The Two Phases of Position Trading

Jan 5, 2012 at 1:08 pm in Position Trading by

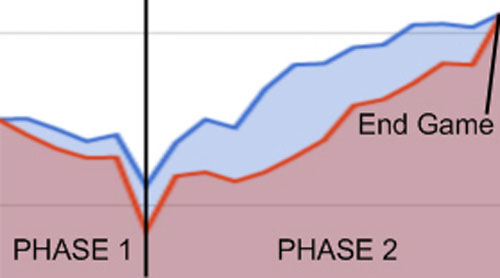

Day trading is all about notching up a series of small profits every day. Position trading, at least in the way that I practice it, consists of two distinct phases:

PHASE 1 is (usually) a losing phase during which a portfolio of longer-term positions is being established.

PHASE 2 is (hopefully) a winning phase during which positions are simply held while their prices are increasing.

The two phases are illustrated in the following real-life equity curve for an account that I ran in Q1 2010. The blue line represents the overall account value and the red line represents the available trading funds at any given time.

At the start the overall value and available trading funds were exactly the same, because the account was entirely in cash. At the end the overall value and available trading funds were exactly the same, because the account was once again entirely in cash.

Let’s look at the two phases in a little more detail.

PHASE 1: Getting Into Position

Phase 1 is characterised by “getting into position”, which for me entails trying to catch a number of stocks at (or near) their lowest points. Money is lost in this phase for two reasons:

1) Every time you buy a stock it becomes immediately less valuable because of the difference between the buying and selling (bid and ask) prices. To sell back a stock that you only just bought, you would usually have to accept a lower price than the price you paid.

2) By definition, in my approach at least, the stocks have been falling in price, so they will likely fall some more. Even trying to “notionally” miss some of the losses — as described in my article Long Trader makes Money From Falling Prices — isn’t sufficient to mitigate the falls entirely.

Phase 1 usually coincides with an overall bear market when stocks are cheap and getting cheaper.

PHASE 2: Running the Positions

Phase 2 usually coincides with an overall bull market when stock prices are rising. There is very little to do apart from trailing stop orders (cautiously); and what little trading activity there is brings fewer frictional losses. Prices rise, dividends roll in, and leverage has a very positive effect.

The End Game

I suppose there is one final phase, “The End Game”, but it’s optional. A diversified position trading portfolio would usually be an ongoing project with no defined end point as positions come into and fall out of the portfolio all the time.

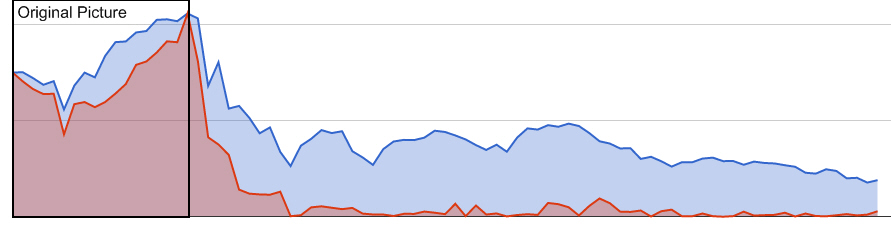

In some cases it might make sense to “cash in” entirely, as I did in this example, and in this case it was a good thing too. Look at what happened subsequently, when I re-invested the cash in a new account (with a different spread betting provider) and resumed trading for “demonstration” purposes:

On the bright side, the account in question is still in operation, it’s rising again (not shown), and this entire chart could turn out to be merely the “losing phase” of a much bigger profitable cycle.

It’s a marathon, not a sprint.

Tony Loton is a private trader, and author of the book “Position Trading” (Second Edition) published by LOTONtech.