China growth worries continue to hurt commodities

Sep 23, 2014 at 7:55 am in General Trading by contrarianuk

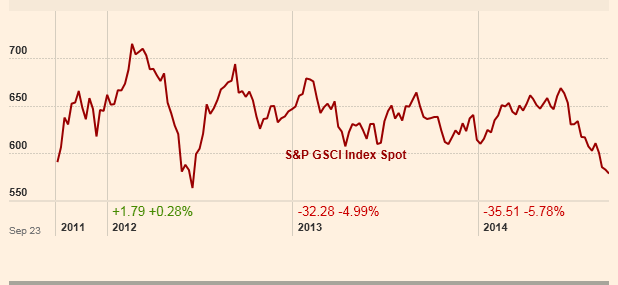

The Bloomberg Commodity index which tracks twenty key global commodities and the related Goldman Sachs Commodity index (GSCI) are both looking pretty poorly right now, with the former down at 5 year lows as worries about Chinese growth continue to way on investors minds.

Manufacturing data from China last week showed factory output had grown at its slowest pace in nearly six years in August and the price of iron ore (which China is the world’s largest consumer accounting for 2/3 of sea borne off take) fell to its lowest level since 2009 after falling below $80 a tonne. Whereas the country’s focus has been on infrastructure and construction since the economic crisis of 2008/2009, the government is trying to move the economy towards a more consumption based model rather than relying on expensive railways, housing projects and roads. Huge expansion in the supply of iron ore from Western Australia have combined with weak consumption from Chinese steel producers to cause sharp falls in the price of the commodity. Sentiment wasn’t helped yesterday when the Chinese Finance Minister appeared to play down the prospect of further stimulus in the face of recent weak economic data which caused mining shares in London to drop between 3 and 5% e.g. Rio Tinto which relies on iron ore dropped 4%. As far as the Chinese government is concerned the country’s 7.5% growth target for this year is achievable without more grandiose projects.

Agricultural commodities have also been particularly weak with a strong crop from the United States hampering grain prices. Wheat has dropped 16%, Corn 22% and Soyabean prices have fallen more than 30% since the end of June.

A strong US dollar has generally driven down commodity prices with oil and gold drifting down as the green back strengthens. Since the price of commodities is in US dollars, the higher the dollar goes the price of these assets goes the other way. Gold is now broadly flat for the year at $1,218 after having finished 2013 at $1,205 after a sharp sell off.

With China looking off its best at the moment, things look pretty uncertain for commodity prices and commodity focused companies such as the global miners. The re-adjustment from the Chinese building binge of recent years may be painful indeed and many of the weaker companies, particularly focused on iron ore, look to be in for a rough time.

Contrarian Investor UK

IMPORTANT: The posts I make are in no way meant as investment suggestions or recommendations to any visitors to the site. They are simply my views, personal reflections and analysis on the markets. Anyone who wishes to spread bet or buy stocks should rely on their own due diligence and common sense before placing any spread trade.