Another bad day for Afren

Oct 30, 2014 at 2:15 pm in General Trading by contrarianuk

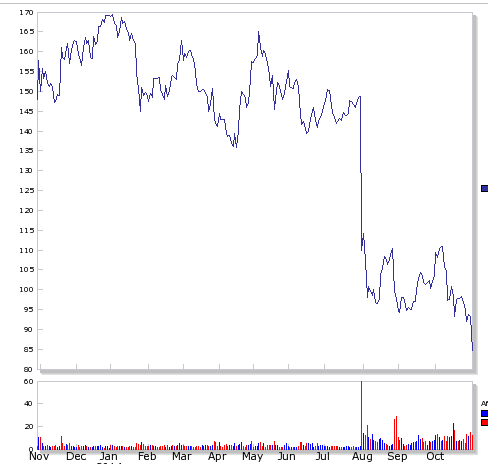

After sliding more than a third in July after it was revealed that Nigeria focused Afren’s CEO and COO were being suspended for receiving improper payments, today proved to be yet another bad day for the company as it issued its interim management statement. The shares are currently down around 9% to 85p compared with the 145p level in July this year.

Production was lower than expected and Afren also announced that it may need to restate accounts for 2012 and 2013 following the unauthorised payments to the CEO and other directors. The company appointed KPMG LLP to review transactions with the assistance of law firm Willkie Farr & Gallagher (UK) LLP to review the situation and in mid-October announced that Osman Shahenshah and Shahid Ullah, the CEO and COO respectively and two associate directors, Iain Wright and Galib Virani had been dismissed.

In the period to the end of September 2014, the company produced 31,147 barrels of oil per day, missing the full-year production guidance of between 32,000 and 36,000 bopd and compared with 48,305 bopd a year earlier. This was blamed on problems at its key Ebok field in Nigeria due to weather which produces the majority of the company’s oil. The RNS said “At the Ebok field, gross production averaged 27,277 bopd during the period. Adverse weather conditions have delayed the installation of the CFB extension platform and the planned three producers targeting additional reservoirs in the CFB. The installation of the CFB extension platform is now expected to complete in Q4 as soon as the weather conditions permit. Batch drilling from the North Fault Block (NFB) targeting three producers and one water injector in 2014 continues to make good progress with one producer currently on-stream which has tested at rates as high as 5,000 bopd and production from the second well to start imminently. ”

Profit after tax came in at $167 million (Q3 2013: US$129 million) reflecting the tax exemption at Ebok offsetting reduction in pre-tax profit and revenue.

With the company expecting first oil from new from the Okoro Further Field Development, Aje and Okwok in 2015 and the drilling campaign underway on OML 26 and the appointment of a new management team likely in the near future, Afren looks pretty cheap at these levels with nearly $2 billion of assets on its balance sheet. Investors were hoping for better short term news in today’s management statement and it wasn’t to be after the calamity of the illegal payments scandal. With South Atlantic Petroleum (SAPetro), led by former Nigerian defence minister General Theophilus Danjuma building a 7% stake earlier in the month, his investing timing seems a little ill judged but at these bombed out levels he may be coming back for more. One to keep an eye on for sure.

Contrarian Investor UK

IMPORTANT: The posts I make are in no way meant as investment suggestions or recommendations to any visitors to the site. They are simply my views, personal reflections and analysis on the markets. Anyone who wishes to spread bet or buy stocks should rely on their own due diligence and common sense before placing any spread trade.