Is it time to look at investing in miners again?

Apr 20, 2014 at 3:28 pm in General Trading by contrarianuk

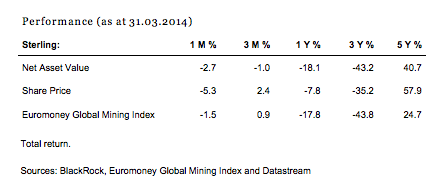

Many investors are wondering whether this is the right time to start putting their money back into mining shares after an awful couple of years. The Blackrock World Mining Investment Trust is a good benchmark for performance of global mining companies with 11.6% of its assets in Rio Tinto, 11% in BHP Billiton and 9.7% in Glencore Xstrata. Over the past year its net asset value has dropped by 18.1%. Some of saying that many mining companies have reached a bottom and that their dividend yield is reason enough to hold them. Are they right?

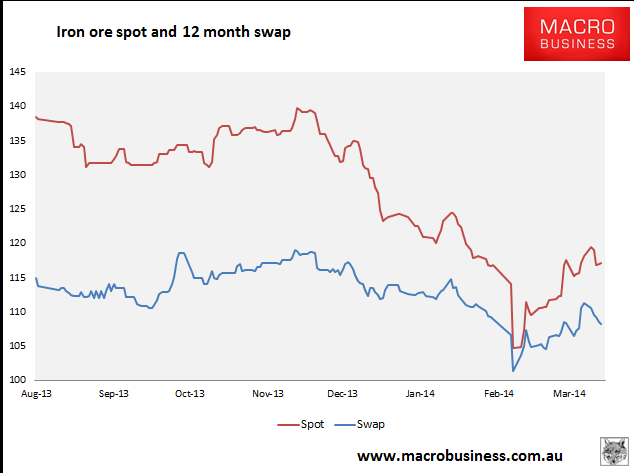

Recent events haven’t instilled a great deal of confidence in an imminent rebound as the price of the key commodities, particularly iron ore and copper ,have shown significant volatility so far this year. In March the price of iron ore had its largest one day price fall in more than four years as worries about China’s economy reemerged, with the price dropping to $104.70 a tonne after closing out the previous week at $114.20 a tonne. Since then prices have rebounded to around $118 a tonne.

Australia’s Bureau of Resource and Energy Economics (BREE) says that while iron ore exports will increase, this will be accompanied by a 30 per cent fall in the price of Iron Ore from last year’s average. It expects the spot price of iron ore to fall from its average of US$126 ($136.82) a tonne last year to US$87 by 2019 due to an expansion in global supply.

Copper has also fallen around 10% in 2014 with concerns over its role in China as collateral for bank loans with as much as 80% of China’s copper imports have been used for this purpose according to some estimates. There are worries that bad debts and defaults could lead to a dumping of copper on to the market.

World refined copper production (mine supply and recycled scrap) is forecast to grow by 6.5% to 22.4 million tons in 2014, and grow by 4.3% in 2015, according to the International Copper Study Group, an intergovernmental and industry body. Morgan Stanley expects copper prices to rise to $7,397 per ton in 2015, below a peak of $8,838 in 2011.

Miners are cutting back on expensive new developments to conserve cash and boost investor returns. For example, BHP Billiton is boosting production of iron ore from its lost cost operations in Australia to offset a lower price per tonne and is considering spinning off its aluminum, nickel and bauxite assets in a $19 billion deal. BHP’s capital spend is expected to fall by 25% to $16.1 billion this financial year and reduce again in the 2014/15 financial year.

New management teams at the big miners seem to have learnt the lessons of their predecessors and are axing expensive trophy projects in favour of preserving capital and increasing efficiency at existing mines.

Companies with diverse commodity interests seem to be a more sensible solution to try and reduce the risks and those with a good dividend yield offer an opportunity to be paid to wait for better times ahead. The words of Blackrock’s World Mining Trust investment team sum things up, “The mining sector has significantly lagged the general equity market in recent years. However, a number of the downside risks for this sector have reduced (albeit not disappeared). The industry has made good progress in refocusing its strategy: operating costs have been aggressively targeted and investment in projects reassessed with capital returns to shareholders rising up the priority list. Many commodities are trading close to or below their marginal cost of production, implying that price downside should be limited, in the absence of a collapse in demand.”

Contrarian Investor UK

IMPORTANT: The posts I make are in no way meant as investment suggestions or recommendations to any visitors to the site. They are simply my views, personal reflections and analysis on the markets. Anyone who wishes to spread bet or buy stocks should rely on their own due diligence and common sense before placing any spread trade.