Swing Trading: Getting Into the Swing, Part 2

Oct 12, 2011 at 12:06 pm in Swing Trading by

In this article I’ll show you how you can move from being a ‘swinger’ to be ‘trendy’, by switching automatically from swing trading mode to trend following mode.

The Swinger Stops Out

In my previous article I alluded to the fact that a swing trader should always place a protective stop order just below the observed trading range (when establishing the long trade) or just above the observed trading range (when establishing the short trade).

On most spread betting platforms you would do this by attaching the protective stop order to the specific long or short trade, usually via the original trading ticket. Where a protective stop order is not mandatory on newly-opened trades, and even where it is, there is nothing to prevent you from creating a completely separate opposing order to act as a protective stop order. It will serve to close your original trade providing it is placed nearer than any mandatory stop order.

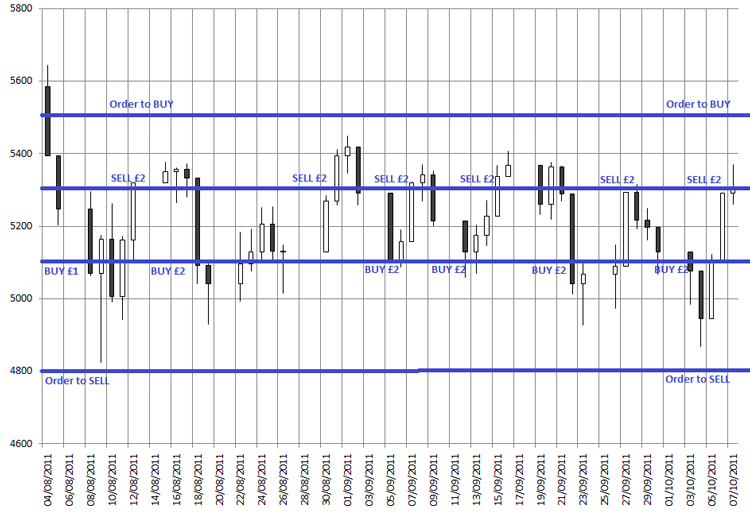

The following picture shows the complete arrangement of trading orders in the ‘swing’ trading pattern. The first SELL at £2-per-point closes the original £1-per-point long bet, banks its profit, and takes us net short at £1-per-point. The subsequent BUY at £2-per-point closes the net short £1-per-point bet, banks its profit, and takes us net long… and so on for as the price moves sideways in a trading range.

This picture also shows how an Order to BUY and an Order to SELL would be placed above and below (respectively) the trading range so as to stop-out the net long or short position if the price breaks out of the trading range.

Important Note: This example illustrates the principle only. In reality, a swing trader might consider these particular stop distances to be too wide relative to the profits on offer within the trading range.

The Swinger Gets Trendy

In the foregoing example, a Stop Order to BUY at £1-per-point just above the trading range would close the last-in-play £1-per-point short trade, thereby taking you out of harms way but leaving you out of position for the newly-established (we assume) up-trend. Similarly,a Stop Order to BUY at £1-per point just below the trading range would also take you out of harms way but leave you out-of-position for the ensuing down-trend.

A variation would therefore be to place protective orders at £2-per-point that would take you net long or short by £1-per-point when the price broke into an new up-trend or downtrend.

On the face of it, this combination of trading orders allows the trader to get the best of both worlds — to ride the swings, and then jump on to the trend — and this “best of both worlds” idea is one that I’ll return to in the next article. But first a warning for you to…

Beware the Whipsaw!

Alternating between long and short trades within the trading range, and then when the price breaks out, is by no means as easy as it sounds. The edges of the trading range tend to be soft rather than hard, which can lead to your trades changing direction unnecessarily and often. You can lose a little money each time, and find yourself heading slowly but surely towards the poor house.

Tony Loton is a private trader, and author of the book “Stop Orders” published by Harriman House.