Trading with Triggers

Dec 13, 2011 at 3:15 pm in Orders by

One of the features of my preferred Position Trading approach is the running of many equity positions simultaneously. Some traders and investors shy away from running many simultaneous positions because of the sheer effort involved in managing a long list of prospective and actual stock holdings; but I use a range of on-line tools that help me semi-automate my trading, for example:

- A Google Docs spreadsheet Stop-Out List that helps me keep track of the stocks I have sold, with a view to buying them back at a cheaper price.

- The Yahoo! Finance Price Losers (%) list that tells me which stocks have fallen a long way today.

I turns out that both of those tools could be implemented in a different way, using stock alerts or triggers.

I know of more than one stockbroker and spread betting provider that provides an alert facility to email you when a particular price event occurs, but I will use the Capital Spreads trigger facility as my demonstration vehicle because Capital Spreads is the platform I’m using for my Trading Trail public account.

A Trigger-Based “Stop-Out List” (or Virtual Order Book)

One of the triggers provided by the Capital Spreads charting package will alert you when the price of a stock rises above or falls below a particular level. As such, this trigger allows you to simulate STOP ORDERS and LIMIT ORDERS without actually placing those orders in the live market.

In the purest sense, implementing my Stop-Out List using triggers would mean placing a trigger on a stock that would alert me when the price fell below my last stop-out price. But I don’t want to re-purchase a stock merely because it has fallen below my last selling price unless it has fallen to a price at which I actually want to buy.

So recently, when adding stocks to my Stop-Out List, I have at the same time been placing a live opening order to open a new position when the price falls to a specific attractive level. One such opening order is this one on LogicaCMG:

![]()

FYI I last sold LogicaCMG (by stopping out) at 74p-per-share, and this order shows that I am willing to buy it back at a price of 65p-per-share.

I understand that some traders don’t like to have opening orders live in the market, and I too am wary that there are no guarantees on opening orders. So as an alternative to placing an opening order, I might instead create a new trigger on the LogicaCMG stock chart as shown below:

You can see that I have decided to Create a new trigger when [the 1-minute] interval close price drops below 65.

When this trigger “triggers”, I will know that my entry criterion has been met but I will have discretion over the trade without it being placed automatically.

I could create a virtual order book by creating similar triggers in place of the opening orders that I currently have in play on some twenty stocks. The triggers wouldn’t do the trading, but they would tell me when I might want to trade.

A Trigger-Based ‘Price Losers (%)’ List

Whereas my Stop-Out List (and now my opening orders or replacement triggers) are relevant to re-opening previously held positions, I often use the Yahoo! Finance Price Losers (%) list as a source of new trades. Well, in a sense, there’s a trigger for that too.

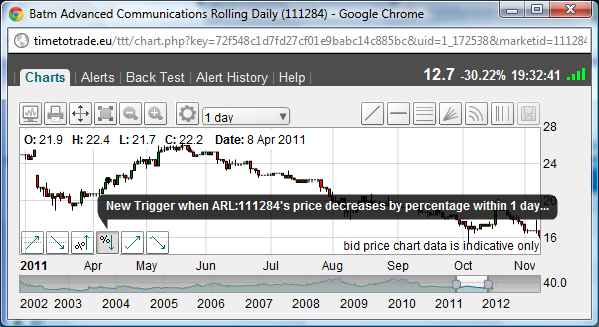

In the following figure you can see how I am about to place a New Trigger when [BATM Advanced Communications] prices decreases by percentage within 1 day…

I wish I had done so a few days ago, to alert me if the price of this stock fell by more than 30% within a day, because yesterday (12 December) that’s exactly what did happen!

The logical conclusion is that I could place such triggers on all of the FTSE 100 (for example) stocks to alert me if any of them fall by more than a predetermined amount — let’s say 10% — within a day. It would have helped me spot the price plunges on Michael Page, Thomas Cook, and many more.

Incidentally, I should tell you that the Price % Fall trigger has defaulted to “within a day” in my example above because the chart interval is set at “1 day”. If I changed the chart interval to “10 minutes” you would see that the trigger help text reads “..decreases by percentage with 10 minutes”.

The Other Trigger

In the row of trigger icons shown in my figures, you can see that they are arranged into three pairs:

- Price Rises Above and Price Rises Below (demonstrated in my first example)

- Price Increases By Percentage and Price Decreases By Percentage (demonstrated in my second example)

- Price Increases By Value and Price Decreases By Value

I have not provided an example of the final pair because — to be frank — I can’t think of a scenario in which it would be useful to me to be alerted when a price rises or falls by a number of points (rather than rising or falling to a specific price level or by a certain percentage). Some of you, particularly day traders, might have a scenario for this and I invite you to share it with the community by leaving a comment below.

Will it Trigger a Change of Trading Tools?

I’ve been aware for some time of these kinds of “trigger” or “alert” facilities on the Capital Spreads and other spread betting and stockbroking platforms, but I’ve kinda settled into a routine of using the opportunity-identification tools I’m currently using. Will my rediscovery of triggers trigger a change of trading tools for me? I don’t know, but I’ll keep you posted.

Tony Loton is a private trader, and author of the book “Position Trading” (Second Edition) published by LOTONtech.