Google’s future growth trajectory under scrutiny with signs of deceleration

Apr 20, 2014 at 8:22 am in General Trading by contrarianuk

Google has been at the epicentre of the internet revolution since its IPO in August 2004. Its market value has ballooned in parallel with internet usage, rising from $27.2 billion to a staggering $363 billion today.

Google has been at the epicentre of the internet revolution since its IPO in August 2004. Its market value has ballooned in parallel with internet usage, rising from $27.2 billion to a staggering $363 billion today.

Yet its first quarter results last week underwhelmed the markets, with the company’s shares dropping 3.65% on Friday to close at $543, with a negative performance for 2014 year-to-date having started January at $558.

Like Facebook the transition from desktop computing to mobile has been a challenge for Google, though both companies see the mobile space as their priority in monetising their offers. Mobile websites with their smaller screen area make it harder to complete transactions which means that advertisers are less willing to pay money for advertising. Less bids means a lower cost per click (CPC), so a term like car insurance is more valuable as an ad click on a desktop than say on an iPhone.

Google has been smart in many ways realising before others like Microsoft that mobile and tablet computing would be the future from the days of bulky PC’s sitting in bedrooms around the land. As mobile 3G and now 4G networks have rolled out in many countries searching for information and buying products through your mobile is a reality compared with the dark days of the 1980’s/1990’s when “surfing the web” on a mobile was almost impossible.

Google’s Android operating system now dominates the smartphone market in terms of volume but the open ecosystem hasn’t been a financial block buster. The company’s efforts to play a part in mobile handsets came to nothing after spending $12.5 billion buying Motorola Mobility in 2011 for $12.5 billion and then selling it for $2.9 billion in January 2014 to Chinese electronics maker Lenovo Group minus most of Motorola’s patent portfolio. Though the loss is not quite as bad as it first appears, given Motorola had $3 billion of cash and Google got $2.4 billion for its set top box business in 2013. Still a $7 billion investment in Motorola’s 17,000 patents was clearly an over pay!

The other drawback of mobile versus desktop is that Google has to pay traffic-acquisition costs (TAC) to be the default search engine on popular devices from the likes of Samsung and Apple. In the fourth quarter of 2013, TAC was 7.8% of the revenue Google generated from its own websites, down slightly from the third quarter. TAC was almost 71% of revenue from other websites in Google’s broader network in the three months ended Dec. 31, 2013.

Another watch out for Google shareholders is that many internet users are now using search functionality within apps e.g. Twitter or Facebook.

