Trading Trail #36: Never Say Never!

Mar 2, 2012 at 10:10 pm in Trading Diary by

My previous trading trail update attracted the following comment from Andy:

“I’m a little puzzled by your reluctance to buy back a share unless at a lower price. I know most people have a mental block against buying back higher, but surely this is something which needs to be overcome? If the reasons for taking the initial trade are still valid and the price is still a good one, I would just bite the bullet and go back in. You can’t bank a notional profit after all.”

It’s a good comment, which deserves an answer as follows.

My answer is that I find my rule to ”NEVER re-purchase a stock or other financial instrument at a higher price than the price at which I last sold it” to be a useful default rule; but with trading — as with all things in life — I would actually NEVER say NEVER (although I probably have).

Here are two contrasting examples:

- If I bought at 50p and stopped out at 40p thereby netting a loss, then the price rebounded to 55p (so I should have stayed in position all along), would I buy back at the higher price out of fear of ‘missing out’? No! I’d let it go and I’d wait for this one that got away to come back… or not… rather than risk a series of whipsaw losses.

- If I bought at 40p and sold at 50p thereby netting a profit, then the price rose to 100p and fell back by 20% when the overall market was also depressed, would I buy again at 80p — which is higher than my last selling price? Yes, I probably would buy this new dip regardless of my last selling price.

While I think it’s good discipline for newbie traders to concentrate first on minimising losses rather than trying maximise profits, perhaps I should restate my rule as:

NEVER buy back at a higher price than you last sold… unless it’s a good idea!

But it’s still a case of “when in doubt, do nowt” as they say in the north of England.

I hope this helps to clarify, and I welcome other comments like Andy’s.

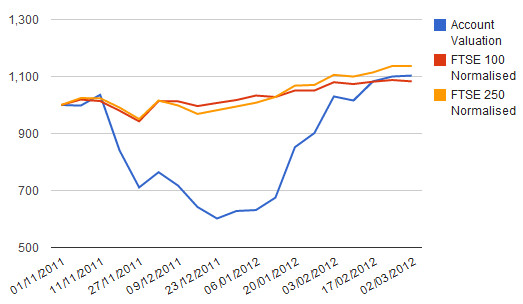

Portfolio Performance Update: The Flat FTSE

Well, the FTSE 100 and FTSE 250 indices have ended this week pretty flat and so has my trading trail portfolio value as shown below.

I’ve been doing very little (if any) buying recently, because buying sprees usually lose me money in the short term and I don’t want to see the portfolio value fall again without me having a very good reason to back up the truck for more positions. So I’ve simply been letting my existing positions run while ratcheting up my stop orders where possible.

I currently have positions in 49 different equities, from Allied Irish Bank all the way through the alphabet to Yell, and that’s enough for me for the moment.

Tony Loton is private trader, and author of the book “Position Trading” (Second Edition) published by LOTONtech.