Buy-and-Hold vs. Market Timing

Nov 17, 2011 at 6:31 pm in Fundamental Analysis by

Reading some investment books, web sites, and printed journals will leave you with the impression that all you need to do is buy a supposedly-diversified FTSE 100 index tracking fund or Exchange Traded Fund (ETF) and simply hold it for the “long term” of at least ten years. This passive approach assumes that market timing is impossible, so there’s no point trying. Or is there?

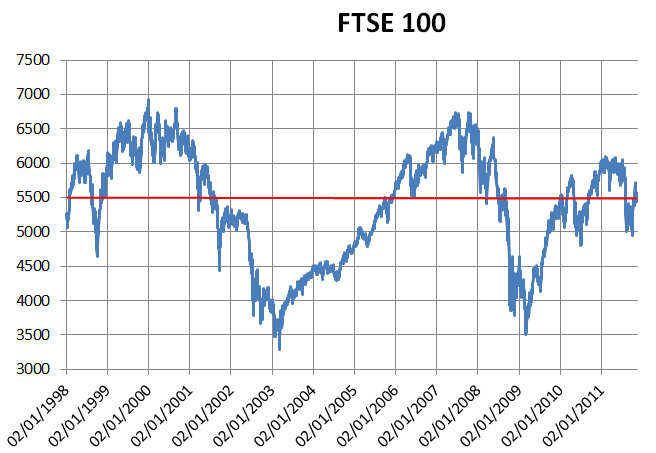

FTSE 100 Goes Nowhere!

The following chart shows how the FTSE 100 index has gone nowhere* in almost thirteen years. The passive buy-and-hold investor would have ended up with exactly the same money that he started with… plus dividends, admittedly, but minus inflation.

* yes, it did go somewhere (up and down) en route to finishing at the same level that it started.

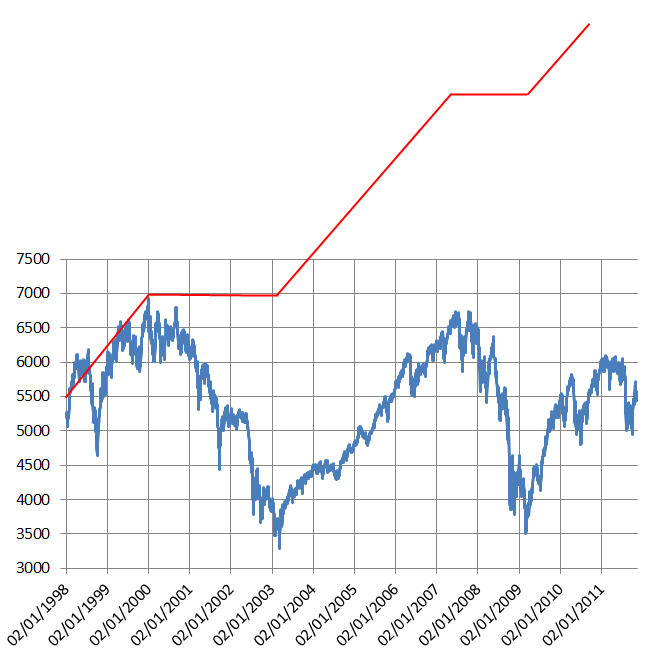

Market Timing Investor Makes a Profit!

The next chart shows how an expert market timing investor could have made a substantial profit over the same period, roughly corresponding with the red line. He was clever enough to have sold out and gone to cash perfectly at each peak, and then to re-invest perfectly at each trough.

Since the market timing investor was invested for roughly half the time, he would have collected roughly half the dividends plus some additional interest while his cash was on the sidelines.

For some ideological reason, those people practicing the noble art of ‘investing’ don’t like to think of themselves as ‘traders’ who dip in and out. But this is hardly day-trading, is it? The market timing investor would have made only six transactions in thirteen years.

Market Timing Spread Bettor Makes a Bigger Profit!

So much for the traditional ‘investor’ who practiced perfect market timing. What about the equally talented or lucky spread bettor? I ask you to imagine what the red line would look like for the spread bettor who sold short perfectly at each peak rather than merely going to cash. There would be no horizontal segments (only rising segments) of the resulting equity curve. And frankly, I don’t have enough space here to show the result pictorially because it would be so far off the scale!

Let me therefore illustrate using numbers. A rough line-of-sight estimate tells me that there were potentially 15,000 points of profit on offer throughout this roller-coaster ride, and I’ll leave you to imagine this translating to £150,000 at £10-per-point.

The market timing spread bettor could also have received dividend credits while ‘long’, and potentially received (yes, not paid) financing charges while ‘short’.

Market Timing is Not Easy

Looks easy, doesn’t it? And with the benefit of perfect hindsight, it is.

In practice it’s rather more difficult to determine the exact tops and bottoms because — as we all know — nobody rings a bell. Yet the market timing aficionado would argue that you only needed to get your timing roughly right in order to have bettered the buy-and-holder.

The other problem is that this is rather like trying to measure the coastline of Great Britain. The smaller your measuring stick, the greater the distance (or profit) as you take in more twists and turns. But more frequent trading means higher frictional costs (like the spread) and more opportunities for the market to whipsaw you out for a long series of cumulative losses.

So now let me summarise:

Market timing is possible, and profitable, but is isn’t easy.

Tony Loton is a private trader, and author of the book “Stop Orders” published by Harriman House.