M&A action this morning with Pfizer – AstraZeneca and Premier Oil – Ophir Energy

Apr 28, 2014 at 9:43 am in General Trading by contrarianuk

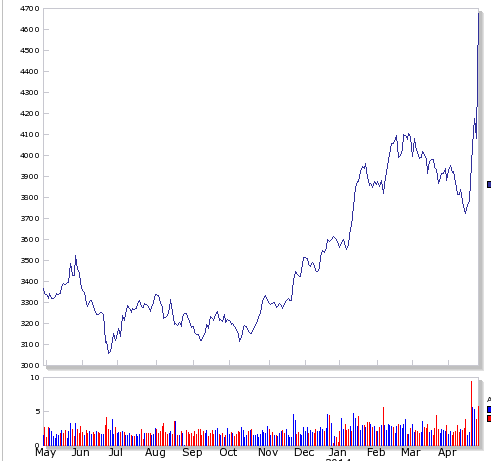

AstraZeneca share price last 12 months

An M&A frenzy going on right now with Pfizer somewhat surprisingly not taking no as an answer with its intention to tie up with AstraZeneca and news over the weekend that Ophir Energy wanted to merge with Premier Oil but was rebuffed. Finally, former Xstrata Chief Executive, Mick Davis, is seeking a loan of up to $8 billion to acquire BHP Billiton’s non-core assets through his new private equity vehicle X2 Resources, according to The Sunday Times.

Astra’s shares are up 15% right now to £47, just over Pfizer’s indicative offer in January on news that Pfizer was still pursuing the British company. A takeover of AstraZeneca would be by far the biggest foreign acquisition of a UK company, substantially larger than Kraft’s £12 billion buy of Cadbury in 2010 and Telefonica of Spain’s £17 billion takeover of O2 in 2005.

Pfizer, the giant American pharmaceutical group with revenues last year of $52 billion, is now appealing directly to shareholders in AstraZeneca and it is not inconceivable that they may sweeten the deal perhaps towards £50 a share. Great news for holders of Astra’s shares, but not so good for income investors who enjoyed the big dividend yield from AstraZeneca and also not for UK PLC which will effectively lose another big pharmaceutical company to a foreign competitor. Britain and the London Stock Exchange will now be left with Glaxo Smithkline and Shire as major drug companies if the deal proceeds with Pfizer.

Having worked for a company acquired by Pfizer in the past, it’s often not a pretty sight and the American firm’s reputation for asset stripping through aggressive cost cutting is not without foundation. R&D and manufacturing efficiencies are created by site closures and given Astra contributes around 3% of the UK’s exports, employees are right to be feeling a little anxious right now. Pfizer said today that “has a track record of realising operational synergies and delivering meaningful value accretion for shareholders in prior transactions of a similar type and scale.”.

Pfizer issued a press release this morning saying

“Pfizer Inc. confirms that it previously submitted a preliminary, non-binding indication of interest to the board of directors of AstraZeneca in January 2014 regarding a possible merger transaction. After limited high-level discussions, AstraZeneca declined to pursue negotiations. The discussions were discontinued on 14 January 2014 and Pfizer then ceased to consider a possible transaction. In light of recent market developments, Pfizer contacted AstraZeneca on 26 April 2014 seeking to renew discussions in order to develop a proposal that could be recommended by both companies to their shareholders. AstraZeneca again declined to engage. Pfizer is currently considering its options with respect to AstraZeneca.

Pfizer’s previous proposal made to the board of AstraZeneca on 5 January 2014 included a combination of cash and shares in the combined entity which represented an indicative value of £46.61 ($76.62)1 per AstraZeneca share and a substantial premium of approximately 30% to AstraZeneca’s closing share price of £35.86 on 3 January 2014.

As in its previous proposal, Pfizer is considering a possible transaction in which AstraZeneca shareholders would receive a significant premium for their AstraZeneca shares, to be paid in a combination of cash and shares in the combined entity. Pfizer believes that a transaction, if proposed and consummated, would offer AstraZeneca shareholders a highly compelling opportunity to realise a significant premium to the undisturbed AstraZeneca share price as of 17 April 2014, which includes a substantial cash payment.”

The transaction, if consummated, is expected to result in the combination of the two companies under a new U.K.-incorporated holding company. As a global corporation, Pfizer would expect the combined company to have management in both the United States and the United Kingdom, and to maintain head offices in New York and list its shares on the New York Stock Exchange.

The possible transaction is expected to be accretive to Pfizer’s adjusted diluted earnings per shars in the first full year following the combination. In addition, Pfizer has a track record of realising operational synergies and delivering meaningful value accretion for shareholders in prior transactions of a similar type and scale. Pfizer believes that synergies would be achieved through the combination of the two companies’ operations and that the combination would enable greater capital efficiency and a more efficient tax structure. In particular, the currently contemplated structure under a new U.K.-incorporated holding company would not subject AstraZeneca’s non-U.S. profits to U.S. tax, which would be in the best interests of the combined company’s shareholders.”

If Pfizer throws another £3-4 share at Astra’s shareholders and given that the Coalition government is unlikely to interfere apart from seeking reassurances about jobs, the deal is likely to be go ahead. Pfizer is said to be keen to put to use some of its £40 billion cash pile obtained from its foreign subsidiaries, which would trigger big tax bills if it was repatriated to the US to be paid in dividends. Lets hope the lessons of the Cadbury acquisition by Kraft have been learnt when it comes to government cooperation. Under takeover rules Pfizer has until 26 May to make a firm offer unless an extension is granted.

