Ocado finally makes a profit but not much of one and Tesco/Morrisons continue to suffer

Jul 1, 2014 at 10:00 am in General Trading by contrarianuk

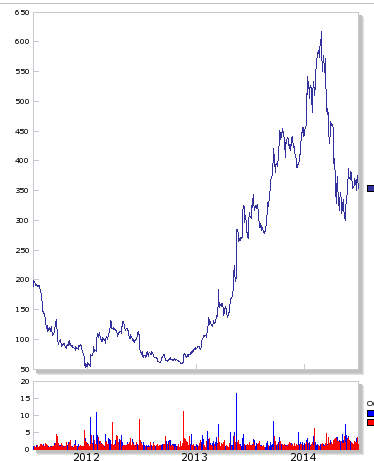

Back in late 2012, the shares of online grocer Ocado were trading at an all time low of 56p as shorters targeted the company in a big way after profitability continued to be elusive after the company launched selling Waitrose products. Huge spending on warehousing and other infrastructure meant that many in the financial community believed the company was doomed. Even early investor the John Lewis sold out of its stake in November making over £220 million for the deal clearly believing that the share price at the time was optimistically positioned. Then everything changed when Ocado signed a 25 year distribution deal in May 2013 with Morrisons. The shorters were burned and the share price boomed to over £6 a share, today they are down 5% to £3.54 after announcing a profit at last – the first for 14 years.

Ocado reported a pre-tax profit of £7.5 million in the 24 weeks to May 18 compared to a loss of £3.8 million in 2013 with revenues up 20.7 per cent to £429.7 million.

The markets weren’t impressed with the statement that “We expect that our retail business will continue growing broadly in line with, or slightly ahead of, the online grocery market.”. Given the growth of online versus bricks and mortar retail it seems that Ocado is already prepping the market for bad news. The chief executive, Tim Steiner, is hoping that investment in a third distribution and warehousing centre will give the company the flexibility to sign further distribution deals but some are worried that Waitrose will pull the plug on using the company’s network in 2017 when it has the first opportunity to do so.

On a p/e of 150 or so, there’s plenty of expectation built into these shares and it is not surprising that they have come off their all time highs. Any suggestion that Waitrose will actually go ahead and walk away won’t do their earnings any favours, especially with second quarter earnings growth slowing versus previous quarters.

Third party technical and logistics advice with other retailers at home and abroad may provide an extra revenue stream for Ocado but does the so called intellectual property the company is playing up have any real value? The IP seems to be underpinning the £2.1 billion market cap based on future growth expectations but it seems to be based on people and certainly can’t be patented.

On the subject of supermarket sales, Kantar have released the latest retail sales data and it isn’t good news for Tesco and Morrisons. Morrisons and Tesco sales dropped 3.8% and 1.9%, respectively, in the 12 weeks to June 22nd 2014 from a year earlier. Morrisons’ market share fell to 10.9% from 11.7% last year, while Tesco’s market share dropped to 28.9% from 30.3%. Sainsbury’s sales rose 3.0% year-on-year, while its market share increased to 16.7% from 16.6%. Asda sales rose 3.6%, with market share increasing to 17.1% compared with 16.9% a year ago.

Its a tough place in the UK grocery world right now.

Contrarian Investor UK

IMPORTANT: The posts I make are in no way meant as investment suggestions or recommendations to any visitors to the site. They are simply my views, personal reflections and analysis on the markets. Anyone who wishes to spread bet or buy stocks should rely on their own due diligence and common sense before placing any spread trade.