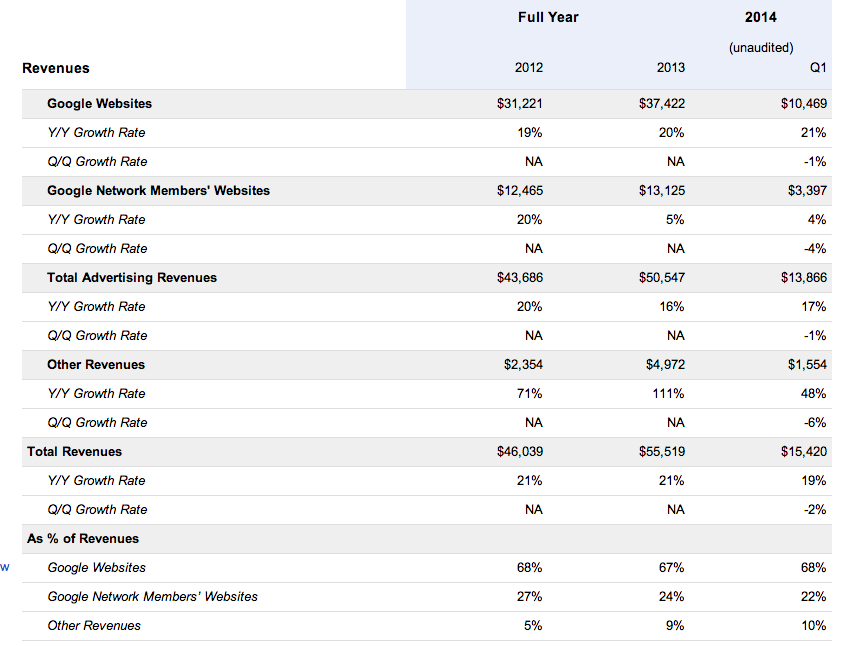

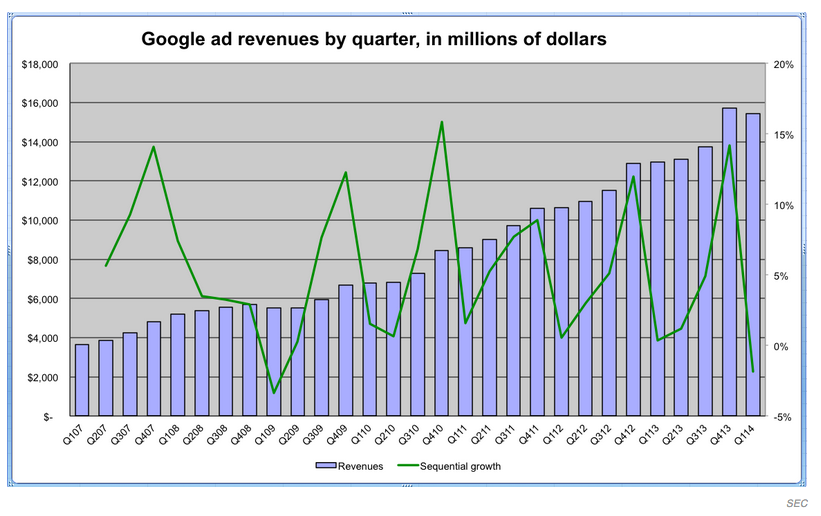

Google reported first quarter earnings results after the closing bell on Thursday with revenues of $15.4 billion and earnings per share of $6.27, against expectations of $15.58 billion and $6.33 a share. In 2013, the company reported earnings per share of $6.19 on revenue of $12.95 billion.

Google’s cost-per-click (CPC), the average price paid by advertisers when users click on an ad, dropped 9% in the 1st quarter, which followed an 11% drop in the fourth quarter of 2013. Paid clicks increased by 26%, against expectations of 29%, a sign highlighted by analysts of potential “deceleration” in earnings growth. During 2013, a new feature of Google’s flagship advertising product, Adwords, called “Enhanced Campaigns” was introduced which meant that serving ads on mobile devices became easier which increased the volume but not necessarily the quality of ads, so more ads but lower CPC.

Operating expenses, other than cost of revenues, were $5.34 billion in the first quarter of 2014, or 35% of revenues, compared to $4.07 billion in the first quarter of 2013, or 31% of revenues. As of March 31, 2014, cash, cash equivalents, and marketable securities were $59.38 billion, compared to $58.72 billion as of December 31, 2013. There are now 49,829 full-time employees (46,170 in Google and 3,659 in Motorola Mobile) as of March 31, 2014, compared to 47,756 full-time employees (43,862 in Google and 3,894 in Motorola Mobile) as of December 31, 2013.

So is Google entering a period of sustained “deceleration” in earnings growth? Possibly, but the year on year growth numbers suggest that there’s plenty more in the tank given a 19% rise in Q1 revenues versus the same period in 2013. But the company needs to keep an eye on operating costs with an increase from 31% to 35% as a percentage of revenue over the past year. Other revenues, distinct from the company’s core ad products, increased to $1.5 billion in the quarter, not too shabby.

The company is facing plenty of challenges ahead though, with the maturing US/UK market which still accounts for the majority of its profits. US/UK revenues per user is over six times higher than in the rest of the world meaning that if the company could deliver stronger growth in Europe and Asia it could overcome the reduction in growth in the markets where it is currently strongest.

Google’s recent acquisitions with the largest being NEST for $3.2 billion in January 2014, shows that there is significant interest in the “internet of things” which is forecast to be a huge revolution in the way we use domestic appliances. The Internet of Things (or IoT) describes the revolution already under way that is seeing a growing number of internet-enabled devices that can network and communicate with each other and with other web-enabled gadgets. NEST has an internet enabled thermostat and smoke alarm, albeit at a premium price.

With net income of $3.4 billion in the first quarter of 2014 and with cash resources of $59 billion Google has plenty of financial firepower to continue its leadership in the internet space. Larry Page and Sergey Brin are wise to move resources into new areas such as IoT given the maturing Adwords and Display Ad products but these investments will take time to mature. Fortunately gigantic acquisitions like Facebook’s WhatsApp buy for $19 billion seem to be off the table for now. Google has been at the cutting edge of the internet for over a decade and despite revenue growth challenges ahead caused by issues such as the transition to mobile devices, the company seems well placed to overcome them but certainly this is no time for complacency given Twitter, Facebook and other social ecosystems are still in the ascendancy. With the shares at $384 in April 2013, they now sit 42% higher despite the tech sell off of the last few weeks. Time for a breather, period of consolidation, I would think despite clear opportunities ahead. The internet is now embedded in our lifestyles and it will continue to be so for the foreseeable future.

Contrarian Investor UK

IMPORTANT: The posts I make are in no way meant as investment suggestions or recommendations to any visitors to the site. They are simply my views, personal reflections and analysis on the markets. Anyone who wishes to spread bet or buy stocks should rely on their own due diligence and common sense before placing any spread trade.