FTSE 100 edges towards all time highs as Vodafone – Verizon deal closes

Feb 22, 2014 at 5:02 pm in General Trading by contrarianuk

Vodafone shares finished on Friday with a 3% gain to 236p, making it a 48% gain for lucky shareholders in this FTSE 100 company over the last 12 months. Verizon Communications revealed that it has completed the acquisition of Vodafone’s 45% indirect interest in Verizon wireless and rumours are swirling that the UK mobile phone group could be the subject of an acquisition.

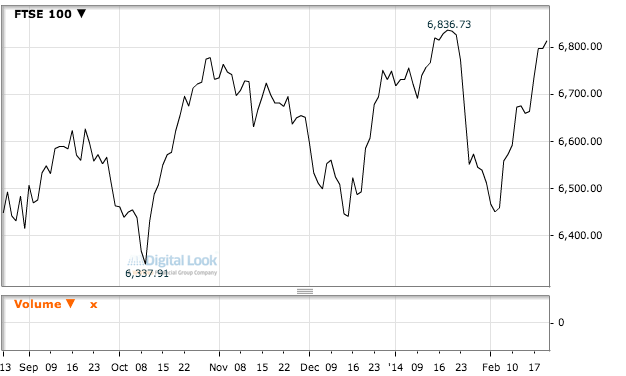

The rise in Vodafone shares helped the FTSE 100 finish at 6838, up 25 points on the day and almost 175 points on the week. That was its highest level since 22 May last year and less than 100 points short of its record close of 6,930 on 30 December 1999.

The deal was originally worth £78 billion, but Vodafone will now pay out £51 billion to shareholders and consolidate its shares on a 6 for 11 basis. This cuts its market value to £65 billion. Vodafone shareholders will get 0.026 Verizon shares for each VOD share plus 30p a share in cash.

With Verizon’s takeover of Verizon Wireless, the third-biggest deal in corporate history, many institutional and private investors will be looking to reinvest in UK stocks.

Some are forecasting that the FTSE 100 could gain as much as 3 percent from the flow of money as shares in Verizon are sold and the cash portion of the deal is distributed meaning that the all time record for the FTSE 100 could finally be broken after a 14 year wait . Many are predicting that the crucial 7,000 level could be breached in late February assuming that the U.S. market behaves itself.

The S&P 500 dropped 3.5 points yesterday to close at 1,836 with a 0.1% for the week, 0.7% below the January 15th record close of 1,848.

FTSE trackers will be able to reinvest the proceeds of the share portion of the deal by next Monday, February 25th. The cash portion will be sent to shareholders in March.

If 7,000 is indeed in the firing line for the FTSE 100 I will be looking to bank some profits around this time. History has shown that this sort of level for the index seems unsustainable and with the January sell off seemingly a distant memory, I will wait patiently for the second correction of 2014 which will inevitably emerge. Still with evidence that many larger resource stocks are bouncing off their lows (and the FTSE 100 over indexes in oil, gas, mining versus other popular global indices) the market may indeed have plenty of strength on this side of the Atlantic over forthcoming sessions.

Contrarian Investor UK

IMPORTANT: The posts I make are in no way meant as investment suggestions or recommendations to any visitors to the site. They are simply my views, personal reflections and analysis on the markets. Anyone who wishes to spread bet or buy stocks should rely on their own due diligence and common sense before placing any spread trade.