Trading Trail #11: The Most Profitable Positions

Nov 12, 2011 at 2:42 pm in Trading Diary by

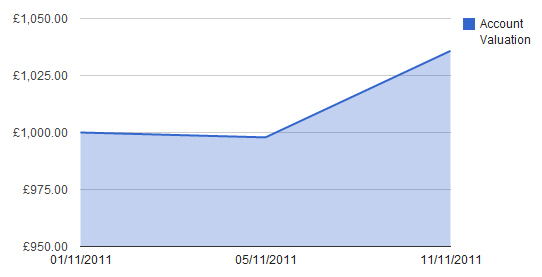

I’d like to update you on the portfolio value which is now back into positive territory having dipped as low as £900 during the week. In fact the total value is now £1035, which I can help you to visualise thanks to the following handy chart.

Yes, my tongue is firmly in my cheek, as this is not much of an equity curve yet. And I’m well aware that these are only ‘paper’ profits.

Yesterday I managed to trail the guaranteed stop order on my Admiral position from 761p to 798.6p, which means that I am now guaranteed to almost break even on my latest Admiral position. It’s lucky I trailed this stop order during the day, because Capital Spreads — like most if not all spread betting companies — doesn’t allow you to alter a ‘guaranteed’ stop order when a market is closed. What a pity, as I could have nudged it up to 800p after hours.

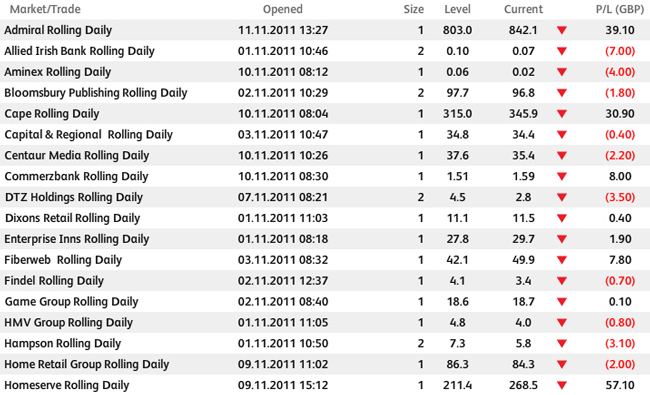

In the partial portfolio snapshot shown below, you can see that Admiral is now one of my most profitable positions alongside Cape and Homeserve.

It would have been tempting to bank the combined £127 profit from my most profitable positions, but these are not the profits I’m looking for. My aim is to run these profits for as long as possible, locking in as much of the cash as possible using my manually-trailed stop orders along the way, until the tide turns and these positions get stopped out.

Here are a few more thoughts on my most profitable positions:

Admiral

Admiral has so far cost me £21.06 in stop-outs and rolling charges. On paper it is now in profit by £39.10, so I could quit while I’m ahead. But like I said, this is not the profit I’m looking for.

Cape

Cape is nicely in profit and has cost me just a few pence in rolling charges. While my stop order at 325 has locked in £10 worth of profit, I can’t guarantee a stop order any closer than 242.1. It’s a problem if the price gaps.

Homeserve

This stock has so far cost me £15.74 in stop-outs and rolling charges. It’s now showing a healthy profit with £32 of that profit locked in… guaranteed! If I had a double position I’d be tempted to take some profit, but I don’t so I won’t.

Prognosis

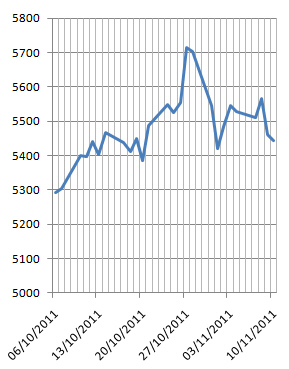

No, this is not the name of another stock. I’m prognosticating on the future direction of the markets. While personally I haven’t a clue what the markets will do except “fluctuate”, those of you who believe in chart pattern spotting might be thinking that the FTSE 100 index has just sketched out a kind of head-and-shoulders pattern (shown below) which is surely not a good thing!

Tony Loton is a private trader, and author of the book “Position Trading” (Second Edition) published by LOTONtech.