Cisco Systems Fundamentals

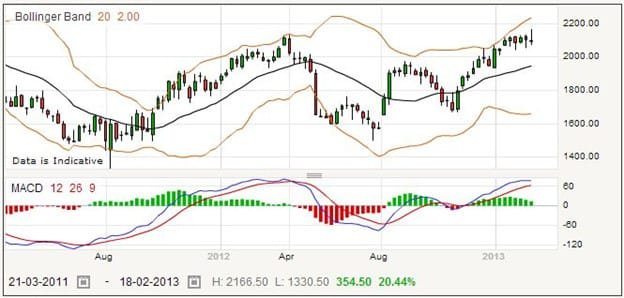

Cisco Systems is an American multinational corporation dealing mainly in networking equipment, and you can see from the volatility in the chart below that it offers good prospects for spread betting. It was founded in 1984, and listed on the NASDAQ stock exchange in 1990. It wasn’t until 2009 that it was included on the Dow Jones Industrial Average, but it is a component of the S&P 500, the Russell 100, and the NASDAQ 100 indices.

The name Cisco came from San Francisco, where the company was founded, though it is now headquartered in San Jose, California. It has always specialized in the networks and routers, and the growth of the Internet in the 1990s presented an opportunity which Cisco managed to exploit. It even briefly became the most valuable company in the world in 2000, when it had a market capitalization greater than half-a-trillion dollars, that is, more than $500 billion.

However, as you can see from the chart above it has yet to return to its previous heights, when it topped more than 3400 per share just before the global economic crash. While it has spent a lot of time refining and developing its Ethernet and network products, the focus in recent years has been on branding and marketing its services. Much of its keeping up with the latest technology has been achieved by a multitude of acquisitions and mergers.

There have been various controversies surrounding its growth, as is almost inevitable with a well-known and prominent company. It has taken part in censorship in China, providing blocking and tracking equipment to the Chinese authorities, but in defence of this allegation, these are standard features available on the Cisco products which were supplied. Other problems include intellectual property disputes and tax fraud allegations, but these do not seem to present much problem to the company’s growth.

Cisco Systems Rolling Daily

When you are considering spread betting on any company, you need to have a plan or strategy, and implement it effectively. If your trading strategy suggests that Cisco systems will fall in value, you might be tempted to place a sell bet on the company, which is currently quoted at 2088 – 2092 for a daily rolling bet. Say you decide to short this stock, staking £1.50 per point.

If you have got it right, then the price might fall to 1763 – 1767. Choosing to close the bet and collect your winnings, you could calculate how much they are like this: –

- Your short bet was placed at the price of 2088

- Your bet closed at 1767

- You gained 2088 minus 1767 points

- That’s a total of 321 points

- Your stake was £1.50 per point

- Therefore you won 321 times £1.50

- A total gain of £481.50

On the other hand, if the price went up you might decide to cut your losses and close your losing bet when the quote reached 2250.5 – 2254.5, giving the following result: –

- Your short bet was placed at the price of 2088

- Your bet closed at 2254.5

- You lost 2254.5-2088 points

- You lost 166.5 points

- Your stake was £1.50 per point

- Therefore you lost 166.5 times £1.50

- Your total loss was £249.75

Many spread betters use a stop loss order, in order to better contain their losses. Even if they are not watching what the price is, their spread betting provider must close the losing trade for them when and if it reaches a certain losing level. In this case, suppose a stop loss order closed the trade at 2185.5 – 2189.5, the calculation is as follows: –

- Your short bet was placed at the price of 2088

- Your bet closed at 2189.5 with the stoploss order

- You lost 2189.5 -2088 points

- You lost 101.5 points

- Your stake was £1.50 per point

- Therefore you lost 101.5 times £1.50

- Your total loss was £152.25

Cisco Systems Futures Bet

Depending on the type of spread betting you are doing, you might consider using a futures style bet which you can hold open for weeks or months, with no adjustments to your account. The current quote for the far quarter futures bet on Cisco Systems is 2086 – 2111. Say you are optimistic about Cisco’s performance, you could choose to place a long bet at 2111, staking perhaps £1 per point.

Over time, you see the price creep up to 2573.5 – 2598.5, and decide to close your bet and collect your profit. Your long bet will close at the selling price of 2573.5, so taking away from this the opening price of 2111, you would have gained 462.5 points. For your chosen stake, that is a gain of £462.50.

Even though you have taken out a futures style bet, intending to hold it open for some time, you are allowed to close it at any time if you want or need to, for example if the price goes against you. Perhaps the price drops to 1923.5 – 1948.5, and you see it is not performing to your expectation and close the trade. The closing price would be 1923.5, so you would have lost 2111 minus 1923.5 points. This works out to 187.5 points. Again, the result is easy to calculate for your stake of £1 per point. You have lost a total of £187.50.

You might find it useful to place a stop loss order when you take out your bet. This requires your spread betting company to close a losing trade if it reaches a level you set, and avoids you having to watch the market continually. With a stop loss order, your bet might have been closed at 1988.5 – 2013.5, which means you would have lost 2111 less 1988.5 points. With the stoploss order, you would have lost 122.5 points, amounting to £122.50.

Join the discussion