile and TV advertising market,” Harper wrote, “it appears valuation metrics are irrelevant and that investors are betting aggressively on Twitter being the next great media-technology platform.”

What has been driving the shares up so strongly? Twitter expanded its ad targeting tools and introduced a specific tool for TV conversation targeting. Around the same time, Apple bought Topsy, a social media analytics company, for a reported $200 million, which some took to be a further validation of the social media space.

Good luck to those who bought Twitter shares over $70!!!!

Contrarian Investor UK

IMPORTANT

The posts I make are in no way meant as investment suggestions or recommendations to any visitors to the site. They are simply my views, personal reflections and analysis on the markets. Anyone who wishes to spread bet or buy stocks should rely on their own due diligence and common sense before placing any spread trade.

Money to be made from the greater fool perhaps… I guess id be interested in any new technology ipos and try to make some money from the madness…..

Will keep an eye out,

Shaun