On the last trading day before the Christmas break, I thought I’d update you on the Trading Trail portfolio. It’s in draw-down, as you know, but I’m not too worried because I think that the upside potential is massively bigger than the downside potential.

If we consider a particular share like Churchill Mining, at a current price of around 10p it’s down some 93% on its 2010 high price of ~145p. Or, to put it another way, if it ever returns to the previous price then it will have to have appreciated by a massive 1400%. I’m not suggesting by any means that it will, but it’s not impossible because investors set a precedent by once thinking that this stock was worth the higher price. The potential downside, of course, is 100% of the current price, so we could be talking about a 14:1 reward / risk ratio.

Before you go out and buy this stock based on my ‘recommendation’ let me remind you that I’m not recommending anything, and you should read the disclaimer.

My original idea was to present you with the reward / risk ratios of all of the portfolio constituents by measuring their all time high prices against the current market prices, and to do this using a Google Finance Portfolio (what else?) as shown below.

Well, I got bored after the C’s because I really don’t want to be constructing a separate portfolio of my live positions when the spread betting company does that for me already. Anyway, for each stock the Overall return column shows potential upside in the case that the previous high prices are ever re-captured. The comparative downsides are all 100%, so Afren plc is pretty much an even bet and I could (but not necessarily will) make a killing on Allied Irish Banks!

So here’s the crux of the matter:

I don’t know if I will ultimately make money in this account; but if I do then it could be a lot of money. In terms of upside risk, the probability (of success) may be low but the impact could be very high. In terms of downside risk, the probability (of failure) may be rather higher, but the adverse impact is fixed at my £1,000 starting fund.

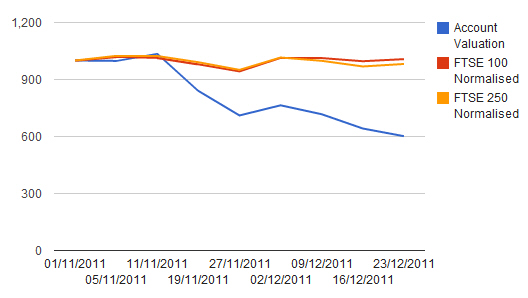

What I’m really doing here is preparing you for the latest equity curve, which looks like this:

Now I need a sustained up-trend that will reduce the frictional costs of stopping out… because I won’t stop-out so much. Even though I stand to gain ‘notionally’ each time I stop out and wait for a further fall, those notional gains (i.e. avoided losses) won’t be reflected in the account balance until my stock holdings embark on a convincing bull run.