Premier Oil is down around 5p today to £3.21 on the announcement from Ophir Energy this morning that it was no longer interested in moving ahead with a merger. Ophir’s RNS this morning said” 28 April 2014: Further to recent press speculation, Ophir confirms that it recently made an approach to the Board of Premier with an indicative proposal to merge the two businesses. The Ophir Board believed that merging the two businesses provided the potential to create a well-funded, re-focussed, full cycle Exploration and Production company. However, the proposal was subsequently rejected by the Premier Board. Ophir confirms that it is no longer considering making an offer for Premier.”

A combination of the two companies would have given them a diverse set of assets including Ophir’s giant Tanzania gas discovery. The all-share merger would have delivered substantial cash flow to Ophir Energy from Premier Oil’s portfolio of production assets in the North Sea, Vietnam, Indonesia and Pakistan.

Ophir is the largest net acreage holder offshore Tanzania and holds five blocks. Two operated blocks (an 80% interest in Block 7 and a 70% interest in East Pande) and three non-operated blocks (a 20% interest in the BG-operated Blocks 1, 3 and 4). It had around $667 million in cash at the end of 2013 after raising $837 million in a share placing and rights issue. In Novermber 2014, Ophir announced it had sold a 20% stake in its Tanzanian Blocks to Pavilion Energy (a subsidiary of Temasek, the Singapore wealth fund) for $1.25 billion with a further $38 million payable at FID (Final investment decision). This transaction completed in March 2014.

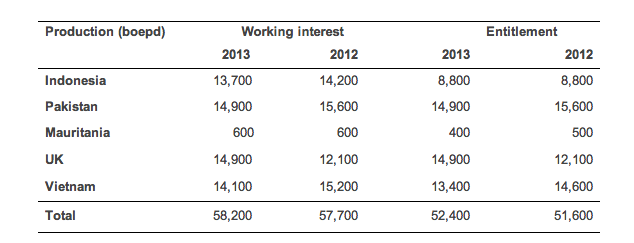

Premier’s Chief Exective Simon Lockett announced his decision to leave the company in February and there has been much speculation as to his successor. At the end of February, the company issued a disappointing set of annual results for the period ending 31st December 2013 with production of 58.2 kboepd (2012: 57.7 kboepd) and profit after tax of down from $252 million to $234.0 million after impairment charges of $67.9 million.

On the face of it there appeared to be some logic for the deal given that Premier’s profit stream could be used to continue Ophir’s appraisal and development of its Tanzanian assets. Premier has been paying a dividend and buying back shares. But if a deal had gone ahead it would have put more pressure on its final decision to proceed with its investment in the Rockhopper Sea Lion discovery in the North Falklands basin which is expected to cost over $3 billion for first oil. Work is now ongoing to optimise the design specifications for the Tension Leg Platform scheme in the Falklands and to prepare the documentation for Front End Engineering and Design which is expected to begin in the second quarter of 2014. A draft field development plan (FDP) will be submitted by the end of 2014 and project sanction is expected in Q2 2015.

For smaller oil and gas companies without revenues the potential Premier Oil, Ophir tie up illustrates the current issues obtaining suitable finance and the logic of consolidation to match producers and explorers. For AIM companies like Bowleven, Xcite Energy and Gulf Keystone finding funding to develop their assets remains an ongoing issue.

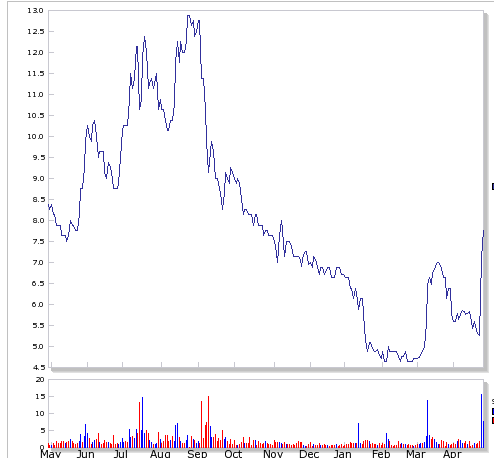

Sound Oil share price last 12 months

But it was interesting to see Sound Oil, the Italian focused oil and gas explorer, secure an outside institutional investor at the end of last week at a significant premium to the share price giving the shares a nice boost and illustrating that there is still appetite for deals with oil companies with undeveloped assets.

Sound Oil has agreed a £14 million share and loan deal institutional investor Continental Investment Partners which will see Continental buy £8 million worth of shares and make two loans totalling £6 million to Sound Oil to fund its drilling programme next year. The company is planning drilling operations in Nervesa and Badile in Italy and under the deal. Continental will subscribe for 100,000,000 new ordinary shares at 8p each to raise £8,000,000 before expenses that will leave it with a 23.41% stake, making Continental the largest shareholder.

Sound Oil shares were up a further 10% today to around 8p on news of a farm out for some of its acreage. It has signed non-binding heads of terms with Niche Group for a farm down of the company’s onshore Carita licence in the Po Valley, Northern Italy.

Under the Heads of Terms, Niche will acquire, subject to completion of due diligence, a 27.5% interest in the Carita licence in exchange for paying 100% of the costs of a second well to address the southern part of the structure, planned for Q2/Q3 2014. Following the farm out, the Company will continue to hold a 72.5% interest in the Carita licence.

The shares are well off their highs, but are showing a healthy return for investors that bought in during the last few weeks! A 40% gain in the last week is pretty good going!

Contrarian Investor UK

IMPORTANT: The posts I make are in no way meant as investment suggestions or recommendations to any visitors to the site. They are simply my views, personal reflections and analysis on the markets. Anyone who wishes to spread bet or buy stocks should rely on their own due diligence and common sense before placing any spread trade.