Financial Trading Patterns #7: TRAILING STOP BUY

Nov 30, 2011 at 5:10 pm in Orders by

In this article I describe a financial trading pattern that is motivated by a failure scenario of the STOP BUY, STOP SELL pattern.

NAME

TRAILING STOP BUY

DEFINITIONS

A TRAILING STOP BUY order is an order to BUY a security when the price rises by a specified amount above the prevailing market price. A TRAILING STOP BUY tracks a falling price.

PARAMETERS

STOP BUY Trigger Distance.

OBJECTIVE

The objective is to buy at a low price at the onset of an uptrend.

MOTIVATION

One of the failure scenarios for the STOP BUY, STOP SELL pattern was as follows:

When we set a STOP BUY above the current price, the price might fall significantly, not triggering our order. If the price subsequently rises all the way back up to our STOP BUY level, we buy-in having missed the additional profit potential of the fall-and-rise. In other words: although we have bought at the onset of an uptrend, we have bought at a higher price than necessary.

SUCCESS SCENARIO

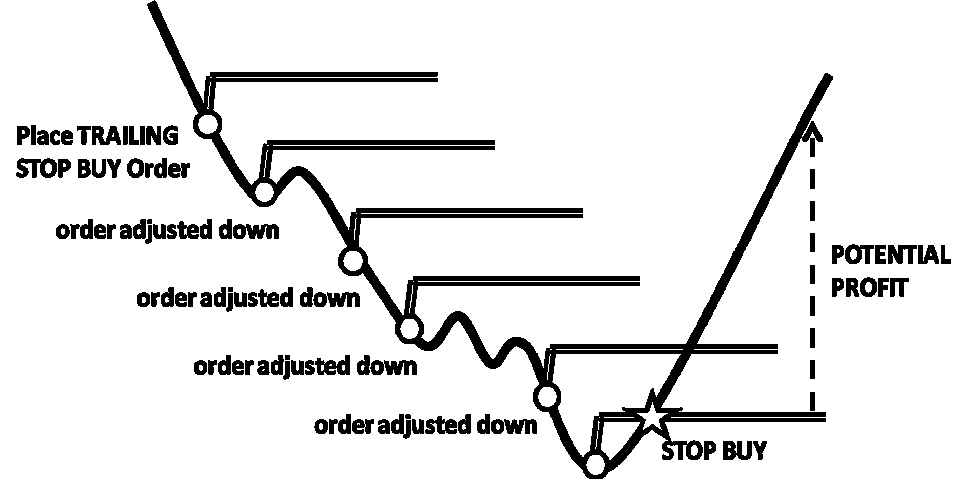

The following figure shows the success scenario in which the TRAILING STOP BUY helps us to buy on an uptrend, at a low price.

With the price trending down, we place a TRAILING STOP BUY order with a trigger price above the current price. As the price falls, the TRAILING STOP is adjusted downwards at the same rate. At some point the trend reverses sufficiently to trigger the STOP BUY order.

The advantage of this pattern is that we don’t need to guess when we might be at the end of a downtrend and the beginning of an uptrend. The TRAILING STOP order tracks the price down until the trend reverses from its lowest point.

FAILURE SCENARIO(s)

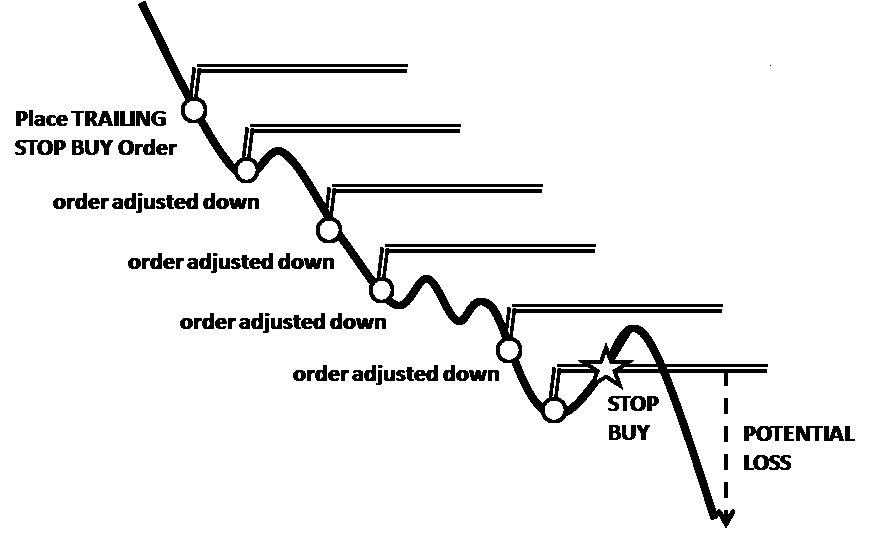

The following figure shows the most obvious failure scenario, in which the price falls dramatically soon after our TRAILING STOP BUY has executed.

Although we stand to make a loss in this scenario, at least we bought-in at what we consider to be a low price. Another failure scenario is the one in which our STOP BUY order executes at the original trigger price soon after we place it, without having fallen first, and then the price falls dramatically.

APPLICATION

Some stockbrokers and spread betting companies provide a dedicated trailing stop facility that fully automates this trading pattern. In this case you would specify an amount by which you want the price to rise before the order executes.

If your provider does not offer trailing stops, you can still trail the stops yourself by adjusting the trigger price of your non-trailing STOP order periodically, in line with the falling stock price. Some traders will prefer trailing their stop orders manually because this allows them to consider other factors such as technical support and resistance levels.

A real-life example of a TRAILING STOP BUY was demonstrated in this article.

This article has been devised and adapted from original text and pictures included in the book “Financial Trading Patterns” by Tony Loton (with permission).