The Google Finance “Portfolio” Stop-Out List

Dec 15, 2011 at 3:59 pm in Tips and Strategies by

My idea of a Stop-Out List that shows me my last selling price of each stock (so that I never buy back more expensively) has served me well, and my implementation of it as a Google Docs spreadsheet that utilises the GoogleFinance() function worked very nicely until very recently.

Issues with the Implementation

Over the past week I have noticed that the stock name column has been blank, as though the GoogleFinance() function to fetch a stock name for a given stock symbol is no longer working. I’ve also noticed that periodically even the stock prices have not been fetched into the spreadsheet. Add to this the fact that it was always a little limited in not recognising stock symbols outside of the main UK and USA markets, and you will understand that it was due for a makeover.

Google is the Problem and the Solution

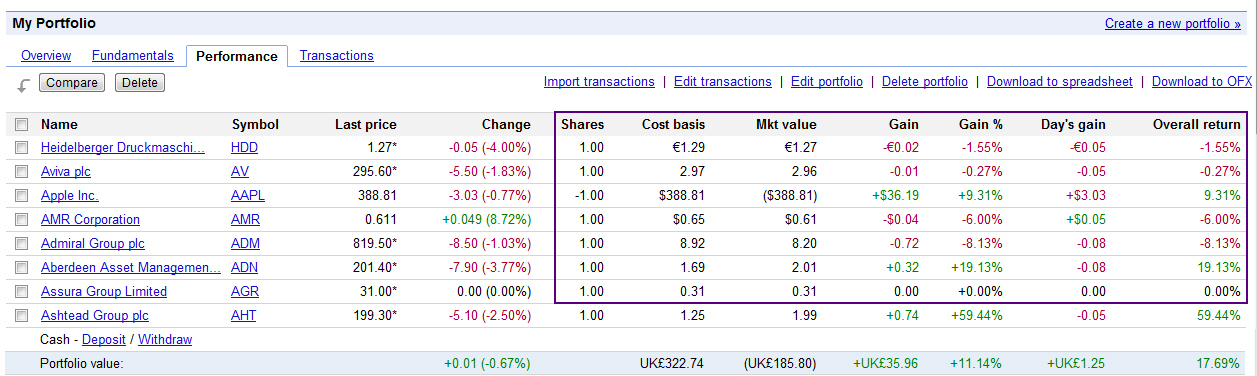

Although Google seems to be the problem, it is to Google that I turn for the solution in the form of the Google Finance “Portfolio” feature. It allows me to build a list of stocks that shows my last dealing price and the percentage change since then, as shown below.

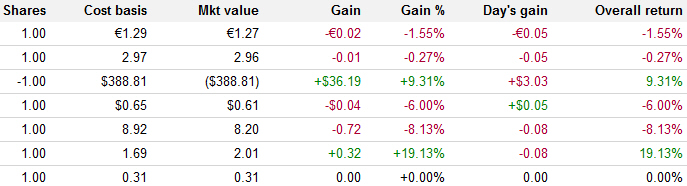

I know it’s hard to read, so here is an expanded section showing the pertinent information:

The Cost basis column shows the price at which I last sold (by stopping out) and the Overall return column shows how far the share price has fallen or risen since then. This is exactly what my Stop-Out List showed, but this is better because:

a) it works!

b) it supports a complete range of international stocks including the National Aluminium company of India.

In the above snapshot the 4th and 5th stocks (which are AMR Cirporation and Admiral Group) may be ripe for re-purchase, but the 6th stock (which is Aberdeen Asset Management) definitely is not!

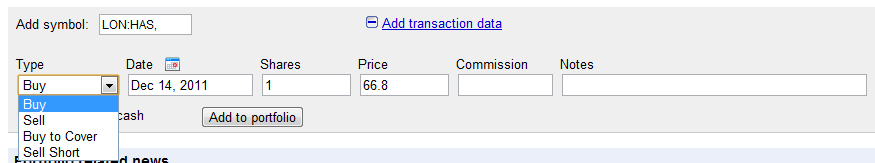

Each time one of my stock-holdings stops out I can record a “transaction” in the portfolio at my stop-out price, as shown below for Hays plc which stopped out at 66.8p. I record it as a “Buy” rather than a sale merely so that subsequent price falls are shown in red in the portfolio.

I would record a stopped-out short position as a “Sell Short” transaction even though stopping out of a short position was enacted by buying long. Think of it like the Type field means that I want to “Buy” again or want to “Sell Short” again, which is exactly how it was in my original spreadsheet implementation.

More of a Watch List than a Portfolio

Although the Google Finance “Portfolio” feature is intended to be used for tracking a live portfolio; it seems pointless to me to replicate the live portfolio-tracking provided by my spread betting company. But as a watch list of positions I might like to re-enter, my anti-Portfolio if you like, it’s perfect.

Do It Yourself

You can get started on setting up your own Google Finance “Portfolio” by clicking the Portfolios link at http://www.google.com/finance

Tony Loton is a private trader, and author of the book “Stop Orders” published by Harriman House.