Trading Trail #19: The Continuing Story of Thomas Cook

Nov 29, 2011 at 5:14 pm in Trading Diary by

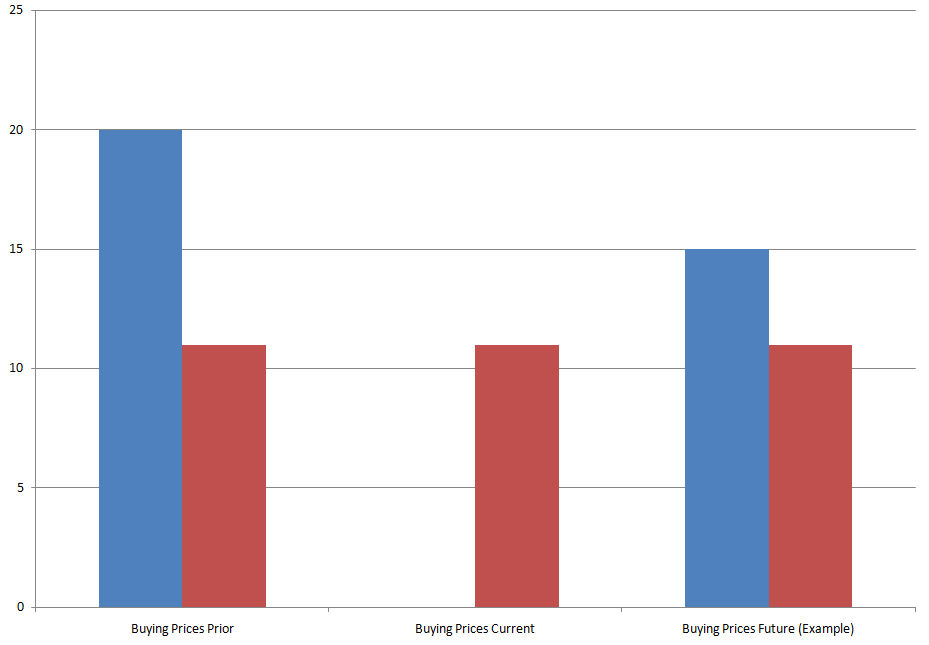

If you recall I had established a position in Thomas Cook at a gapped-down price of 20p and had then “averaged down” by establishing a second position at an even lower price 11p.

Yesterday I managed to raise the stop orders on my Thomas Cook position to break even, i.e. the first position’s stop order at 20p and the second position’s stop order at 11p. Thus these positions were rendered no longer risky.

During the day (yesterday) the higher-priced position stopped out at 20p for no overall gain or loss, but the lower-priced position that I established at 11p is currently still in play. The end result is as though I didn’t catch this falling knife originally at 20p at all, but caught it just once at 11p. I could even use the risk capital freed up from the original position to average down again if the price falls back from the 20p level. In a nutshell: I could end up with two positions at 11p and (for example) 15p rather than my original two positions at 11p and 20p.

I have shown this pictorially below; with my prior buying prices to the left, my currently-in-play single position in the middle, and the possible future situation if I get to average down (or is it “average up”?) again more favourably.

While writing today, I’ll also tell you that my Admiral position is now showing a paper profit of more than £100 with £66.70 of it locked-in absolutely thanks to the guaranteed stop order. It means that Admiral will definitely have made me at least £61 profit (minus any future financing charges) since I started dabbling in this stock.

Tony Loton is a private trader, and author of the book “Position Trading” published by LOTONtech.