Trading Trail #34: On Par with the FTSE 100

Feb 17, 2012 at 3:11 pm in Trading Diary by

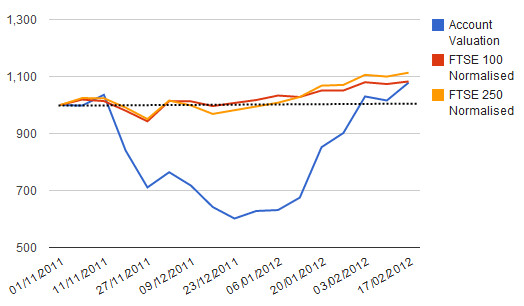

I thought I’d use this week’s short “Trading Trail” update to mark the point at which my reference position trading account got back to par with the performance of the FTSE 100 index as demonstrated in the equity curve below. This momentous event occurred at about midday today (17 Feb) when the account value reached the dizzying heights of £1078.66. It’s may not (yet) the vast riches that you were hoping for, but give it time, and in the meantime it’s a positive result that shows how you don’t have to lose your shirt when spread betting.

Digging a Little Deeper

Depending how you look at it, this account has either:

- grown by 8% in the 3.5 months since it started, which many “investors” would be happy with;

- or grown by a whopping 80% in the 8 weeks since its low point, which I hope continues.

(conveniently, I’ll ignore the fact that it drew down by 40% along the way)

It occurred to me that I’m not exactly comparing like with like in my ongoing chart, because the FTSE 100 and FTSE 250 lines do not include the effect of dividends whereas my account equity curve does. Thus far it’s not been a major problem, because the dividends into my account have been few and far between.

Since I scaled back on my trading trail updates, I’ve not been telling you too much about the trades and positions in the account, but I can tell you that the techniques used in this account are the ones that I described in my article on The Seven Pillars of Position Trading.

Tony Loton is a private trader, and author of the book “Position Trading” (Second Edition) published by LOTONtech.