Accounting for Spread Bettors

Mar 26, 2012 at 2:00 pm in General Trading by

If I asked the question ‘Are you in the spread betting business?’ I wouldn’t be asking you if you work in the spread betting industry as an employee or owner of one of the spread betting companies. I’d be asking you whether you approach spread betting as you would approach a traditional business, rather than treating it as a mere hobby. A ‘business’ is generally (or at least it should be) run with the aim of increasing your wealth by making a profit, whereas a hobby is something that you do for fun at a cost to you.

Incidentally, some of the most satisfying businesses are the ones where the business owners have turned a hobby that they love doing — and would do anyway, even at a loss — into a money making venture. If you can make your hobby your business, that’s great, but remember that a ‘business’ must make a profit.

Business as a ‘Retail’ Client

Before I continue, I should point out that I’m not talking here about setting yourself up in any formal capacity as a financial trading business. Most of us spread bettors will be classed as ‘retail’ clients of the spread betting companies, thereby benefitting from the consumer protections and tax advantages afforded to us by that status. And most of us will be using spread betting to supplement another main source of income rather than living entirely off the proceeds of our multi-million-pound trades (you wish). But it doesn’t mean we can’t give our spread betting the respect that we would give a traditional profit-making business, nor adopt some of the same accounting disciplines including the concepts of a ‘balance sheet’ and ‘profit-loss statement’.

The Spread Betting Balance Sheet

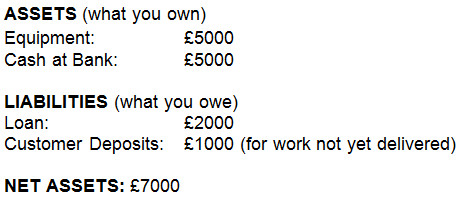

Every business has a balance sheet that shows the current standing of the business in terms of what is owned (in physical assets, cash at the bank, and / or retained profit from previous years) and what is owed (to lenders, suppliers or customers who have paid up-front for products or services not yet delivered).

A typical company balance sheet, abbreviated, might look something like this:

The positive net assets figure shows that overall the company is ‘worth something’.

Although it is not an exact analogy, your spread bet portfolio snapshot shows your assets (profitable positions and cash) and liabilities (losing positions) along with your overall account net asset value (account valuation) that results from offsetting the liabilities against the assets plus cash balance.

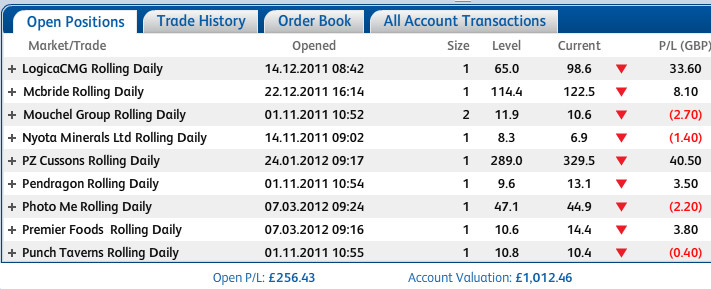

Here is a partial snapshot of my open positions — or what I might refer to as the spread betting balance sheet — for my Trading Trail reference portfolio:

It’s just a pity that in this view I can’t sort it so that all of my profitable ‘asset’ positions are listed above my loss-making ‘liability’ positions as they would be in a business balance sheet. But anyway, the final Account Valuation figure tells me what my spread betting business is currently ‘worth’ if I decided to cash-in.

The Spread Betting Profit-Loss Statement

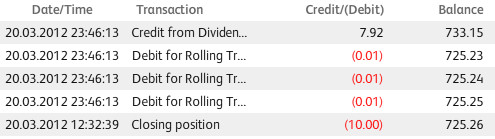

Just as every business has a balance sheet, so every business also has a profit-loss statement that shows money flowing into and out of the business as income and expenditure. This is more intuitive than an balance sheet, so I won’t show you an equivalent one for a ‘real’ business, but here is a partial snapshot of the income (from dividends) and expenditure (on rolling charges and crystallized losing trade) flowing into and out of the same spread betting account:

As with a traditional business, the transactions detailed on the profit-loss statement affect the cash (at bank) value of the balance sheet, but they have no effect on the current valuations of the assets and liabilities that are owned or owed.

The Bottom Line

The bottom line is that you spread bet portfolio snapshot shows the net worth of your spread betting business based on the current valuations of your assets and liabilities; rather like how a balance sheet does for a real business. Over time you want your net asset value (or Account Valuation) to increase — as an indication that your spread betting really is a profit-making “business” rather than a loss-making hobby.

Although the net worth of your spread betting ‘business’ may increase (or decrease) purely as a result of the changing market valuations of your assets and liabilities, you should not neglect the importance of running a business that has a positive cash flow as a result of more money flowing into the business than is flowing out. If you take more in dividends than you give in rolling charges, and if your closing trades are ‘net profitable’, then you will have a positive cash flow.

A healthy balance sheet and a positive cash flows makes a good spread betting business; more than just a hobby.

Final Thoughts on ‘The Perfect Business’

For the record: I’m not an accountant, and never have been, but I feel that I know just about enough to draw this analogy between a set of company financial accounts (the combined balance sheet and profit-loss statement) and the information provided by your spread betting company.

By regarding the spread betting portfolio snapshot and transaction report as a form of business accounts, you are taking the first step towards running your spread betting operation (however small) at least notionally as a business rather than a hobby. Thinking about spread betting in business terms reminds me that I have of often heard people describe financial trading as ‘the perfect business’.

It’s the perfect business because you can run it from pretty much anywhere via the Internet, you need no physical stock or expensive equipment, and — perhaps best of all — you don’t need to deal with any pesky customers!

Tony Loton is a private trader, and author of the book “Position Trading” (Second Edition) published by LOTONtech.