Financial Trading Patterns #2: LIMIT SELL

Nov 24, 2011 at 9:28 pm in Orders by

In the previous Financial Trading Patterns article I documented the LIMIT BUY trading pattern, and in this article I document its complement: the LIMIT SELL trading pattern. For spread bettors the LIMIT SELL is pretty much a mirror image of the LIMIT BUY, but for regular investors it isn’t… because they don’t sell short.

NAME

LIMIT SELL

DEFINITIONS

A LIMIT SELL order is an order to SELL a security when the price rises to a specified level.

PARAMETERS

LIMIT SELL Trigger Price.

OBJECTIVE

The objective is to ‘sell high’ a stock (or other financial instrument) when it’s expensive.

MOTIVATION

We’d like to “sell high” a financial instrument that we originally “bought low”, so as to bank a profit. Alternatively, we’d like to “sell short” the financial instrument that we expect to fall in price.

SUCCESS SCENARIO(s)

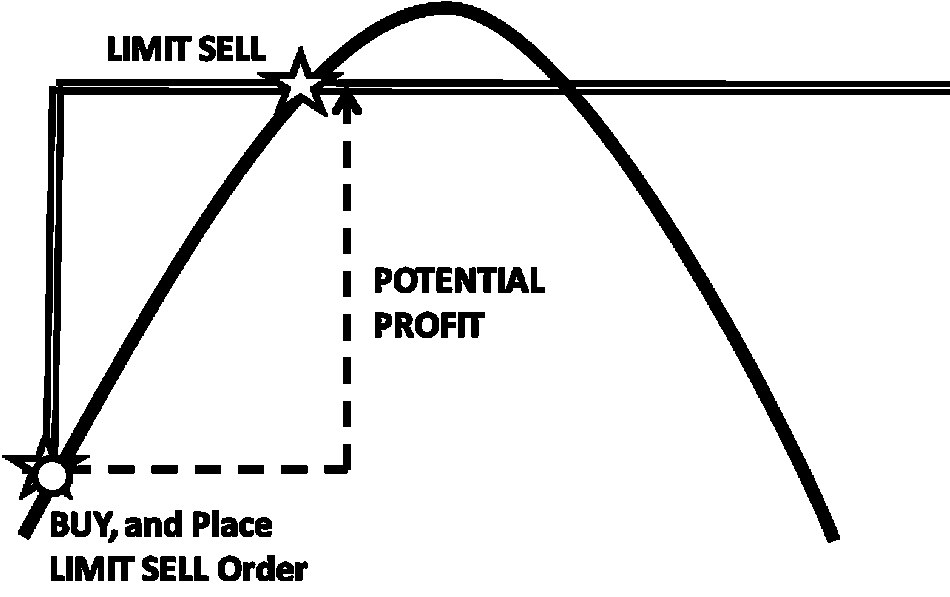

The following figure shows the LIMIT SELL success scenario in which we buy a rising stock and place a LIMIT SELL order to sell the stock when the price rises to what we consider to be a healthy profit. When the order executes, we bank the profit.

Note that when able to short stocks in a spread betting account rather than a conventional share dealing account, there is an additional success scenario in which we open a new short position when the limit price is reached, in expectation that the price will fall and our short position will move into profit. This would be the exact mirror image (reflected vertically) of the LIMIT BUY success scenario.

FAILURE SCENARIO(s)

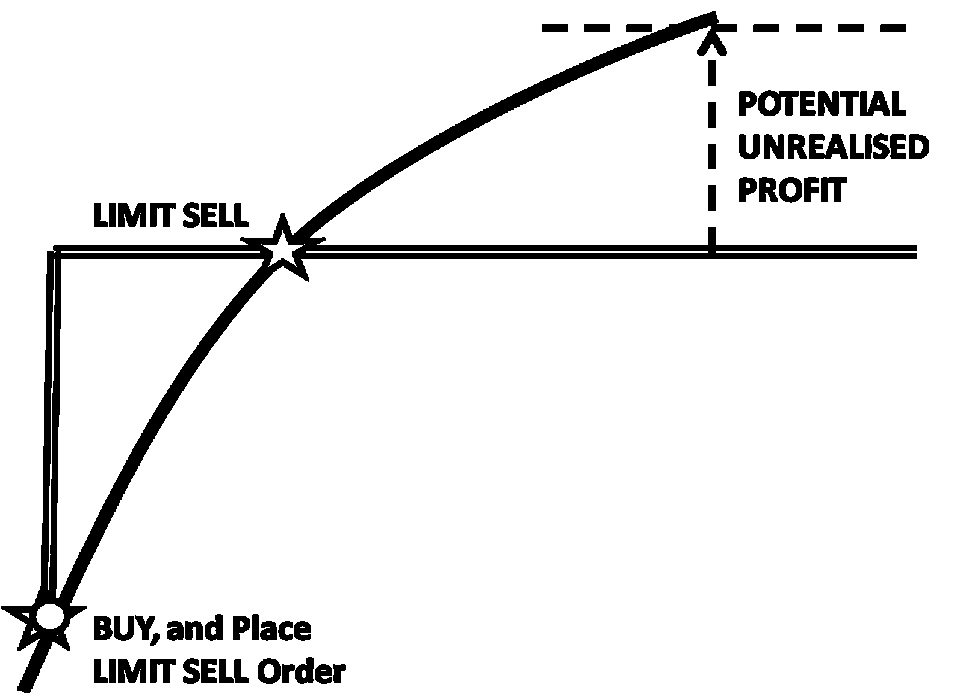

The following figure shows the most obvious failure scenario, in which the price continues to rise after the order executes. There is additional potential profit, which we fail to realize by selling out too soon.

In the short case, the failure scenario would be that the price goes on rising after we have sold short using the LIMIT SELL order, therefore our short position goes further and further into loss.

APPLICATION

A conventional stockbroker will offer a specific LIMIT SELL order type, or will provide an order form via which you can specify the order type (as LIMIT) and the order direction (as SELL).

A spread betting order ticket may allow you to specify your order as a LIMIT order, or this may be inferred from the fact that an order to sell at a price above the current price must be a LIMIT SELL order.

In all cases you specify a target price at which you wish your chosen stock or other financial instrument to be sold or sold short. The sell order will not be executed until the price rises to the specified level. Where the spread betting order ticket obliges you to specify this as a LIMIT order to SELL, you will likely encounter an error message if your target price is not above the current market price.

This article has been devised and adapted from original text and pictures included in the book “Financial Trading Patterns” by Tony Loton (with permission).