Trading Influences: Michael Covel

Apr 14, 2012 at 10:08 am in General Trading by

Way back in my article On My Trading Bookshelf, alongside books by my trading idols Nicolas Darvas and Jesse Livermore and my trading influence Van Tharp, I gave pride of place (on the trading bookshelf) to the book “Trend Following” by Michael W. Covel.

As I tried to explain in my original feature, and as will have become apparent from my other writings, I try to catch a trend before it develops (by catching a falling knife or at least buying on a dip) and then I hold on for as long as possible as the trend plays out — until ultimately my position is closed automatically (when the trend reverses) thanks to my stop order. Despite this slight difference in style (I’m not a true trend follower) Michael Covel’s work on trend following has been one of the major influences on my trading.

The trend following approach taught me that trading is largely but not wholly technical rather than fundamental in nature. This is less true of my preferred longer-term position trading approach than it is of shorter day-trading strategies, but nonetheless I still regard price action and a few technical indicators such as support and resistance — rather than “fundamental” financial ratios — as my primary motivators when opening new positions.

The trend following approach taught me that trading can be part-mechanised via price-based stop orders and (to some extent) opening orders, rather than being an entirely manual discretionary process. My own preference is to use discretion when opening positions or adding to them by pyramiding, but to let my stop orders do their job mechanically of taking me out of position when the price trend reverses.

Covel’s trend following book includes many real-life track records achieved by real-life successful trend-following traders, and the associated equity curves are instructive (for me) in showing how in many cases those traders suffered significant capital draw-downs and sub-market performances – sometimes for an extended period of time – before going on to significantly and consistently trounce the market. On this point, though, I urge caution against complacency, lest it becomes a self-fulfilling prophecy. What I mean is this: many new first-time business owners rationalise their initial over-spending on unnecessary plant and equipment on the basis that “most businesses lose money in their first two years” before turning a profit. Yes, it’s true that many now-successful businesses did make initial losses, but a good deal more businesses went to the wall as a result of those losses. Don’t let your “trading business” go the same way just because you think that an initial draw-down is automatically okay.

While on the subject of Covel’s book, it is interesting to note that one of the many trend followers mentioned is Jesse Livermore whom I nominated as one of my trading idols.

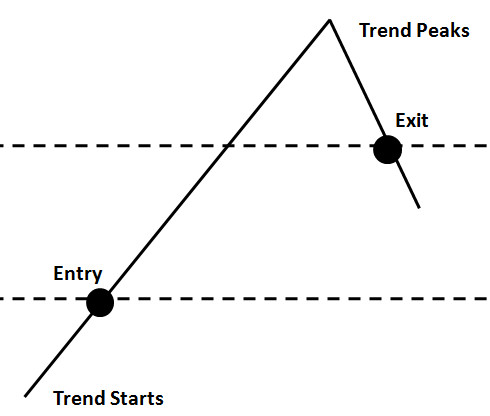

Finally: the classic stylistic picture of a trend-following trade in which you try to capture the major part of a trend, as Jesse Livermore would have done, without trying to catch the exact top or bottom looks as follows (redrawn based on Covel’s original figure).

Tony Loton is a private trader, and author of the book “Position Trading” (Second Edition) published by LOTONtech.

Tony,

You should check out Covel’s podcast on iTunes, it has some really good interviews with trendfollowers.