Trading Trail #1: Penny Share Punts

Nov 1, 2011 at 7:20 pm in Trading Diary by

Don’t forget the DISCLAIMER

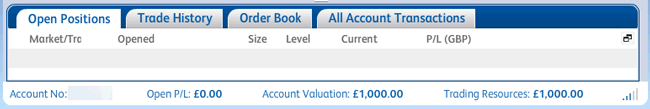

As promised, today I reset my Capital Spreads spread betting account to have zero open trades and £1000 of available cash, as evidenced here:

I then proceeded to make the first few trades in this virgin account, these first few being a series of penny share punts. You will recognise some of these as beaten-down retail stocks that will henceforth either a) rebound to become multi-baggers when they recover to their much higher former prices, or b) go bust. I’m betting on them because I can do so at very little risk — no more than about £10 each — and because I can simply let them sit around in my portfolio until they do something significant. Here they are:

I’ve used my spread betting company’s Order view so that you can see that each new position has a token stop order at 0.1 (or 0.01 for Allied Irish Bank) which means that, in effect, those positions have no stop orders at all. They don’t need stop orders because I’m limiting the risk on each one through prudent position sizing of just £1-per-point.

I know I’ll make only £10 profit on each one of these that doubles in price, but I’m betting that eventually they will 10-bag or even 100-bag and that along the way there will be plenty of time to pyramid additional funds into the winners.

These penny share punts are not the only trades I made today. I also opened long £1-per-point positions in Enterprise Inns (at 27.8p), Mothercare (at 162.3p), Wolfson Microelectronics (at 104.9p), Home Retail Group (at 96.1), and Man Group (at 136.1) with the tight stop orders you can see in the snapshot below:

If the prices of these stocks fall below my entry prices, I’d like these positions to stop out quickly for a small loss of less than £10 in each case.

You should have figured out by now that I am willing to risk no more than about £10 on each trade in both sets of trades, which I will aim to do through some combination of stop distance and position size. Why a limit of £10 risk per trade? Because it’s 1% of my original trading budget of £1000.

This conservative money management regime might not make me rich anytime soon, but then again it might, and you’ll be surprised when it does. In the meantime it will at least keep me in the game long enough for this trading diary to last more than a week!

Now, having told you earlier my rationale for taking the original penny share punts — massive upside potential with negligible downside risk — you might be wondering about my rationale for placing the five additional trades. To find out why, you’ll have to stay tuned.

Tony Loton is a private trader, and author of the book “Stop Orders” published by Harriman House.