Financial Trading Patterns #9: TRAILING STOP BUY, TRAILING STOP SELL

Dec 1, 2011 at 5:18 pm in Orders by

This article completes my compendium of Financial Trading Patterns that utilise the various stockbroker (and spread betting provider) order types in various combinations to achieve specific trading objectives. This pattern combines the TRAILING STOP BUY and TRAILING STOP SELL patterns into the TRAILING STOP BUY, TRAILING STOP SELL pattern.

NAME

TRAILING STOP BUY, TRAILING STOP SELL

DEFINITIONS

A TRAILING STOP BUY order is an order to BUY a security when the price rises by a specified amount above the market price. A TRAILING STOP BUY tracks a falling price.

A TRAILING STOP SELL order is an order to SELL a security when the price falls by a specified amount below the prevailing market price. A TRAILING STOP SELL tracks a rising price.

PARAMETERS

STOP BUY Trigger Distance.

STOP SELL Trigger Distance.

OBJECTIVE

The objective is to buy at the onset of an uptrend at a low price; sell at the onset of a downtrend at a high price.

MOTIVATION

In effect this pattern combines two motivations, which are:

- to buy low, sell high

- to buy or sell in line with the trend

Thus we have an opportunity to realize maximum profit potential in rising and falling markets.

SUCCESS SCENARIO(s)

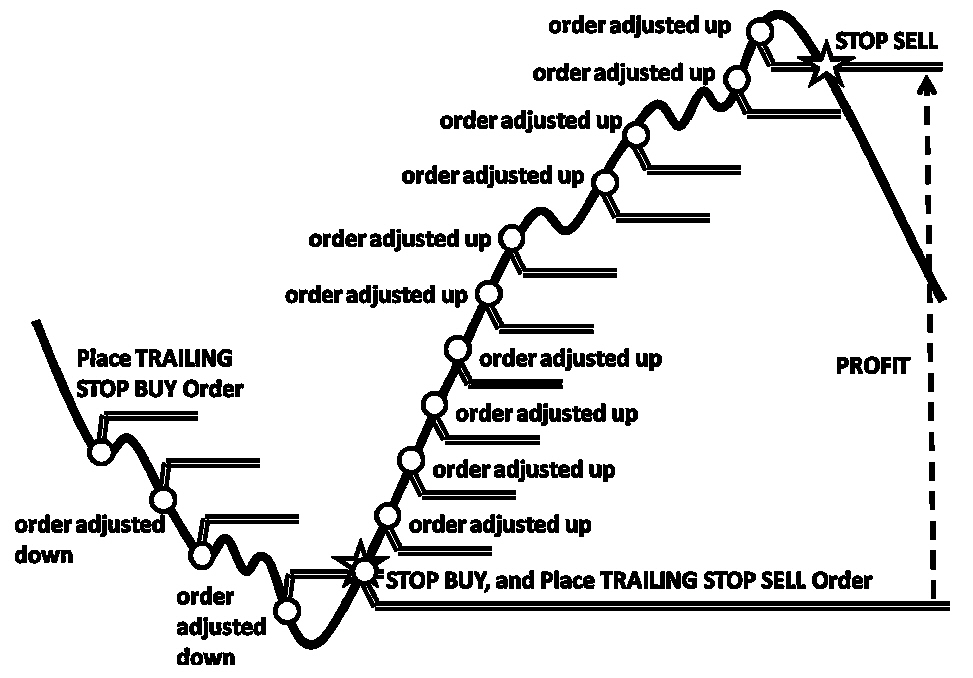

The following figure shows the success scenario in which the TRAILING STOP BUY helps us to buy at the onset of an uptrend, at a low price; and the TRAILING STOP SELL helps us to sell at the onset of a downtrend, at a high price.

FAILURE SCENARIO(s)

The failure scenarios for this pattern occur when the price trend reverses soon after one or other of the orders executes. For example; if the price falls soon after the TRAILING STOP BUY executes, or the price rises soon after the TRAILING STOP SELL executes.

APPLICATION

Ideally you would implement this pattern using your stockbroker’s TRAILING STOP BUY and TRAILING STOP SELL order types. For the TRAILING STOP BUY, you would specify an amount by which you want the price to rise before the order executes. For the TRAILING STOP SELL, you would specify an amount by which you want the price to fall before the order executes.

If your stockbroker or spread betting provider does not offer trailing stops, you can still trail the stops yourself by adjusting the trigger prices of your stop orders periodically, in line with the rising or falling stock price.

The key to success with this pattern is getting the trailing stop distances right. Too close and you will stop out repeatedly and prematurely for no good reason. Too far and you will capture a sub-optimal profit.

Coming next…

Having documented a set of financial trading patterns stylistically, in the next articles I will demonstrate their efficacy (or otherwise) using charts of real market conditions.

This article has been devised and adapted from original text and pictures included in the book “Financial Trading Patterns” by Tony Loton (with permission).