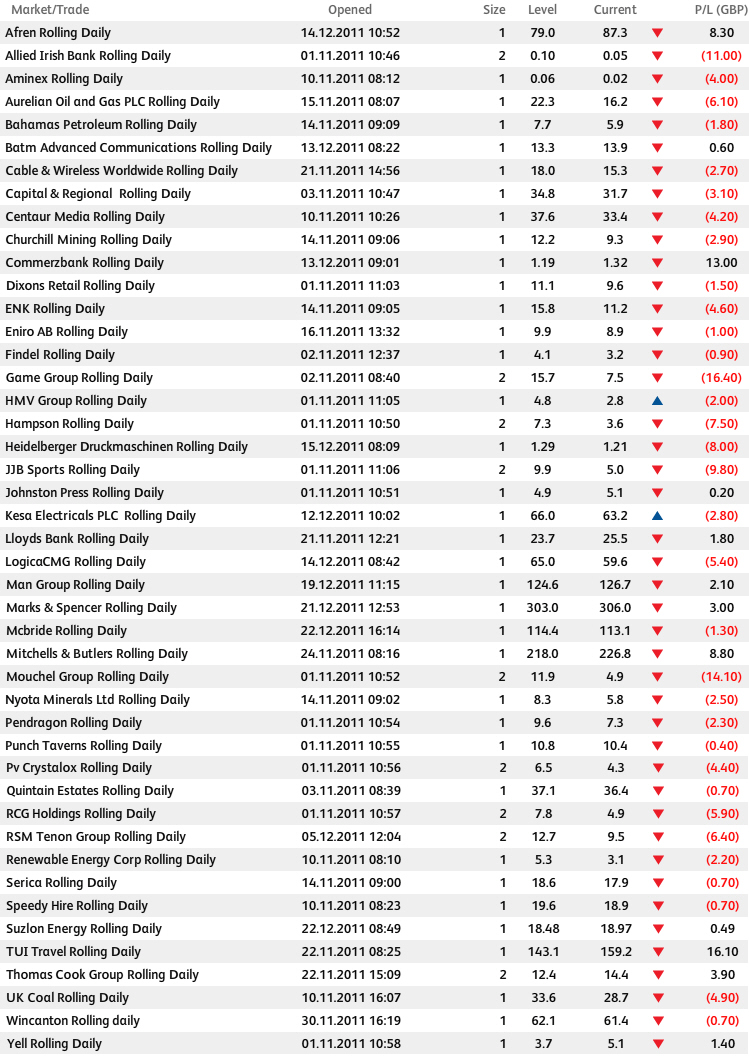

At close-of-play on the last trading day before Christmas, those rolling spread bet stock holdings are:

Best wishes for the festive season — if it’s something you celebrate, that is.

Tony Loton is a private trader, and author of the book “Position Trading” (Second Edition) published by LOTONtech.

Tags: trading commentary

by

Trading Trail #26: Upside / Downside

Dec 23, 2011 at 7:14 pm in Trading Diary by

On the last trading day before the Christmas break, I thought I’d update you on the Trading Trail portfolio. It’s in draw-down, as you know, but I’m not too worried because I think that the upside potential is massively bigger than the downside potential.

If we consider a particular share like Churchill Mining, at a current price of around 10p it’s down some 93% on its 2010 high price of ~145p. Or, to put it another way, if it ever returns to the previous price then it will have to have appreciated by a massive 1400%. I’m not suggesting by any means that it will, but it’s not impossible because investors set a precedent by once thinking that this stock was worth the higher price. The potential downside, of course, is 100% of the current price, so we could be talking about a 14:1 reward / risk ratio.

Before you go out and buy this stock based on my ‘recommendation’ let me remind you that I’m not recommending anything, and you should read the disclaimer.

My original idea was to present you with the reward / risk ratios of all of the portfolio constituents by measuring their all time high prices against the current market prices, and to do this using a Google Finance Portfolio (what else?) as shown below.

Well, I got bored after the C’s because I really don’t want to be constructing a separate portfolio of my live positions when the spread betting company does that for me already. Anyway, for each stock the Overall return column shows potential upside in the case that the previous high prices are ever re-captured. The comparative downsides are all 100%, so Afren plc is pretty much an even bet and I could (but not necessarily will) make a killing on Allied Irish Banks!

So here’s the crux of the matter:

I don’t know if I will ultimately make money in this account; but if I do then it could be a lot of money. In terms of upside risk, the probability (of success) may be low but the impact could be very high. In terms of downside risk, the probability (of failure) may be rather higher, but the adverse impact is fixed at my £1,000 starting fund.

What I’m really doing here is preparing you for the latest equity curve, which looks like this:

Now I need a sustained up-trend that will reduce the frictional costs of stopping out… because I won’t stop-out so much. Even though I stand to gain ‘notionally’ each time I stop out and wait for a further fall, those notional gains (i.e. avoided losses) won’t be reflected in the account balance until my stock holdings embark on a convincing bull run.

At close-of-play on the last trading day before Christmas, those rolling spread bet stock holdings are:

Best wishes for the festive season — if it’s something you celebrate, that is.

Tony Loton is a private trader, and author of the book “Position Trading” (Second Edition) published by LOTONtech.

Tags: trading commentary